Market Brief

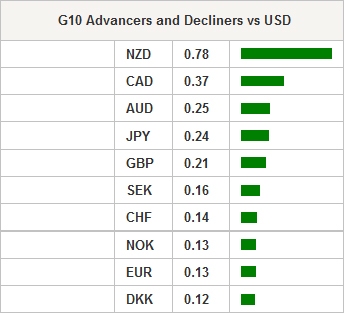

The US dollar continued to lose ground against most currency as the boost provided by Fischer’s hawkish comments fade away. US treasury yields were moving sharply lower with the monetary policy sensitive 2-year yields hitting 0.74% this morning, down from 0.78% in early trading session on Monday. Commodity currencies surged the most against the greenback - with the exception of the Norwegian krone that traded sideways in Tokyo - in spite of another sell-off in crude oil. The West Texas Intermediate was down another 1% at $47 on Tuesday after falling more than 3% in the previous day as investors could hardly find a good reasons to lift prices higher. From a technical standpoint, the 50dma - currently at $45.47 - will act as support. The following one can be found at around $40 (low from early August).

The New Zealand dollar was the best performer in overnight trading as it surged 0.78% against the greenback to 0.7325, the highest level since August 10th. This is fourth time since mid-August that the currency pair tests the 0.7335-0.7350 resistance area and failed at it. Indeed, renewed Fed rate hike expectations over the last week had prevent the Kiwi to move higher.

In Japan, the yen extended gains against the dollar with USD/JPY falling 0.30%, down to 100.08. The currency has been testing the 100 support area for the last seven days as the market anticipates that the BoJ will not allow the yen to strengthen further. On the data front, Japan’s flash manufacturing PMI rose to 49.6 in August compared to 49.3 and 51.7 a year ago. In spite of the improving trend since May this May this is the sixth straight month of contraction. The market is already starting to price further monetary easing from the BoJ as indicated by the sharp increase in risk reversal measure. Indeed, 1-month 25 delta risk reversal in USD/JPY bounced to -0.98% compared to roughly -2% last week. 1-month at-the-money implied volatility reached 14.40% from less than 10% at mid-August.

Today traders will be watching consumer confidence from Denmark; manufacturing, service and composite PMI from France, Germany and the euro zone; interest rate decision from Turkey (market is expecting a 25bps rate cut of the lending rate to 8.50%); manufacturing PMI, Richmond manuf. index and new home sales from the US.

| Global Indexes | Current Level | % Change |

|---|---|---|

| Nikkei 225 Index | 16497.36 | -0.61 |

| Hang Seng Index | 22916.45 | -0.35 |

| Shanghai Index | 3084.284 | -0.02 |

| FTSE futures | 6852.5 | 0.58 |

| DAX futures | 10522.5 | 0.44 |

| SMI Futures | 8169 | 0.26 |

| S&P future | 2182.3 | 0.04 |

| Global Indexes | Current Level | % Change |

|---|---|---|

| Gold | 1339.31 | 0.02 |

| Silver | 19.04 | 0.66 |

| VIX | 12.27 | 8.2 |

| Crude wti | 46.94 | -0.99 |

| USD Index | 94.41 | -0.12 |

| Today's Calendar | Estimates | Previous | Country/GMT |

|---|---|---|---|

| DE Aug Consumer Confidence Indicator | - | 3,1 | DKK/07:00 |

| FR Aug P Markit France Manufacturing PMI | 48,8 | 48,6 | EUR/07:00 |

| FR Aug P Markit France Services PMI | 50,5 | 50,5 | EUR/07:00 |

| FR Aug P Markit France Composite PMI | 50,4 | 50,1 | EUR/07:00 |

| SA Jun Leading Indicator | - | 90,8 | ZAR/07:00 |

| TU Aug Consumer Confidence Index | 66,5 | 67,03 | TRY/07:00 |

| GE Aug P Markit/BME Germany Manufacturing PMI | 53,6 | 53,8 | EUR/07:30 |

| GE Aug P Markit Germany Services PMI | 54,4 | 54,4 | EUR/07:30 |

| GE Aug P Markit/BME Germany Composite PMI | 55,1 | 55,3 | EUR/07:30 |

| EC Aug P Markit Eurozone Manufacturing PMI | 52 | 52 | EUR/08:00 |

| EC Aug P Markit Eurozone Services PMI | 52,8 | 52,9 | EUR/08:00 |

| EC Aug P Markit Eurozone Composite PMI | 53,1 | 53,2 | EUR/08:00 |

| UK BOE Indexed Long-Term Repo Operation Results | - | - | GBP/09:40 |

| UK Aug CBI Trends Total Orders | -10 | -4 | GBP/10:00 |

| UK Aug CBI Trends Selling Prices | - | 5 | GBP/10:00 |

| EC ECB's Coeure, Lane, Smets on Panel in Geneva | - | - | EUR/10:30 |

| TU Aug 23 Benchmark Repurchase Rate | 7,50% | 7,50% | TRY/11:00 |

| TU Aug 23 Overnight Lending Rate | 8,50% | 8,75% | TRY/11:00 |

| TU Aug 23 Overnight Borrowing Rate | 7,25% | 7,25% | TRY/11:00 |

| BZ Aug 22 FGV CPI IPC-S | 0,46% | 0,48% | BRL/11:00 |

| CH Conference Board China July Leading Economic Index | - | - | CNY/13:00 |

| US Aug P Markit US Manufacturing PMI | 52,6 | 52,9 | USD/13:45 |

| UK Bank of England Bond-Buying Operation Results | - | - | GBP/13:50 |

| US Aug Richmond Fed Manufact. Index | 6 | 10 | USD/14:00 |

| EC Aug A Consumer Confidence | -7,7 | -7,9 | EUR/14:00 |

| US Jul New Home Sales | 580k | 592k | USD/14:00 |

| US Jul New Home Sales MoM | -2,00% | 3,50% | USD/14:00 |

| BZ Jul Current Account Balance | -$3774m | -$2479m | BRL/18:00 |

| BZ Jul Foreign Direct Investment | -$500m | $3917m | BRL/18:00 |

Currency Tech

EURUSD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1340

S 1: 1.1046

S 2: 1.0913

GBPUSD

R 2: 1.3534

R 1: 1.3372

CURRENT: 1.3176

S 1: 1.2851

S 2: 1.2798

USDJPY

R 2: 107.90

R 1: 102.83

CURRENT: 100.07

S 1: 99.02

S 2: 96.57

USDCHF

R 2: 0.9956

R 1: 0.9775

CURRENT: 0.9604

S 1: 0.9522

S 2: 0.9444

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.