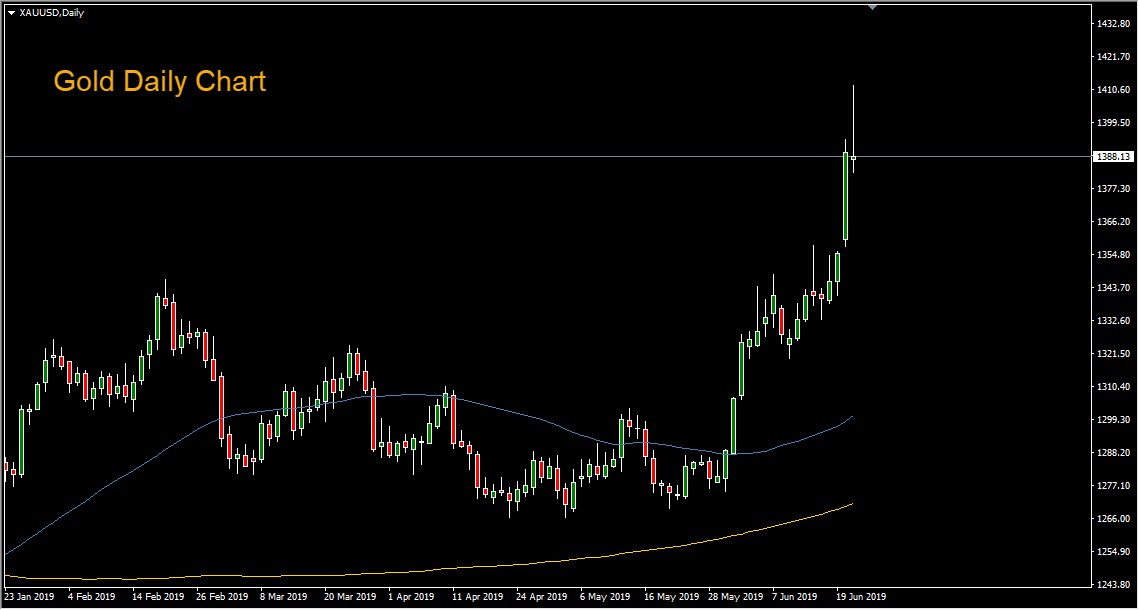

Gold continued to rally on Friday, reaching its highest levels since September of 2013 before beating a retreat. The yellow metal powered higher after Wednesday’s FOMC meeting, where the US central bank left interest rates unchanged, but adopted a more dovish stance. The CME Fedwatch Tool currently shows a 100% chance of a rate cut at the July meeting.

US Treasuries rallied on the heels of the Fed news, sending yields lower. Bond yields typically fall when investors expect a rate cut. On Thursday, yields on the 10-year US Treasury bond fell below 2% for the first time since late 2016.

Analysts attributed the surge in gold to falling treasury yields and a weaker U.S. dollar after the Fed meeting. Lower interest rates makes non-yielding investments such as gold more attractive. Meanwhile, geopolitical tensions in the Middle East escalated following Iran shooting down a U.S. drone on Thursday, boosting oil prices and supporting safe haven assets.

Another major alternative investment, Bitcoin, rallied to its highest levels since April of 2018 in Friday trading. Bitcoin benefited this week from news announcing Facebook’s Libra cryptocurrency. Libra has reportedly secured backing from giants including Uber, Spotify and Visa and is expected to launch in the first half of 2020. The new coin would allow users to make payments both on Facebook and other sites.

An additional bullish factor for bitcoin is that many investors are anticipating a “supply shock” with the bitcoin halvening event in 2020, which will see the daily bitcoin supply cut by half overnight. Bitcoin had a devastating 2018, losing 70% of its value. However, in 2019 it has staged a remarkable comeback, trading 160% higher since the beginning of the year.

Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.