Gold has had a stunning 7 sessions run, which started last Friday June 3rd when Non-Farm Payroll data came out much lower than expected. The shiny metal has gained 5.84% in this period alone, reaching levels just short of $1300. Most of the momentum has come from incorrectly estimated jobs data for May. The forecast had been for 170k jobs and only 39k was reported. Gold jumped, and went from an open of $1210.68 to the ounce to close at $1244.44 for the day.

The particularly low jobs data meant that the likelihood of an interest rate hike in the US suddenly became extremely slim. There had been calls for an interest rate hike as early as the next Federal Reserve Open Market Committee (FOMC) meeting to be held over today and tomorrow. The decision on monetary policy will be announced Wednesday at 7:00 pm.

Most analysts’ expectations are for the Federal Reserve to hold interest rates steady. This view is despite the fact that the Yellen has recently stated that they see the economy strong enough to support higher interest rates, and that last month’s job data was an anomaly. It would therefore seem that the central bank will wait at least one more month to see if jobs data does return to more consistent levels.

The outlook is for an interest rate hike at the July FOMC meeting at the earliest, or at the meeting of September at the latest. Analysts see the likelihood of at least one more interest rate hike as extremely likely before the end of the year, with some making calls for two hikes.

The wording of the statement at the end of the FOMC meeting tomorrow at 7pm will be highly watched as to clues as to high fast the monetary tightening will be implemented. The statement should also include some considerations on the state of the economy.

We should see an increase in volatility straight after Ms. Yellen makes her statement, and comments that seem to dampen hopes for an imminent rate hike should give the price of Gold a boost. Whereas, statements that indicate a the Federal Reserve believes there is a strong economic cycle taking place and interest rates will be raised accordingly should send Gold back down again.

If you feel that the price of Gold will increase over the next week then you may buy a Call option, which gives you the right to buy Gold at a pre-set price (strike) on a specific date (expiry) and for an amount of your choice.

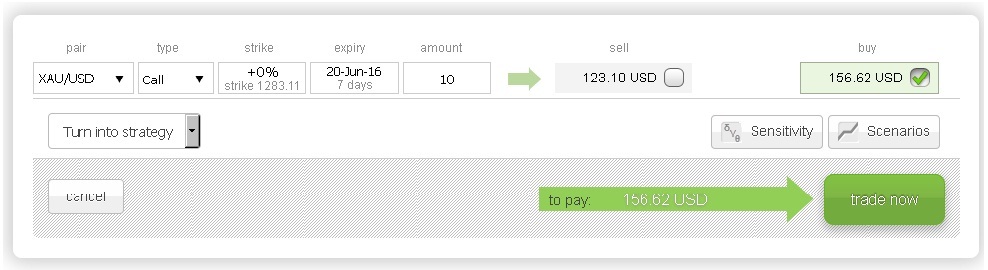

The screenshot below shows that a Gold Call option with a 1283.11 strike, 7 day expiry and for 10 ounces would cost $156.62, which would be the maximum risk.

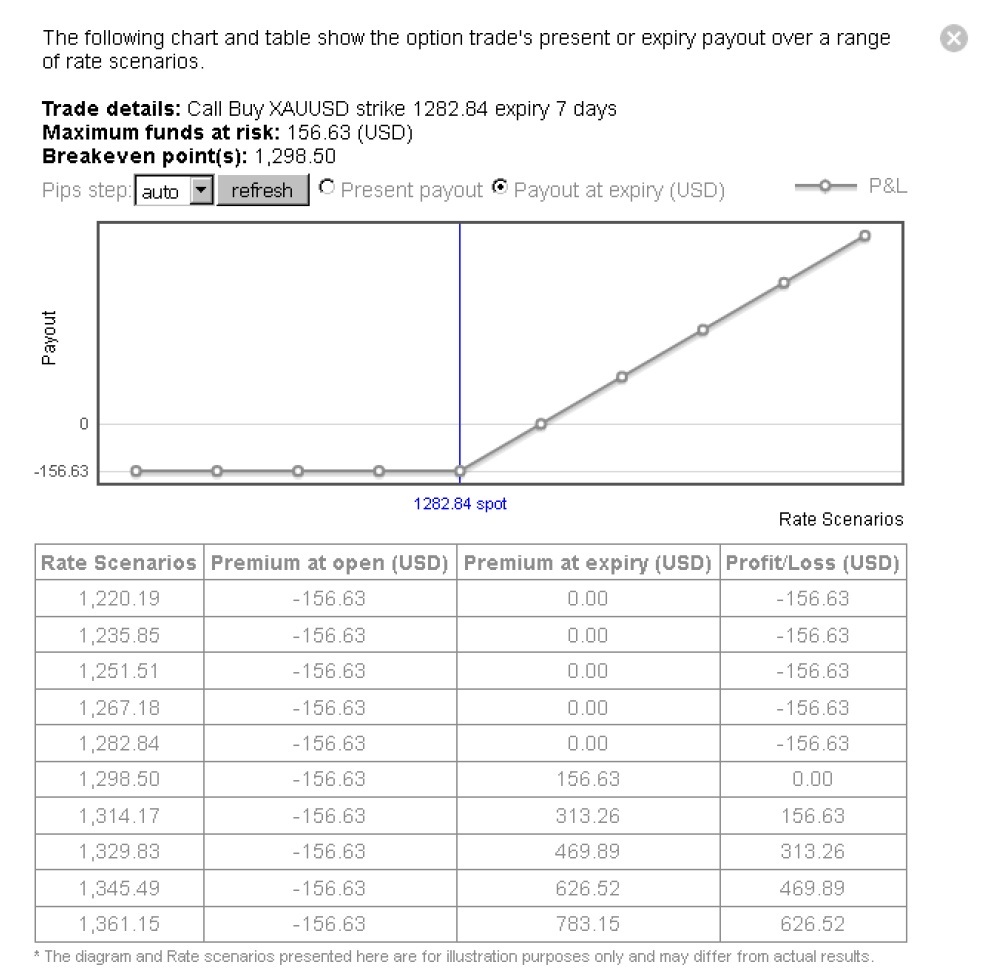

This screenshot shows the profit and loss profile of the above Call option, just click the Scenarios button.

On the other hand, if you think that the price of Gold will head south over the next week then you may buy a Put Option, which gives you the right to Sell Gold at a set strike, expiry and amount.

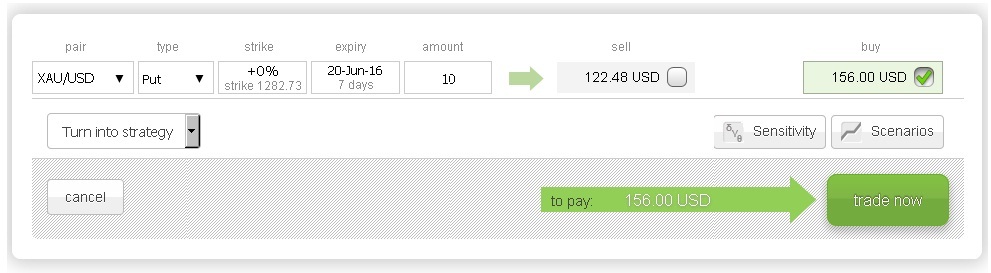

The screenshot below shows a Gold Put Option with a 1282.73 strike, 7 day expiry and for 10 ounces would cost $122.48, which would also be the maximum risk.

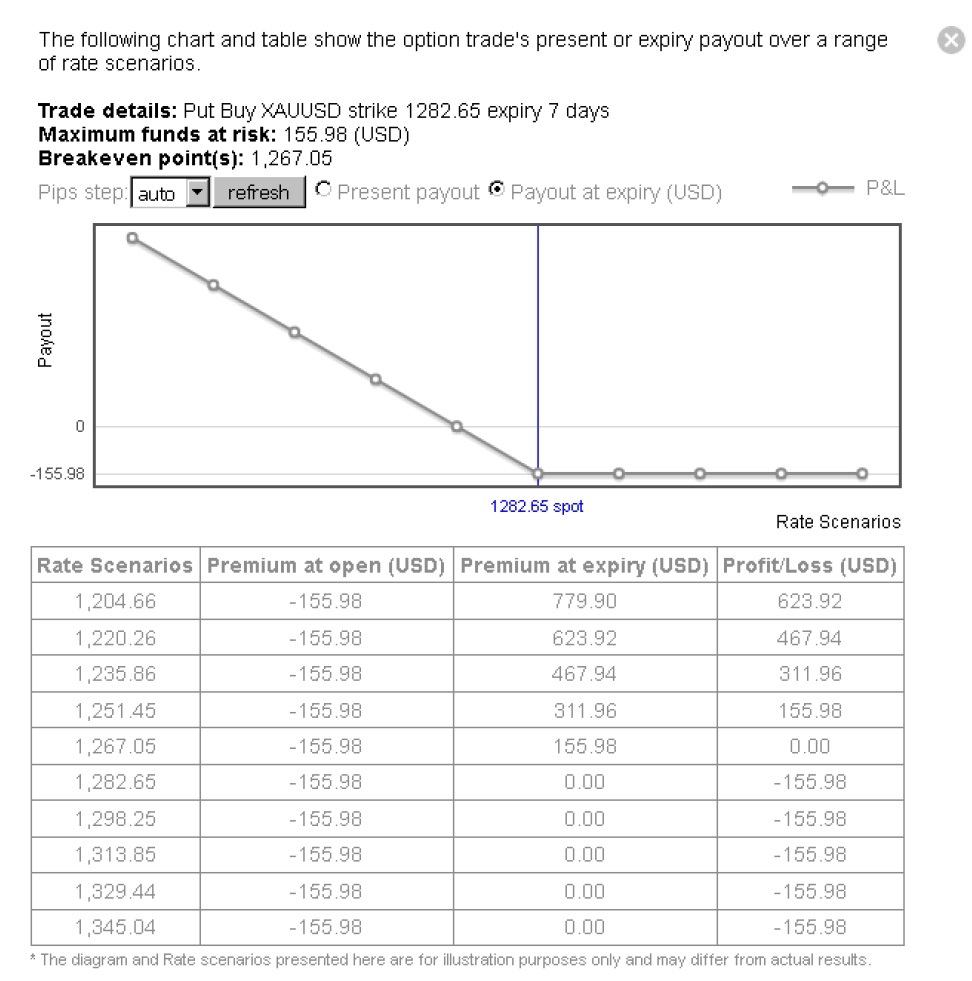

This screenshot shows the profit and loss profile of the above Put option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.