- Gold prices heavily depend on the fate of fiscal stimulus.

- A blue wave could unleash a golden age for the precious metal.

- If Trump remains is reelected, the reaction could be mixed.

- President Biden with a Republican Senate would cause a meltdown.

Gold could power up if the government prints more money – that is the simple logic that has been rocking the precious metal in recent months. XAU/USD soared to new highs as central banks enhanced their bond-buying programs and as authorities used the funds to shore up the economies amid the coronavirus crisis.

The Federal Reserve, the European Central Bank, and even European governments did "whatever it takes." The US government also played its part early in the crisis with the CARES Act – but most programs have lapsed. Now, markets and gold bulls want more of what Uncle Sam can give.

Democrats and Republicans seemed to hover around a $2 trillion deal but failed to reach an accord ahead of the elections. A decision on more funds – of which some will likely fuel into gold – will wait for the new administration.

There are three main election scenarios that would all yield distinct results for XAU/USD:

1) Blue wave – Golden wave

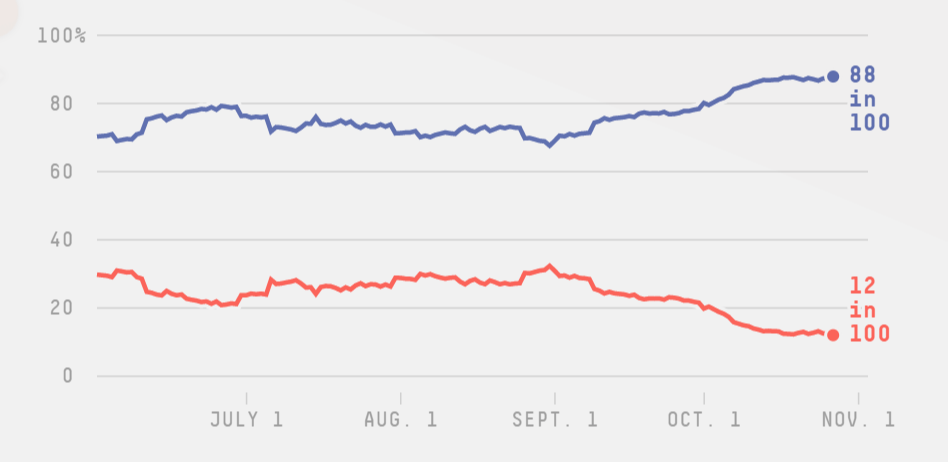

President Donald Trump is trailing rival Joe Biden in national and state polls. According to FiveThirtyEight, he has an 88% chance of winning at the time of writing. Democrats have around 70% probability of winning the House and the Senate.

Source: FiveThirtyEight

In this "blue wave" scenario – which is the likeliest according to the polls – Dems could approve a bill worth $2 trillion as they nearly agreed with Republicans, or even $3.4 trillion as they originally wanted to do back in May.

For the yellow metal, the more the merrier. A break above the all-time highs cannot be ruled out in this scenario.

2) Trump reelected – a mixed reaction

Many still remember 2016 and claim that polls are missing the "shy Trump voter" and that he can still win the electoral college. While surveyors probably fixed some of their problems, there is still a chance that the president squeezes another victory. In that case, Republicans are also likely to cling onto the Senate.

See 2020 US Election: Polling, history and the submerged Trump vote

In this scenario, Trump may feel he has the mandate to impose his will on Republicans –something he struggled with toward the elections – and a stimulus package is likely even during the "lame duck" period.

Gold bulls would likely cheer such a scenario, but any rally would be short-lived, as the total package will probably be smaller than a "blue" one.

3) President Biden, Republican control – meltdown scenario

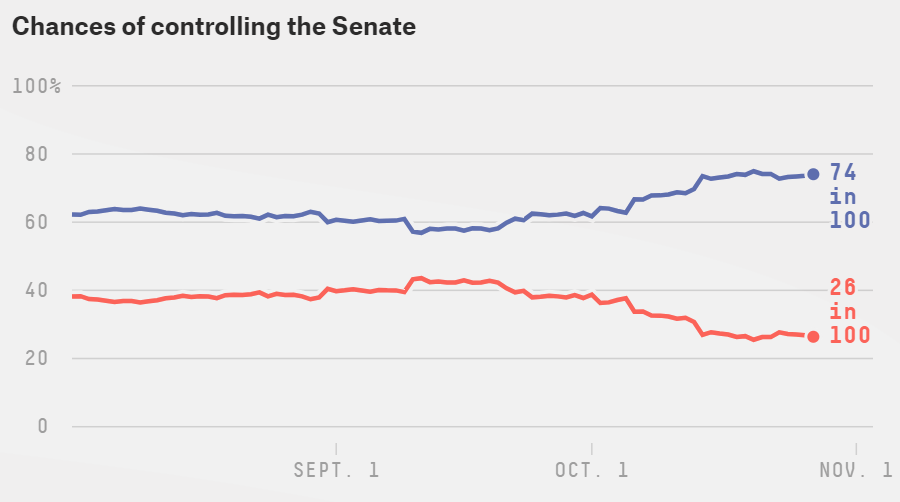

As mentioned above, the chances for Biden to oust Trump are higher than for Dems to beat the GOP in the race for the Senate. If Republicans cling onto the upper chamber, they would probably limit any large package.

Source: FiveThirtyEight

Gold could suffer in response to partisan brinkmanship – especially if the relief deal falls short of the $1 trillion mark. A significant retreat toward pre-pandemic levels is an option as well. Negotiations could be protracted.

Conclusion

Gold heavily depends on stimulus, and the more, the merrier. The optimal scenario is a clean Democratic sweep, followed by a Trump victory. A split between President Trump and the Senate is the worst outcome.

More: 2020 Elections: Seven reasons why this is not 2016, time to focus on the Senate

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.