Today’s AM fix was USD 1,194.00, EUR 953.60 and GBP 762.65 per ounce.

Yesterday’s AM fix was USD 1,200.75, EUR 957.61 and GBP 766.08 per ounce.

Gold prices fell $13.80 or 1.15% to $1,183.00/oz yesterday. Silver slipped $0.08 or 0.49% to $16.14/oz.

Gold in USD - 5 Days (Thomson Reuters)

Gold declined for a second day in volatile trade. The market rose following the Russian central bank gold announcement but priced were then capped in mid morning trading in London.

Some attributed the weakness to the negative gold poll in Switzerland. However, gold had fallen prior to the release of the Swiss poll and was trading below $1,180/oz and near the lows of the day at 1600 BST when the poll results were released.

The poll yesterday showed Swiss voters will likely reject an initiative that would require the nation’s central bank to boost bullion holdings. 47% percent of voters are seen as voting “no” on the Nov. 30 Swiss gold proposal and 15 percent were undecided, according to a gfs.bern poll for Swiss public broadcaster SRF. It was conducted Nov. 7 to Nov. 15 and had a margin of error of 2.7 percentage points.

Although many such polls favouring the establishment position have been very wrong in recent years.

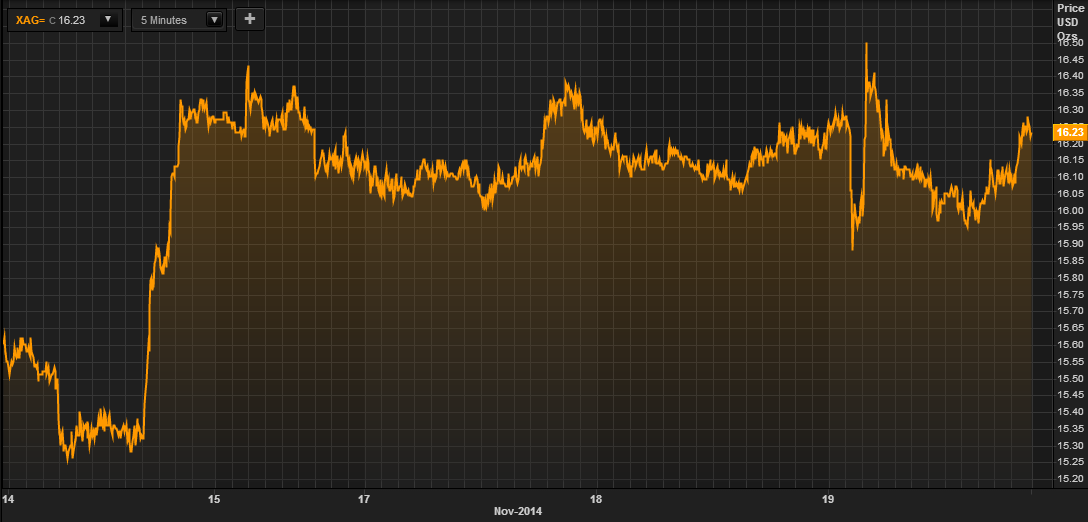

Silver in USD - 5 Days (Thomson Reuters)

One way or another, gold and silver quickly bounced higher again. Gold retested $1,200/oz prior to further weakness set in once again in less liquid markets after the close in New York.

Besides ongoing manipulation, gold’s weakness may also be related to traders selling as the dollar remains firm and oil prices weak. For now they are ignoring the continuing ultra loose monetary policies globally and focussing on the Fed’s ‘jawboning’ and signalling that they will increase interest rates. We will believe it when we see it.

Monetary policies globally have actually become looser in recent days due to Japan’s monetary ‘bazooka’ and the threat of ‘Super Mario’s’ bazooka.

Futures trading volume on the Comex was more than double the 100-day average for this time of day, data compiled by Bloomberg show. Holdings in gold ETFs fell 1.9 metric tons to 1,616.7 tons yesterday, the lowest since May 2009 as traders and weak hands sell and gold flows to stronger hands in allocated storage and in Asia.

Buy Gold Bars in the Safest Way and at the Lowest Prices

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.