Today’s AM fix was USD 1,310.25, EUR 968.40 and GBP 765.78 per ounce.

Yesterday’s AM fix was USD 1,302.75, EUR 962.65 and GBP 761.35 per ounce.

Gold rose $21.10 or 1.62% yesterday to $1,319.60/oz and silver climbed $0.39 or 1.88% to $21.14/oz.

Source: Finviz

Gold dipped 0.4% on profit taking today but is likely to be supported by a wave of risk aversion after the airline tragedy. Stocks fell and brent oil climbed above $108 a barrel, extending sharp overnight gains amid heightened geopolitical concerns over the Ukraine and in the Middle East.

Gold, silver, platinum, palladium, oil and wheat surged yesterday after confirmation of the tragic events in Ukraine. News of the new Israeli ground invasion and bombing of Gaza also contributed to gold’s gains. Safe haven assets rose, while stock markets around the world extended losses following the news.

Today, Asian stocks were mixed but the Nikkei fell 1% and European indices are down this morning after U.S. stocks fell. Risk aversion has returned to markets on concerns that the tragedy could lead to an escalation in the military confrontation in the Ukraine and tensions and even conflict with Russia.

While defensive assets were quickly rotated into, the VIX, which measures volatility and is sometimes dubbed the "fear gauge", shot up as much as 17%.

Geopolitical tensions with Russia and in the Middle East are leading to safe haven demand and there are bargain hunters buying gold bars and coins at these levels.

With the U.S. seeking to impose tough new sanctions on Russia, we appear to be on the verge of a new and more intense phase of currency wars and indeed of an economic war.

What Happened To MH-17?

There is much speculation as to how it happened, with claims and counterclaims and much pointing of fingers. The Ukrainians and the Russians are blaming each other. U.S. politicians such as John McCain and Hillary Clinton have been very vocal in blaming the Russian separatists.

The plane was flying at around 33,000 feet. This suggests quite sophisticated, high tech weaponry which is largely beyond the capabilities of the insurgents. The insurgents rely primarily on shoulder-mounted rocket launchers. There is evidence that suggests that they commandeered more sophisticated surface to air missiles - a BUK missile battery - in recent weeks. There remains doubts as to whether they had the necessary radar equipment, whether they have the fifteen man specialist crews needed to man the BUK missile battery and whether they would be capable of shooting down a plane at 33,000 feet - if even in error.

There is very little concrete evidence at this time that could allow any side to come to definitive conclusions. The black boxes and recording devices could provide answers but, depending on who secures them, even that evidence would likely be disputed given how bad relations have got in Ukraine and between NATO, many western powers and Russia.

There needs to be a forensic and unbiased investigation by the U.N. or by another genuinely neutral body. World leaders demanded an international investigation into the tragedy.

The tragedy could mark a pivotal moment in the worst crisis between Russia and the West since the Cold War.

A Butterfly Flaps Its Wings And Your World Changes

A butterfly flaps its wings and your world changes.

The tragic deaths of 298 innocent civilians on the Malaysian passenger jet is partly due to the dangerous game of poker currently taking place between major powers and the lack of will or complete failure to broker a meaningful ceasefire and peace negotiations.

Real people, people like you and me, have had their lives destroyed. Yesterday morning, many of those 298 people woke up in the comfortable homes around Europe and started preparing for departure. They were excited about the prospect that they would be enjoying the beauty of a far distant land and gain a reprieve from their daily routines.

The conflict in Ukraine was probably known to them due to it being headline news for months now. It may have been a concern, but not a serious one. They probably hoped for the best and hoped that international governments would find a resolution.

In a way, they may have felt it was remote to them, not immediate, a different place with people who spoke different languages, had a different history. In a flash that illusion was gone and their lives and the lives of the participants in the conflict became forever linked.

This is the nature of risk. Risk is born of change and it is driven by a multitude of possible variables. All of which are in a state of constant flux. We all manage risks in our daily lives. Our leaders manage risks in our respective countries and their leaders manage risk in our respective economic blocks.

In order to manage risk we must be aware of the variables that affect us. We must know how they work, how they can be managed and how they can be diminished or leveraged?

You do this when you lock your house and set the alarm. When you put your seatbelt on. When you ensure that your child wears a helmet while cycling their bike. When you buy health insurance.

These are risks that you actively manage, there are other risks that you can do nothing about. These are so called acts of god, where no one is to blame, no one could have known.

The destruction of the passenger plane was not an act of god, it was an act of man.

An entire series of events had to happen, and in sequence, for this tragedy to have occurred. It is a failure of modern leadership and shows just how poor our political elites have become. It also shows how fragile our world is.

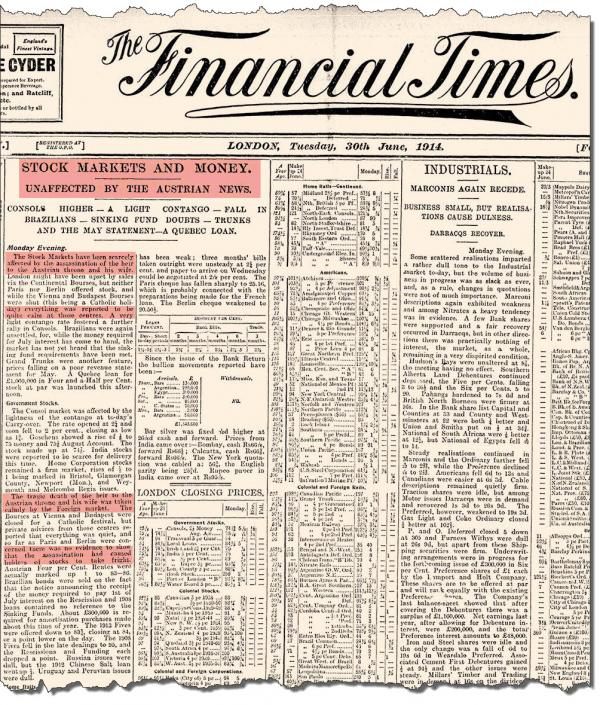

Financial Times, 30th June, 1914 via Financial Times

The warning signs have been seen before. Local conflicts eventually boil over. Regional powers get sucked in. Powerful countries that would be better off in peaceful coexistence opt instead for conflict. Wrong choices are made.

The greatest wars in history all started with someone somewhere having an idea, taking liberties (often literally), taking advantage of their neighbours, imposing their economic and military might on less powerful countries. It is when such actions go unchecked for too long and peaceful solutions are not genuinely sought that wars start.

As Sir Winston Churchill said “to jaw-jaw is always better than to war-war.”

'Archduke Ferdinand' Moment? Drums Of War Grow Louder In Ukraine and Middle East

Geopolitical risk is very high today and yet it is not appreciated by experts and the majority of the public . The same was true in 1914.

Very few thought that the assassination of Archduke Ferdinand would be a spark that ignited the brutal war that was World War I and the attendant economic depression. Indeed, as the Financial Times front page from the day after the assassination shows, stock markets were “scarcely affected by the assassination of the heir to the Austrian throne... there's no evidence that stock holders took fright."

Complacency reigned about the geopolitical risks. Six months later the Dow Jones Industrial Average was 35% lower and World War I was in its first year.

There is always a catalyst in the form of an event in history which people look back on as the start of tremendous global turmoil. Usually, there are significant pre-existing political, military and economic tensions which are the real factors leading to war.

The butterfly event can be the spark that ignites the conflagration.

The tragic events in Ukraine and in Gaza today are momentous. The fog of war could lead to an incident, such as the tragic airline crash yesterday or an act of terrorism, which could be the spark of a much greater conflict.

There have been many potential butterfly events in recent weeks, any one of which could lead to the hurricane of war.

The problem with war is that no matter how well the plans are made, strange things happen in war and there are many tragic unintended consequences.

Political and financial complacency reigns today as it did in 1914 ...

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'