- Gold finishes the week in the red as US data overshadowed fears.

- Robust US data overshadowed risk-averse sentiment this week.

- Spot gold technically bullish but holding below a critical Fibonacci resistance level.

Gold’s safe-haven condition is undeniable, although when the dollar runs on self-strength, the base metal can’t beat it. That’s what happened this week. A mixture of risk-aversion and robust US macroeconomic figures led gold lower.

Spot settled at $1,5xx.00 a troy ounce, after hitting a weekly high of 1,592.04. The metal traded as low as 1,547.34, despite coronavirus concerns, amid upbeat US ISM reports. Manufacturing activity in the country improved in January, with the index up to 51.9, while services output was also better than anticipated in the same month, as the index printed 55.5.

The greenback got further support from the ADP survey on private jobs’ creation, as it printed a whooping 291K almost doubling the market’s forecast of 156K. A mixed monthly employment report, however, failed to impress. According to the Nonfarm Payroll report, the country added 225K new jobs in January, but the positive headline was overshadowed by a higher unemployment rate, which rose to 3.6%, despite the participation rate decreased to 63.4%. Wages’ growth was also uneven when compared to the market’s expectations, up by 0.2% MoM and by 3.1% YoY.

The coronavirus outbreak has been the main catalyst for gold’s gains. Concerns that the illness continues to spread worldwide and affect global trade and hence economic growth, tend to weigh on the market’s mood. The WHO declared it a global health emergency, although Director Tedros said that there’s no need to interfere with global travel or trade. Nevertheless, fears it could affect global progress would affect the performance of equities and trigger demand for the bright metal.

Would the greenback retain its strength?

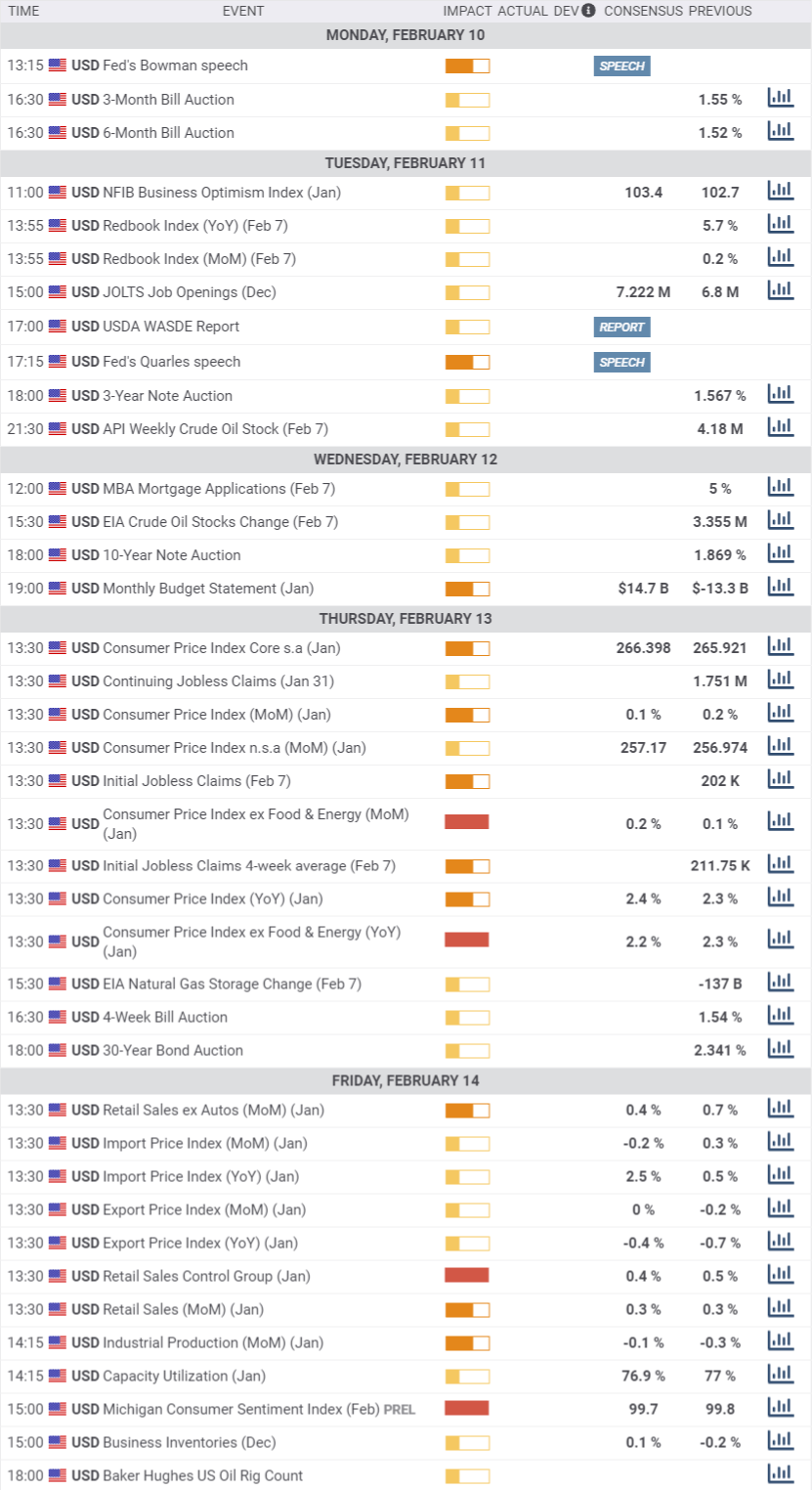

The upcoming week will be lighter in terms of US relevant data, although US Fed’s Chief Powell, is scheduled to testify before the Congress. The annual CPI, to be out next Thursday, is foreseen at 2.4%, slightly better than the previous 2.3%, while the core yearly CPI is seen at 2.2% from 2.3%.

On Friday, the country will release January Retail Sales, seen increasing by 0.3%, and the preliminary estimate of the February Michigan Consumer Sentiment Index foreseen at 99.7 from 99.8 in January.

With that in mind, the dollar’s strength would depend on how coronavirus-related headline could affect equities.

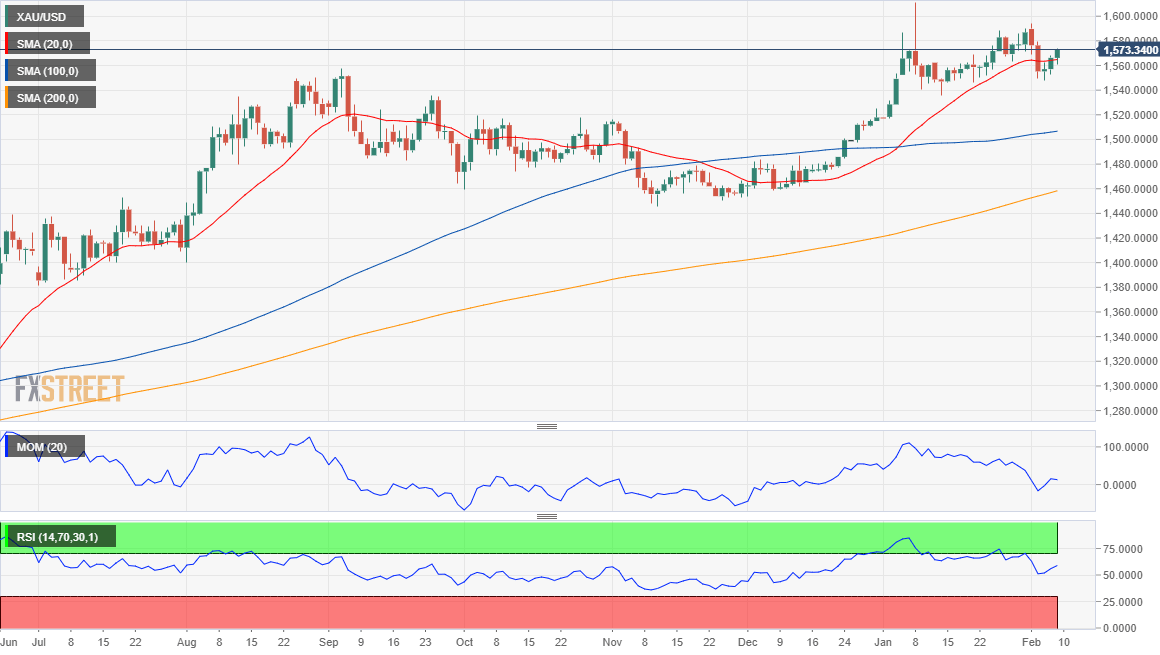

Spot Gold Technical Outlook

The bright metal is trading close to the 61.8% retracement of its long-term decline measured between 1,920.70 and 1,046.37, at 1,585.98. Spot tried multiple times to overcome the level this year, but so far, sellers have rejected them

The weekly chart shows that the price is far above all of its moving averages, wihich retain their bullish slopes. Technical indicators, however, have turned lower, the Momentum just above its mid-line but the RSI closer to overbought levels, indicating limited selling interest and keeping the risk skewed to the upside.

Daily basis, the commodity is holding just above a flat 20 DMA, but far above the larger ones. Technical indicators are bouncing from their midlines, also favouring further advances. The immediate resistance is 1,579.60 ahead of the mentioned Fibonacci level around 1,586. An immediate support level is 1,560, ahead of 1,547.40.

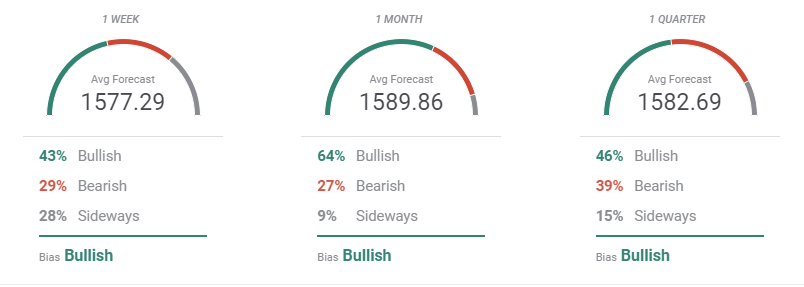

Gold Sentiment Poll

According to the FXStreet Forecast Poll gold is poised to retain its bullish stance. Bulls are a majority in all the time-frame under study but the pair mentioned Fibonacci resistance weighs on investors, as the pair is hardly seen above it. The positive sentiment is stronger in the one-month perspective when it’s seen on average at 1,589.86.

The Overview chart shows that moving averages are losing their bullish momentum, mostly flat. Nevertheless, chances of a steeper decline seem limited for now.

Related Forecast:

EUR/USD Forecast: A bottom not yet at sight

AUD/USD Forecast: Coronavirus and RBA remain in focus as Aussie eyes the abyss

GBP/USD Forecast: Bears leading in battle between Boris' Brexit blues and bullish economy

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.