EURUSD support at 1.12 in focus

Silver surges to top of three-month range

AUD soft ahead of RBA meeting

Silver grew wings today as the commodity currencies (save the AUD) rallied and the EUR battled higher before taking an ungraceful dive.

Today's key FX developments

The euro was all over the map today, first surging higher versus the US dollar and especially the Japanese yen in early trading before reversing hard against both currencies coming into the US hours.

AUD was weak, even amid strong risk appetite and an enthusiastic rally in CAD and NZD as traders perhaps fear a dovish performance from the Reserve Bank of Australia at tonight's meeting.

CHF notably remains toward the weak side of the local range versus the euro today despite the EUR trading generally weakly elsewhere later today. This suggests that while there is no apparent safe-haven bid in the franc, there may be a tendency for the currency to weaken when risk sentiment turns more positive.

Gold remains elevated after Friday's strong performance, and silver really leaped into action today, powering all the way to the top of the three-month range and setting up a test of an interesting zone of resistance (if it continues higher) that could have structural implications.

EURUSD

EURUSD saw an odd double pump and dump since Friday; it seems the local support around 1.1200 is the immediate focus, though we really need to see a breakdown below 1.1100 to get things going again for the bears as we need to work out of this local range.

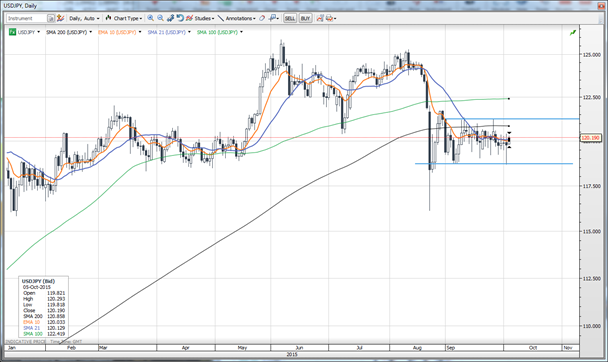

USDJPY

USDJPY saw a very solid bounce from the lows on Friday amid the renewed surge in risk sentiment, which is obviously key for the pair. This marks too many reversals to continue counting them for now as we look for a close either above the 121.25 area or below 119.00. Note that the Bank of Japan makes an announcement on Wednesday.

AUDNZD

Focus on AUD crosses ahead of the RBA tonight and we have this one through the important 1.0900 area, theoretically opening up for the 1.0750 area eventually if the RBA waxes a bit dovish. In the end, though, we are still looking at this as a counter-trend consolidation that eventually yields to a new rally.

XAGUSD

Silver ripped higher on the day and all the way to the top of the 3-month range above $15.50/oz. A continuation of this rally begins to have structural implications, especially if we can continue to power higher (without steep retracements) back above the 200-day moving average currently near $16.00/oz.

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.