Key developments in FX today

Today's action saw the USD attempting to follow through on a comeback attempt after the US Q2 Employment Cost Index release on Friday triggered an avalanche of USD selling. That experience will mean bad nerves for USD traders all week on each and every data release, though of course the chief focus will be on Friday's July jobs numbers.

GBP eased back lower after testing a bit higher as traders are unwilling to make a commitment to GBP positioning ahead of this Thursday's Bank of England bonanza, in which we get the meeting announcement (no move expected), the vote, the meeting minutes, and economic forecasts all at the same time under a welcome new regime of meeting day behaviour from the central bank. As if that wasn't enough, we'll also see the quarterly inflation report delivered by Governor Carney. EURGBP will look lower if the bank continues to tilt to the hawkish side and risk appetite rallies afresh, keeping a pro-cyclical focus. GBPUSD, meanwhile, will be more susceptible to the US data this week for direction. The latter pair has gone sideways.

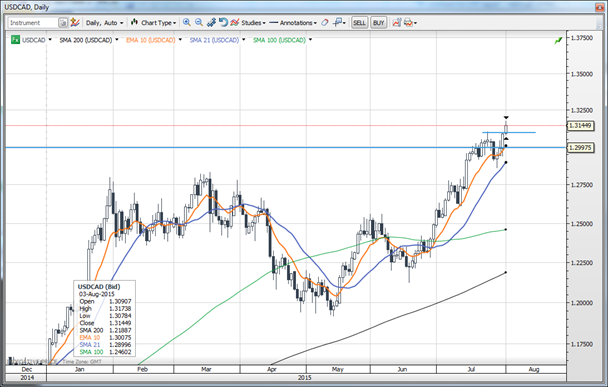

CAD has been the weakest currency of late on the further dump in oil prices and a weak Canadian GDP number on Friday suggesting the country is mired in outright recession, and USDCAD set new decade-plus highs above 1.3100, the new local support.

AUD trading sideways ahead of an RBA meeting tonight that doesn't appear to be highly anticipated, but that may have a higher risk of negative rather than positive surprises (as the market already looks complacent on the RBA's declared "wait and see" stance.)

EURUSD

The "pump and dump" on Friday has likely frazzled traders' nerves as we await the key US data, crowned by Friday's payrolls number and the market attempts to price in or price out a rate hike at the September FOMC meeting.

USD awaiting direction from data

USDCAD

USDCAD has jumped to new highs despite the inaction elsewhere as the oil price slide continues and the Canadian GDP data release on Friday suggest that Canada is in recession. There are few chart points up here to project as the bulls have full sway and the pair could continue to higher, especially if USD strength contributes on top of the CAD weakness. 1.3100 is the new support and the next focus could be 1.3250 and even 1.3400+.

The Canadian dollar has fallen to new lows against its US counterpart

AUDUSD

The AUDUSD chart is in need of a catalyst as we have been stuck in range for some time now. The bears may get what they want tonight from the RBA and help the chart lower toward 0.7000. The local resistance remains 0.7330/50.

The Aussie dollar could head lower tonight

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.