Hourly

Yesterday’s Trading:

On Tuesday, euro/dollar trading closed slightly up. Support for the rate came from euro crosses. The dollar also weakened against the Japanese yen and Swiss franc. They became safe haven assets as geopolitical tensions were ratcheted up; yesterday the Turks shot down a Russian plane. Oil and gold is up and the euro has a positive correlation with these commodities.

US industrial manufacturing for October was down 0.2% (forecasted: 0.1%, previous: -0.2%).

Main news of the day (EET):

15:30, US October data for incomes and expenditure, durable goods orders, initial unemployment benefit applications;

16:00, US September housing index;

16:45, Markit November service sector business activity index;

17:00, October new housing sales.

Market Expectations:

The US Fed published the minutes from their closed meeting on discount rates from 24th November. Two reserve banks requested that the discounted rate remain at 0.75%, one asked that it be dropped to 0.25%, nine wanted to raise the rate by 0.25%. The rate was left where it was but it’s possible that it could be up following the FOMC’s meeting on 16th December.

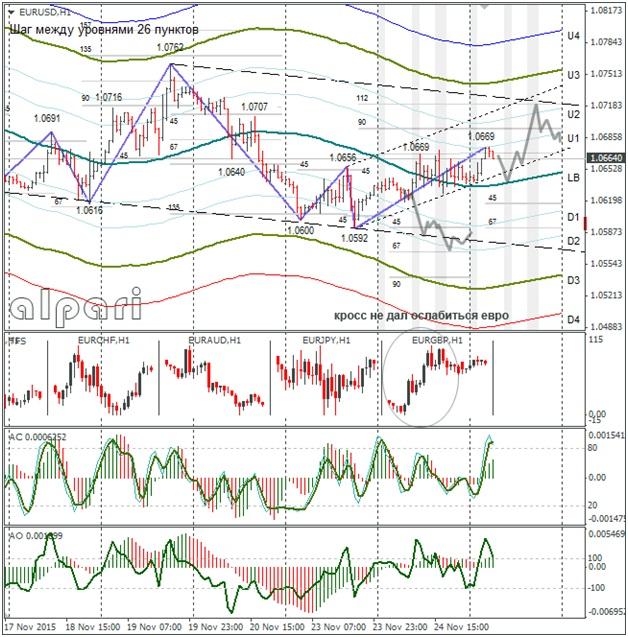

Europe’s calendar is empty, this means that the market will be working off technical analysis and the price levels of the supports and resistances until the evening. The euro/dollar rate is above the LB. The 1.0600 and 1.0592 minimums can be seen as a double bottom. The target on it is 1.0750.

It’s not worth really trusting my forecast because since 20th November I’ve only been seeing signals which indicate euro growth and it’s not for nothing that I see this: the cycles are showing a strengthening for the euro and on the daily time period there are three downward fractals with bull divergence. I’m not excluding a return of the euro to the trend at 1.0575. The situation is a complete 50/50.

Technical Analysis:

Intraday target maximum: 1.0723, minimum: 1.0635, close: 1.0685;

Intraday volatility for last 10 weeks: 103 points (4 figures).

The euro/dollar is trading by the LB. The market is balanced so the pair is ready to stray from this line.

Daily

I’m just going to repeat myself again here. The cycles are telling me that the bear phase switched into a bull one on 20th November. Bull divergence has formed between the price and the indicators. The inverted price pattern on the hourly also indicated that the euro is to strengthen. These are technical signals, so it’s not worth ignoring them. If the first target of 1.0730 is brought back, its break will lead to another target of 1.0829 being formed. Now to the Weekly.

Weekly

The bulls are trying to break from 1.0592. The weakness of the pound in its cross with the euro has aided the euro bulls. The CCI indicator has flipped downside up, but it is for the moment still below -100. As soon as the line crosses the level, on the daily we will have a signal to leave short positions. The closest target is still at 1.0520.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.