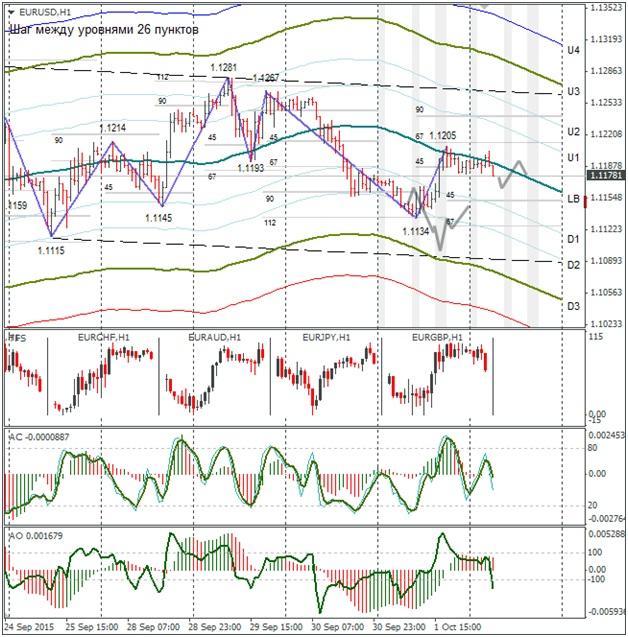

Hourly

Yesterday’s Trading:

On Thursday the euro/dollar closed up. Weak Eurozone stats saw the euro renew its minimum and then return to the LB after weak US stats came out. Unemployment benefits in the US were up and the ISM business activeness index was down.

The amount of unemployment benefit applications in the US for the week ending 26th September stood at 277,000 (forecasted: 270k, previous: 267k).

Markit’s US business activeness index was up from 53.0 to 53.1.

The ISM’s version of the same thing was down from 51.1 to 50.2.

Main news of the day:

At 09:00 EET, Germany is publishing data on August retail sales changes;

At 11:30 EET, the UK’s construction sector PMI for September is out;

At 15:30 EET, the US will release unemployment level figures and those for the NFP for September;

At 17:00 EET, the US will release its report on August changes in manufacturing orders.

Market Expectations:

On Friday investor attention is on the NFP as always. Expect euro/dollar fluctuations near the LB until 15:30.

Technical Analysis:

Intraday target maximum: n/a, minimum: n/a, close: n/a;

Intraday volatility for last 10 weeks: 123 points (4 figures).

The euro/dollar returned to the LB on Thursday during the American session. We should see a consolidation for the pair around the LB until 15:30 due to today’s NFP being out. The publication of the NFP will be sure to knock the rate out of position.

Daily

The triangle is still on the cards and so I’ve left the graph unchanged from yesterday.

Weekly

The euro/dollar is still trading in a sideways trend between 1.1086 and 1.1456. We need to wait for a depart from this zone.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.