Trading opportunities for currency pair: after a sharp growth due to Janet Yellen’s announcement, the USD/NOK is seeing a correction. If the dollar starts correcting against all the key pairs, we can set our first target at 8.3310.

Background:

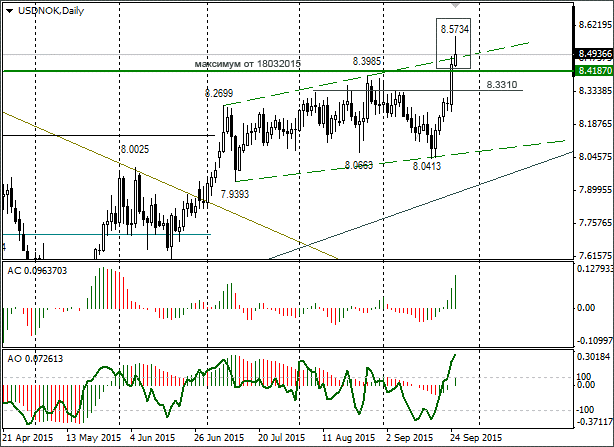

The last idea I did on the USD/NOK came out on 24th September. After a break in the trend, the dollar was trading near the lower limit of the channel. In the idea I considered a weakening of the dollar to 7.8950 if pressure were to increase on the currency due to a strengthening of the price of oil. The USD/NOK fell to 8.0413 and rebounded upwards to 8.5734.

Current situation

The dollar was up on Thursday after Janet Yellen’s speech. The Fed chief left the possibility of putting up the US base rate open for this year.

What’s interesting at the moment?

On Friday the USD/NOK closed around 8.4936 after a renewal of the maximum. In this idea, I’m considering a fall of the dollar to 8.3310 as part of a correction. It’s unlikely to go lower, since oil is now going for $50 per barrel and Brent has been trading in a narrow range for the past 18 days.

Friday’s candle has a long tail. Its weakness is its bullish body. With this kind of candle, the rate could return to 8.5734 at some point today. If the USD/NOK closes Monday around 8.4440, it might be best to put a sell-stop order on. A strengthening of the sellers below 8.4187 will strengthen the dollar’s bearish mood on the market. Before selling dollars, keep an eye on the price of oil and other dollar pairs.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.