We saw a sharp rebound of Chinese equity markets recently. One of the key reasons for the rebound is that investors are expecting stimulus package from the National Development and Reform Commission (NDRC). Shanghai Composite Index YTD returned to positive territories, yet still underperforming compared to the MSCI Asia ex-Japan index. The 1Q GDP will be released this Wednesday and it could lead to further speculation regarding its coming infrastructure stimulus package.

We expect that the 1Q GDP growth would be in between 7.3-7.5% this year. If it is true, local authorities would need to respond by slowing down economic growth with more mini-stimulus packages. If not, the economy will fall further for the rest of the quarters. Chinese government has started to withdraw in the 4Q last year, when the economic conditions began its falling trend. Bad weather in U.S. and China for the past months could be one of the reasons, but lack of the policy support is the main reason.

Chinese new government is believed to promote social stability in order to build its credibility. Current situation in China is very complicated. There will not be any perfect policy in near term if they want to achieve both growth and reform at the same time. At this moment, Chinese government will not risk ignoring the growth bottom line. If confidence wanes and triggers a slower growth, it will be much easier to reach a larger credit crisis and bailout costs will be even more expensive, based on previous experiences in U.S. and the Euro Zone. The policy will remain accommodative this year where measures and regulations to “taper the debts level” will be gradually adopted, if the Q1 growth fails to reach 7.5% or above. Stable growth means a higher employment rate, which does not contradict the promotion of consumptions. If growth slows down too much, the officials will react immediately.

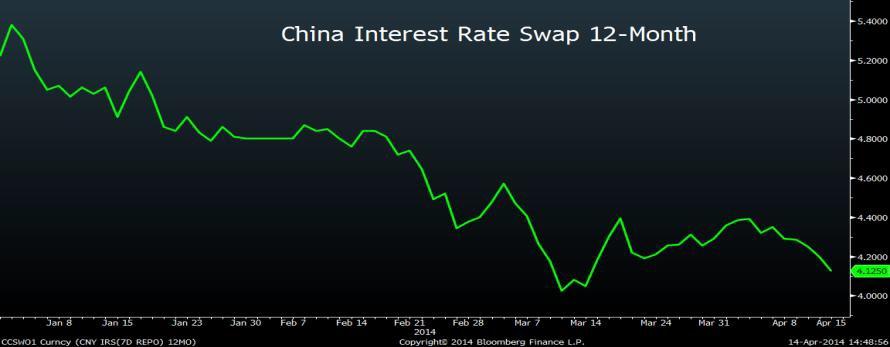

Evidence of another wave of stimulus has been seen. Jan-Fed Infrastructure investment grew 18.8% MoM, accelerated after a significant drop in the end of 2013. Railway investment surged leads to “pro-growth” policy to be “believable”. The numbers of the City Investment Bond in China issuance increased significantly, indicating that more infrastructure projects will be introduced in the coming months. China’s rates slid to a one-month low on speculations that the central bank’s money-market operations will add cash to the financial system.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.