GBP/USD was sticking to the 1.5550 area. The bears were not very active despite good news from the US. The reason is that like the Federal Reserve, the Bank of England is also close to raising interest rates. In line with expectations, British economic growth has accelerated in Q2. Although growth is fueled by the service sector and not manufacturing, recent hawkish comments of the central bank’s official make investors rather positive about the pound.

Next week the UK will release three PMIs – manufacturing, construction and services. On Thursday, the Bank of England will publish its quarterly inflation report. As you may remember, British inflation was heavily hit in the previous months, but, according to the regulator, it was due to the falling oil prices, and without their disturbing impact inflation is OK. Moreover, for the first time ever the Bank of England’s meeting minutes will be released right after the meeting. The market will expect at least two members of the Bank of England’s Monetary Policy Committee to vote for the rate hike, which is bullish for GBP. Surely, such abundance of data on Thursday will need comments from the top officials, so Governor Mark Carney will give a press conference.

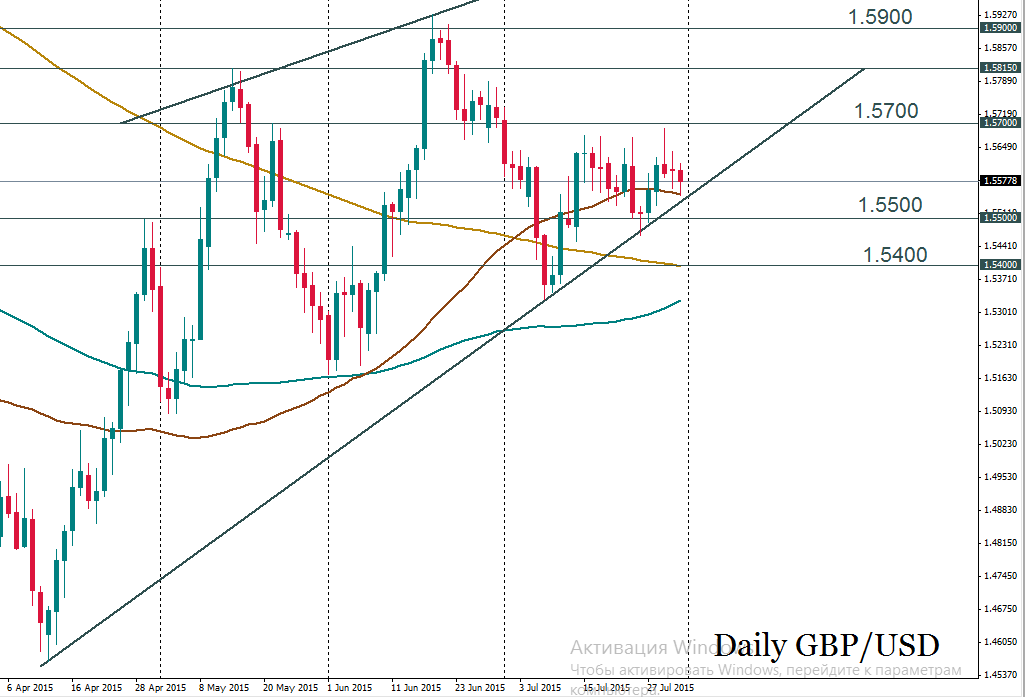

We expect great volatility in GBP/USD. The risk for pound will be to the upside. Strong resistance lies at 1.5700 – many times the bulls failed to overcome this psychological mark. If GBP/USD manages to fix above this point, it could rise to 1.5900/30 (June high). Support is seen at 1.5500 and 1.5400.

GBP/USD, Daily

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.