Markets have spent the week so far being largely uncertain about what to do next. However, we are finally beginning to see some movement from GBP, and in particular GBPJPY. The mammoth pair is riding upwards to close the gap that has occurred over the weekend, as shown in Figure 1.

Figure 1: GBPJPY is Rising to Close the Gap

The question in traders’ minds should be what happens after the gap is closed, assuming it is closed. In many cases, there would be a consideration of two opposing factors:

-

That the gap reflected overly bearish sentiment and was a false breakout, and thus that prices are headed higher on the closing of the gap.

-

That prices are only headed higher for a brief respite, and will continue lower.

Both situations are possible, of course. However, given the severity of the implications of Brexit, it would seem reasonable to assume that the probability of price going lower is higher than of it rising. More importantly, pullback trades tend to be better in reward-to-risk profile than breakout trades.

Thus, bold traders may well be willing to take on a short once the gap is closed.

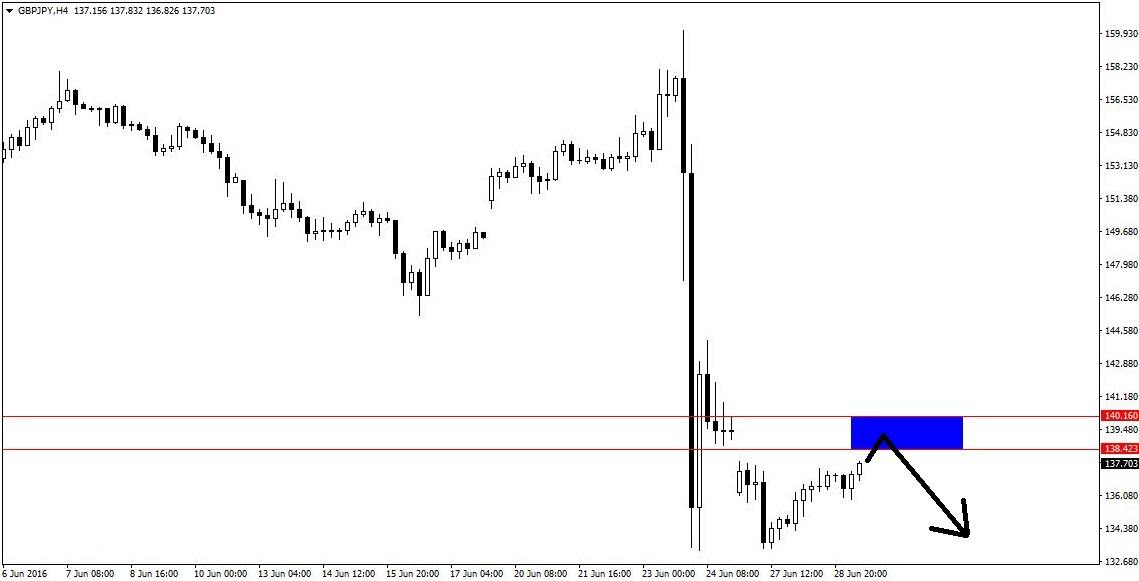

The levels of interest are illustrated in Figure 2. The Blue Box shows where there is a confluence of technical levels and factors, which may well turn lower. Once price touches this Box, signs of reversal in the form of candlestick patterns or divergence would all be acceptable potential trade triggers into a short. Traders will need to decide which triggers are appropriate for their risk appetites and trading plans, as always. Figure 2’s Blue Box is 138.42-140.16.

Figure 2: GBPJPY’s Blue Box

RISK DISCLOSURE: Trading foreign exchange (FX) and contracts for difference (CFD) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in FX or CFDs you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with leveraged trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.