The British Pound is under pressure after the release of the UK manufacturing PMI down to 51.4 in June against expectations of 52.5. The manufacturing sector grew at its weakest rate in more than two years, weighed by subdued export demand from Europe.

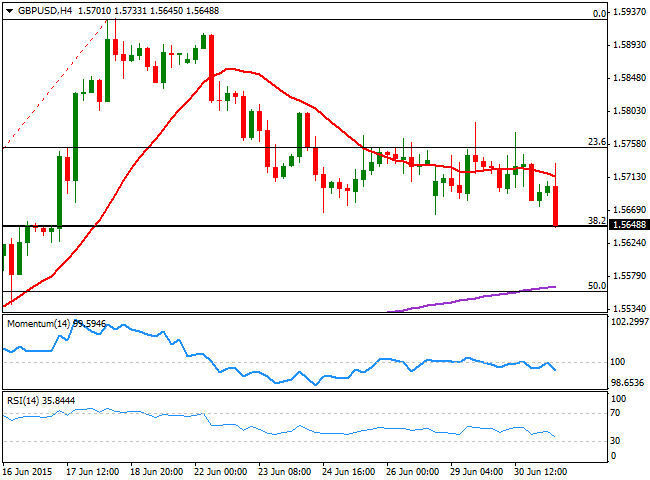

The GBP/USD accelerated south and pressures the 1.5645 strong static support, the 38.2% retracement of the latest bullish run, with the pair poised to extend its decline on a break below it. The 4 hours chart shows that the technical readings support such decline, as the price extended below its 20 SMA whist the technical indicators are gaining bearish momentum below their mid-lines. A break below the level should lead to a test of the 1.5600 figure, in route to 1.5550, the 50% retracement of the same rally.

The immediate resistance comes at 1.5700, with some steady gains above the level required to revert the negative tone intraday, and signaling a probable recovery up to the 1.5750 region.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.