The second estimate of the US first quarter 2015 GDP is due for release tomorrow. The preliminary estimate had predicted a growth rate of just 0.2%. The second estimate due tomorrow is likely to show a massive contraction of 0.9% in the economic growth rate.

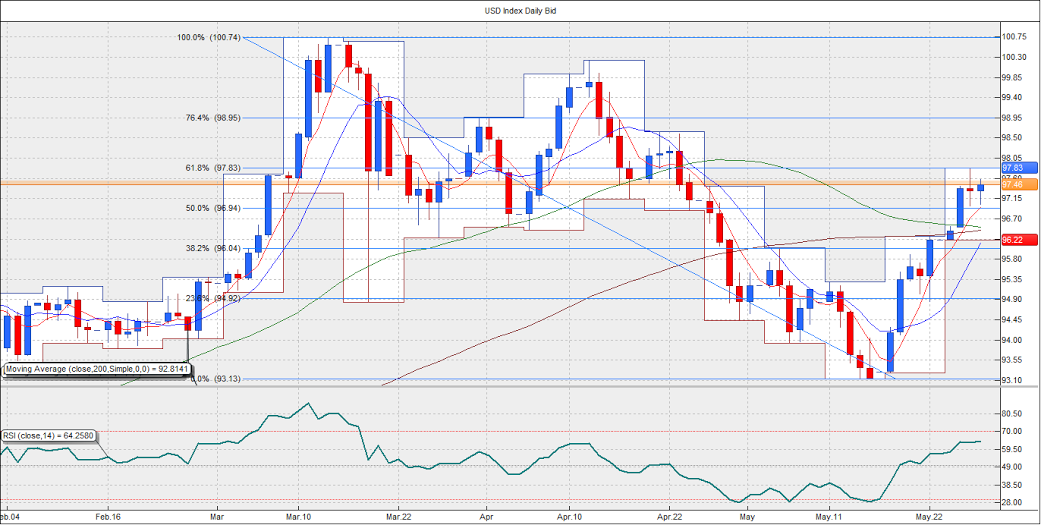

USD rallied ahead of GDP report released in the month end

The USD index has rallied from the low of 93.15 seen in Mid-may to trade currently at 97.50 levels. The major part of the rally was fuelled by increased speculation of a rate hike in the US this year, after core CPI, core durable goods in April bettered expectations. Especially, core CPI rose at its fastest rate since early 2013. Furthermore, Yellen’s comments of a rate hike sometime this year added fuel to the fire. Meanwhile, renewed tensions in Greece also helped strengthen the USD.

The move in the USD index Mid April to Mid May (100.23 to 93.13) and Mid-May till date (93.13 to 97.50) indicates markets could–

Have priced-in weak Q1 growth (100.23-93.13)

Have begun pricing-in rebound in growth in the current quarter (93.13-97.50)

Hence, the second estimate of Q1 GDP by itself could very well turn out to be a non-event tomorrow. However, there are always three scenarios that could unfold – A weaker-than-expected print, a stronger-than-expected print, and an actual print that is in-line with the estimates.

A stronger-than-expected print, especially in a positive territory is a no-brainer in a sense that it would trigger increased rate hike expectations and lead to cross the board rally in the USD index.

If the second estimate prints in-line with expectation of (-0.9%), we could see a minor correction in the USD index. Moreover, the data comes at the month-end and thus dollar long positions could be squared off.

In case, the GDP is revised lower than -0.9%, the correction in the USD could be bigger.

The first scenario is highly unlikely. Between the second and the third, the reaction would be more intense of a weaker-than-expected growth rate. Not only would a weaker-than-expected print delay rate hike bets, but it would also amplify the impact of month-end unwinding of profitable trading positions (dollar long positions).

Meanwhile, anything between -0.9% to 0.00% is likely to be met with a lackluster reaction in the markets. Again, as said earlier, the movement in the USD index suggests markets have priced-in a weak Q1. Only a a weaker-than-expected print could trigger a significant sell-off in the USD.

The forward looking indicators so far have - core CPI, core durables have indicated a rebound in growth. The job market also rebounded in April. Thus, expectations are high that current quarter would reverse the declining quarterly trend in the US GDP - 3.9% growth figure in Q3 2014 followed by a 2.2% GDP reading for Q4 2014. Hence, once again, a GDP between -0.9% to 0.0% is unlikely to result in significant dollar weakness.

USD index trades at 61.8% Fib level

The recovery in the USD index from the low of 93.13 has stalled around 97.52 (61.8% Fib R of 100.23-93.13).

The index clocked a high of 97.83 (61.8% Fib of 100.74-93.13) in the previous session before ending lower at 97.31 to form a bearish spinning top on the daily chart.

In case of a weaker-than-expected GDP print, we could see the USD index drop below 96.94 (50% Fib R of 100.74-93.13) to 95.84 levels.

In case of no positive/negative surprises, we could see the index suffer losses and drop to 97.00 levels on month-end profit booking.

A break below 97.01 would confirm a breach of head and shoulder pattern on the hourly chart and open doors for a technical target of 96.00.

On the upside, only a daily close above 98.57 could open doors for a re-test of 100.74

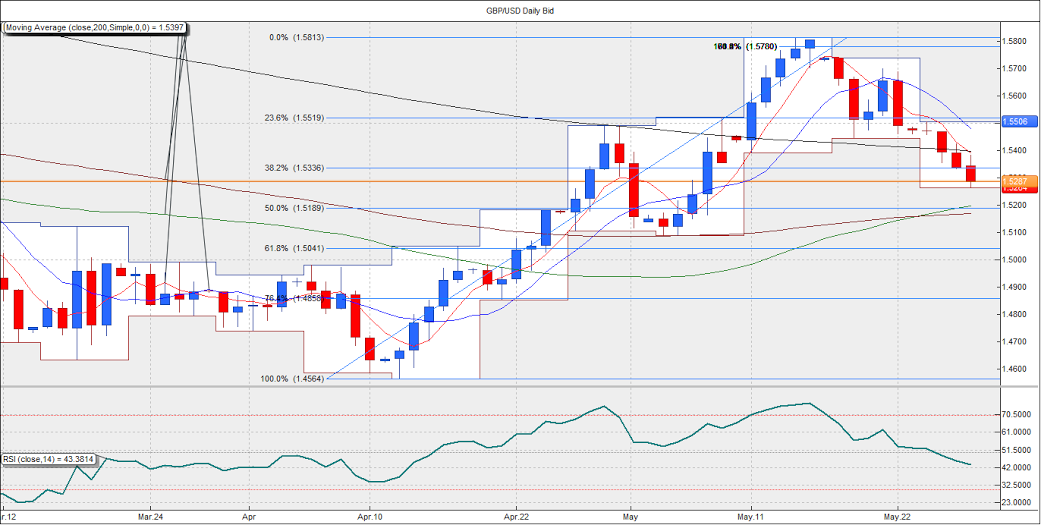

GBP/USD – Could be restricted to a range of 1.5390-1.5189

The GBP/USD pair dipped to a low of 1.5264 levels today after the second estimate of the UK first quarter 2015 GDP was left unrevised at 0.3% quarter-on-quarter and 2.4% year-on-year. Markets were expecting an upward revision of 0.1% to both the numbers.

The pair could remain stuck broadly in the range of 1.5350-1.5189 in case we have no significant positive/negative surprises from the second estimate of US GDP.

The losses in the GBP/USD could be extended to 1.5189 (50% Fib R of 1.4564-1.5813) in case we have a GDP print above the expected fall of 0.9%.

Meanwhile, a contraction of 0.9% would be a non-event and lead to a correction in the GBP/USD to 1.5350-1.5390 levels. The pair could rise to 1.5390 in case we have a daily closing today above 1.53.

Events Post GDP

While trading the GDP report, it is worth nothing the events that are scheduled in the next week. We have

Non-farm payrolls report in the US,

Greek payment to the IMF, scheduled on June 5 and

OPEC semi-annual meeting scheduled on June 5

News has been doing the rounds that Greece is nearing a deal with its international creditors. A deal before June 5 would be supportive for the EUR and bearish for the USD.

Meanwhile, the OPEC is expected to keep the production levels unchanged. Crude prices have started falling ahead of the meet. Thus, we could see the repeat of - falling bond yields across developed nations on weak energy prices, rise in the USD - seen ahead of the November meet.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.