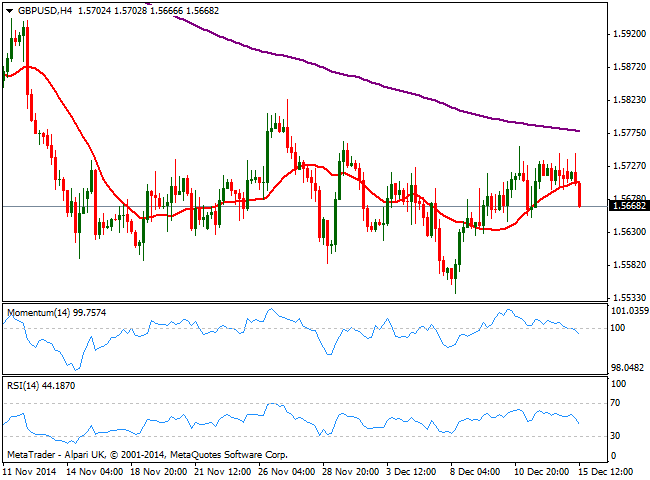

Technically, the 1.5750 price zone has proved once again its strength as resistance, as the level has been attracting selling interest since late November. Stops got tripped below 1.5700, fueling the side and pointing now for an approach to the 1.5610/20 area, first line of buying interest. The 4 hours chart shows the price extending below its 20 SMA and indicators accelerating below their midlines, supporting further declines; a break below mentioned 1.5610 price zone should see the bearish momentum extending, and price reaching 1.5550 price zone.

The pair needs to recover above 1.5700 to revert current negative intraday tone, and advance again towards mentioned 1.5740/60 area, albeit a break above this last seems unlikely for today.

View Live Chart for GBP/USD

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.