- GBP/USD has rocked and rolled on election-related news.

- Additional opinion polls, gaffes, and trade-related headlines are set to determine the next moves.

- Mid-November's daily chart is painting a mixed picture for the pair.

- The FX Poll is pointing to falls beyond the short term.

While opinion polls have been favorable to the Conservatives, the televised debate was a shot in the arm to Labour. Election news will likely dominate the last full week of November, but trade headlines and other developments are also on the cards.

This week in GBP/USD: Polls giveth, debate taketh away

The week began positively for Prime Minister Boris Johnson and the pound. Opinion polls ahead of the December 12 elections have shown double-digit leads for the PM's Conservative Party over opposition Labour.

Investors would like to see an outright majority for Johnson, who would then proceed to ratify his Brexit deal and enact market-friendly policies. Markets are shivering at the thought of seeing Corbyn – with his nationalization plans – at 10 Downing Street.

Most of the increase in support for the Tories came from the Brexit Party. Supporters of Nigel Farage's outfit have jumped ship following the right-wing outfit's decision to drop candidates from a majority of British constituencies.

In the meantime, support for Jeremy Corbyn's Labour Party only marginally increased. Support for the pro-Remain Liberal Democrats and the Greens eroded in favor of the main opposition party but mostly remained intact.

Pound/dollar hit a high of 1.2985, setting a new high for November, but things changed after the debate. Viewers of ITV's faceoff showed a tie between Johnson and Corbyn, who had clashed over Brexit, the NHS, and other topics. However, further polling details revealed that the opposition leader's showing outperformed the PM's. Moreover, seeing Corbyn as an equal contender may boost his appeal to the public.

Sterling found itself on the back foot once again.

The pound also suffered from downbeat Purchasing Managers' Indexes. The first-ever preliminary release of services and manufacturing PMIs before the end of the months showed that both sectors are in contraction. The UK economy returned to growth in the third quarter but could be squeezing in the fourth quarter.

Elsewhere, US-Sino relations have deteriorated after the US Senate unanimously passed a bill supporting pro-Democracy protesters in Hong Kong. Beijing expressed its anger by summoning the US ambassador. The ongoing crisis in the city-state is growing in prominence and has weighed on stock markets, and the risk-off mood boosted the safe-haven greenback.

Optimistic and pessimistic headlines have been whipsawing markets, but GBP/USD has mostly reacted to domestic developments.

Officials from the Federal Reserve have reaffirmed their stance that the US economy is doing well and that the bank plans to leave interest rates unchanged for now. However, Lael Brainard, Governor at the bank, has warned that trade uncertainty is weighing on investment.

UK events: Polls, blunders, and promises

With the clock ticking down to December 12, opinion polls will have a more significant say. Can Corbyn convince voters to support him and not Johnson? That may weigh on the pound. However, if the Conservatives extend his lead, sterling may rally.

As the campaign becomes more intense, tired politicians may make mistakes. Johnson's unintentional early unveiling of changes to the National Insurance caught his party by surprise, but that was only a minor mistake. Any significant scandals may rock sterling.

The parties' manifestos and voters' responses to them – via surveys – may also move the pound.

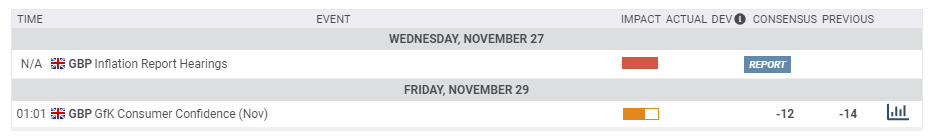

Apart from the elections, the British economic calendar is void of market-moving events. GfK's Consumer Confidence for November will likely show ongoing pessimism among consumers. It is still unclear if Mark Carney, Governor of the Bank of England, will detail the bank's latest inflation report. The event has been postponed in the past, and that may happen again.

Here is the list of UK events from the FXStreet calendar:

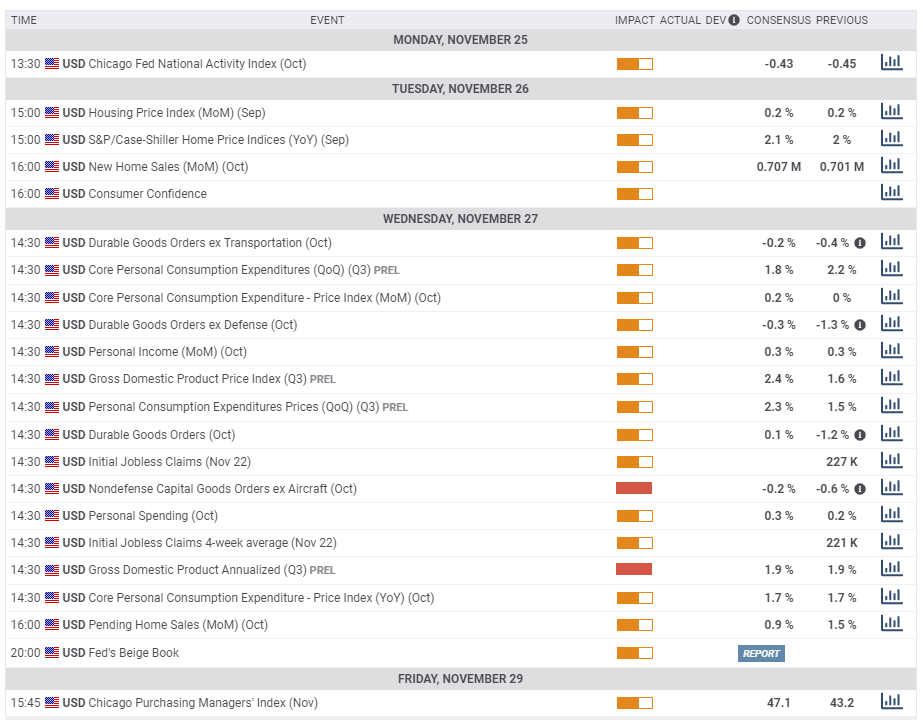

US events: Trade, GDP, and more

Trade headlines will likely rock the dollar, as the December 15 deadline for imposing new tariffs is getting closer. If the world's largest economies strike a deal, the safe-haven greenback may come under pressure.

The economic calendar features several housing figures and the Conference Board's Consumer Confidence measure on Tuesday. However, the top-tier events are due out only on Wednesday, ahead of the Thanksgiving holiday.

US Gross Domestic Product will likely be confirmed at 1.9% annualized for the third quarter, a slow rate, but a quicker pace than other developed economies. More recent investment data – via the Durable Goods Orders report – may steal the show. The figures for October are set to show no substantial increase in long-term spending.

The Fed's preferred measure of inflation, the Core Personal Consumption Expenditure Prices (Core PCE) is forecast to remain below 2%. Markets may be choppy on Wednesday, ahead of the holiday, and amid the big bulk of data.

Here the upcoming top US events this week:

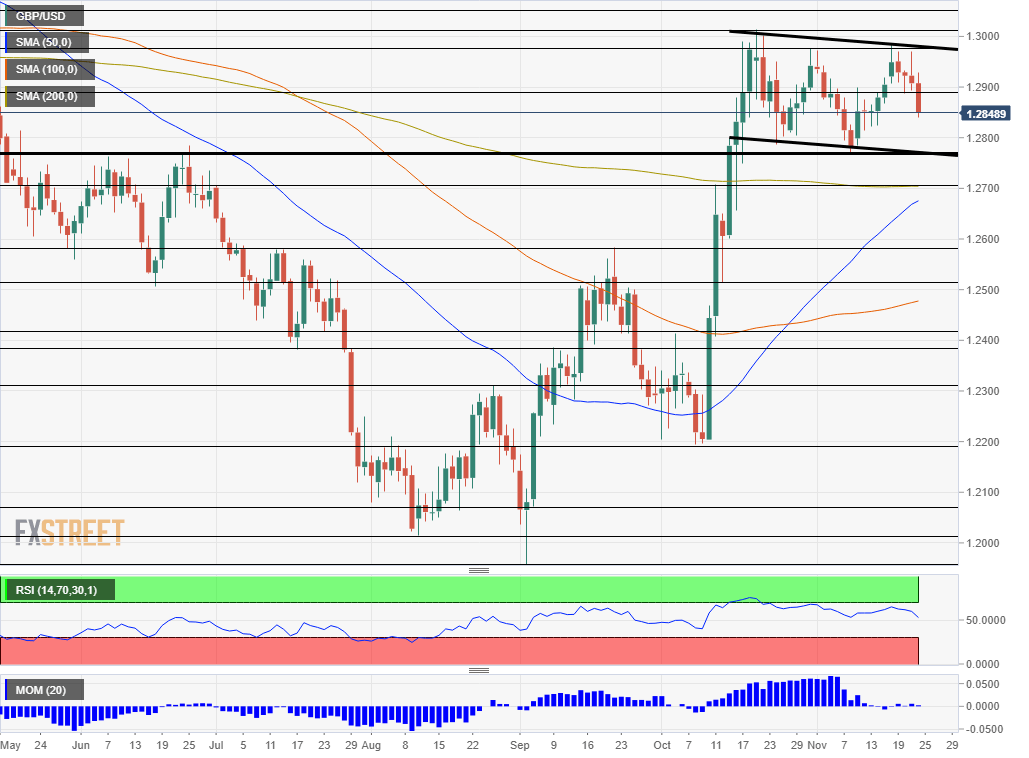

GBP/USD Technical Analysis

Pound/dollar has lost its upside momentum and also trades within a moderate and broad downtrend channel. However, cable continues holding above the 50, 100, and 200-day Simple Moving Averages and the 50-day SMA may cross the 200-day SMA soon – a bullish sign.

All in all, the picture is mixed.

Resistance awaits at 1.2985, which is November's high and only a tad above the late-October peak of 1.2980. The six-month high of 1.3013 is a critical line. Next, 1.3055, 1.32, and 1.3380 date back to the spring.

Looking down, support awaits at the mid-November low of 1.2885. It is followed by 1.2760, November's low. At 1.2700, we find the confluence of the 200-day SMA and a swing high from October. It is followed by 1.2580, which capped sterling twice in recent months. 1.2505 and 1.2420 are next.

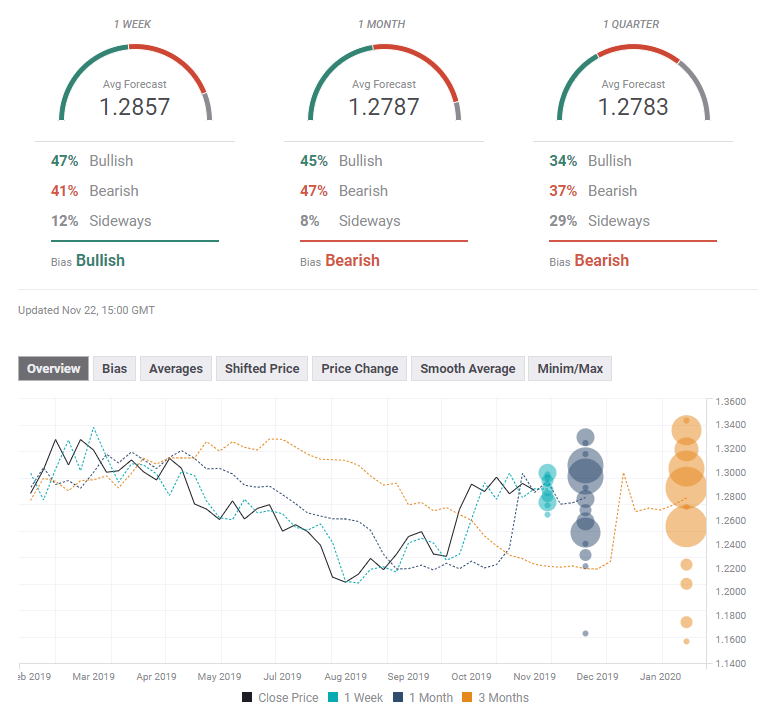

GBP/USD Sentiment

After Labour managed to stage a comeback in 2017, markets may fear that this history will repeat itself. GBP/USD may drop in the upcoming week before bouncing – if polls continue showing a substantial lead for the Tories.

The FX Poll is pointing to minimal short-term gains and a resumption of the falls afterward. Experts have upgraded their forecasts for all timeframes, but only just. Experts are divided on potential pound reactions to the elections, with a broad range of objectives for the medium and long terms.

Related Forecasts

- EUR/USD Forecast: Further falls due amid downtrend channel downbeat data and trade troubles

- USD/JPY Forecast: Tricky tests after Trump's one-two punch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.