Near term eur/$ outlook:

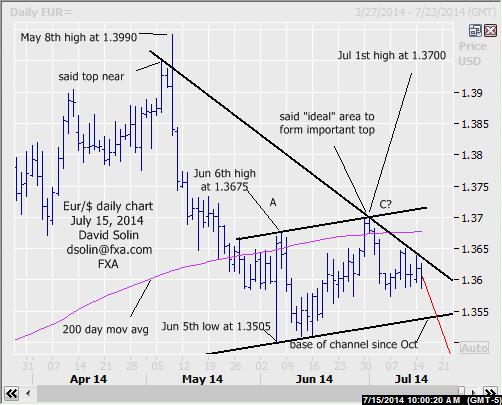

The market is trading near the middle of the 1.3505/1.3700 range that has been in place since Jun 5th. Seen as a correction with a resumption (potentially sharp) of the longer term declines after (see longer term below). Also as discussed in the Jun 8th email, this correction may have been completed at the Jul 1st high at 1.3700 (3 wave A-B-C, see numbering on daily chart below), and suggests that the resumption of the larger declines may be directly ahead. Key support is seen at 1.3505/30 (base of correction, base of bull channel from Oct, 38% retracement from the Jul 2013 low at 1.2755 and bull trendline from May 2012), with a break/close below potentially triggering that downside acceleration. Resistance is seen at the bearish trendline from May 6th (currently at 1.3640/55). Though a break above would not abort the bigger picture bearish view, it would raise the risk for a more extended period of wide correcting/consolidating before resuming the larger decline. Bottom line : month long correction may be complete with scope for a resumption of the larger declines ahead (potentially sharp).

Strategy/position:

Still short from the Jul 8th resell at 1.3610, and for now would continue to stop on a close 15 ticks above that bearish trendline from May 6th.

Longer term outlook:

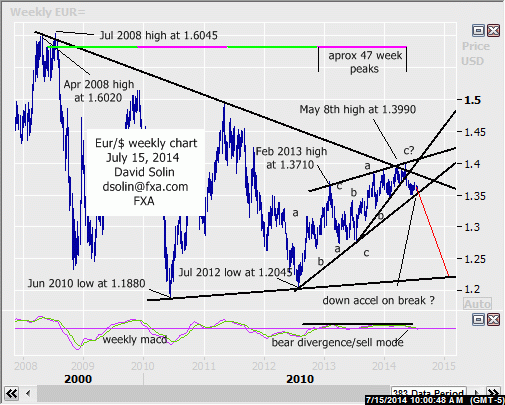

Still very bearish out the next number of months as an important top is seen in place at the May high at 1.3990, and with eventual declines all the way to the bullish trendline from Jun 2010/base of the triangle from Jul 2008 favored (currently at 1.2150/00, see in red on weekly chart/2nd chart below). Note that the market continues to trade within the huge triangle that has been forming since Apr 2008, with the May test of the ceiling near 1.40 targeting declines to the base. Other longer term negative remain and include technicals which remain bearish (see sell mode on weekly macd), the series of 47 week peaks which has recently topped, and the ECB which is clearly not comfortable with the market above 1.40. A last note, as discussed above the next downleg may be sharp as that bullish trendline from July 2012 (comes in the 1.3500 area) is also the base of a potential 2 year rising wedge (pattern that often resolves sharply), while such a move lower would also be seen as wave 3 in the fall from the May 1.3990 high (3rd waves are often the most "explosive" part of a trend). Bottom line : longer term bear, with a break below 1.3500/15 area potentially triggering a further, downside acceleration.

Strategy/position:

With a more important top seen in place, would stay with the longer term bearish bias that was put in place way back on Jan 17th at 1.3540 (got a bit caught).

Current:

Nearer term: short Jul 8th at 1.3610, scope for down acceleration on break below 1.3505/30.

Last: short May 23 at 1.3630, took profit Jun 18 above t-line from May (1.3580 , closed 1.3595).

Longer term: bearish Jan 17th at 1.3540, at least another few months of big picture downside ahead.

Last: bull bias Nov 26th at 1.3455, to neutral Nov 7th at 1.3635.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.