Euro Research Report

- Fears of a hung parliament in the UK unfounded

- Potential "Grexit" weighs on the Euro

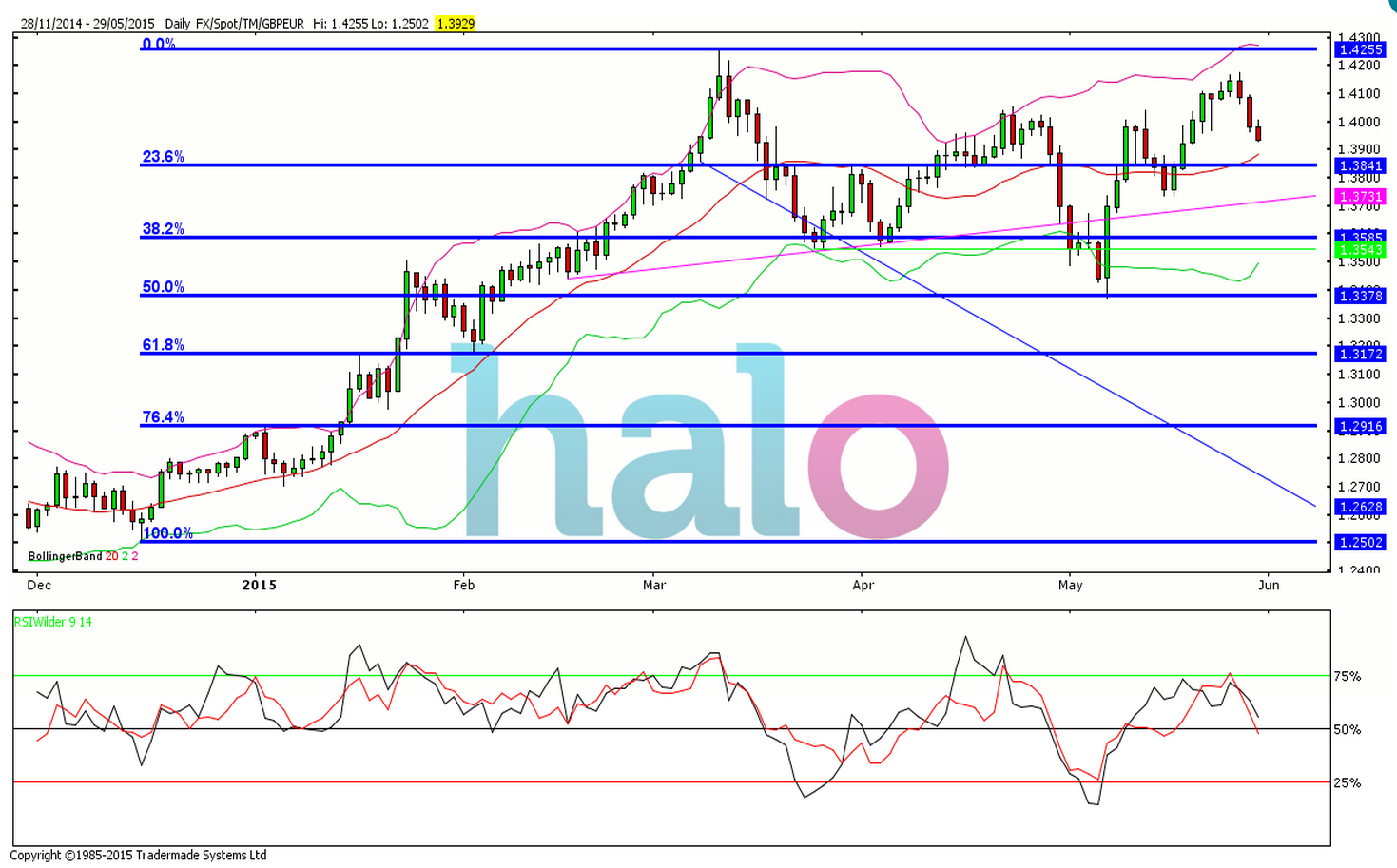

Sterling Euro (GBPEUR) FX Technical Analysis

Volatility has been the theme in 2015 and May was no exception. The political uncertainty of who will govern at 10 Downing Street caused the Pound to be sold off across the board. The Sterling Euro rate broke through key support levels, giving Euro sellers their long awaited opportunity. The pound then surged higher against the Euro after the first exit poll showed the Conservative Party racing ahead of their rivals and the window of opportunity for sellers was shut as quickly as it opened. Sterling Euro has resumed its uptrend and looks well supported as it targets the 7-year high once again.

A weaker Euro has helped to boost Euro zones exports by pushing higher the trade surplus and aiding its economic recovery. As a result, this has halted the decline of inflation after four consecutive months. It is clear that the ECB still would prefer the Euro lower, as displayed by the European Central Bank Coeure latest jawboning. He suggested that the ECB will step up its bond purchases under its €1.1 trillion for May and June ahead of an expected low liquidity period in the summer. Any gains the Euro made in the two previous months were immediately erased.

Eurozone data again proved to be mixed. Growth in Germany, the powerhouse of the region , slowed as business optimism declined and the manufacturing sector - a key component of Germany’s GDP - was in worse shape than the previous month. Overall though , the Eurozone’s economy expanded at nearly its fastest pace in 2 years suggesting that a recovery is taking hold. This will give policymakers some real encouragement that the economic health of the region is improving and the ECB program of quantitative easing is working as planned.

Still weighing on the Euro is the political uncertainty surrounding the possible ‘Grexit’. Fears have continued to mount that if a deal cannot be struck with its creditors, Greece will default on their debt obligation and ultimately be forced to leave the Eurozone. Greece needs to repay €1.6 billion to the IMF over the period between June 5 and June 19. This instability clearly demonstrates how precarious the Eurozone’s recovery will be over the coming years and leaves the Euro vulnerable.

The Bank of England remained unanimous in decision to leave policy unchanged in May, although the minutes revealed a rift among the policymakers, as two members remained finely balanced. This was despite inflation dipping into deflationary territory for the first time since 1960 as the drop in food and energy prices depressed the cost of living. However, Governor Carney had forewarned the market about the potential drop below 0%, and had described this “good deflation” as only temporary. This optimism is a stark contrast to that of the Eurozone deflation. Consumers took advantage of higher real income and lower prices and pushed retail sales up by 1.2%.

Growth the UK sectors was mixed too. U.K. factory orders unexpectedly cooled last month to a 7 month low, as the stronger Pound hit demand for British goods abroad. UK Construction PMI also underperformed as it fell to a 22-month low in Q2. Construction , however accounts for only 6% of the UK's total GDP and it still remained in expansionary territory. The UK Services Sector contributes close 78% of the UK total GDP and hit an 8-Month high as expansion of new business improved and job creation increased at a strong pace causing the unemployment level to fall to 5.5% , the lowest since 2008. This upturn in service sector activity should help offset sharp slowdowns in both manufacturing and construction sectors.

For EUR Buyers

Although the rate has depreciated from the recent high of just above 1.4000 at present this move is corrective in nature. There is a small amount of support around 1.3730 although the real level for long term buyers is 1.3350. At the moment I would consider the uptrend to be intact until this breaks. For now I prefer a move higher towards the recent high of 1.4255

For EUR Sellers

You may see a bit of relief in the short term however protection should be left above 1.4250. For now the limit of your aspirations should be 1.3350.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.