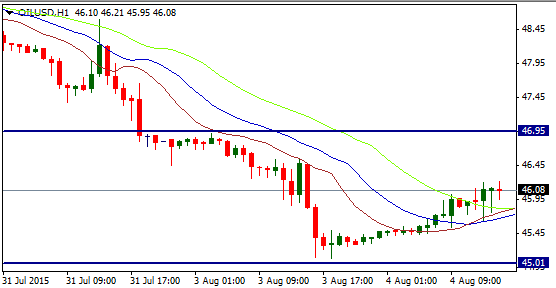

Market perception still sees overall supply very high as there continue to be new findings of oil fields and drilling operators are becoming more efficient and lowering extraction costs. WTI started the week yesterday on a low closing down at $45.29 from Friday’s close of $46.78, indicating new lows may continue to develop. Tomorrow’s data is forecast at -1 million barrels and although a negative number it shows signs of increased supply. If the number released is much higher than expected it may send the market lower, if the number is lower than expected (more negative) it may send the market higher.

Overall the market for Oil still looks depressed and the downward trend, apart from slight corrections, seems to be well in place. The options market also indicates oil is more likely to fall in 2015 (according to Reuters).

Trading WTI OIL

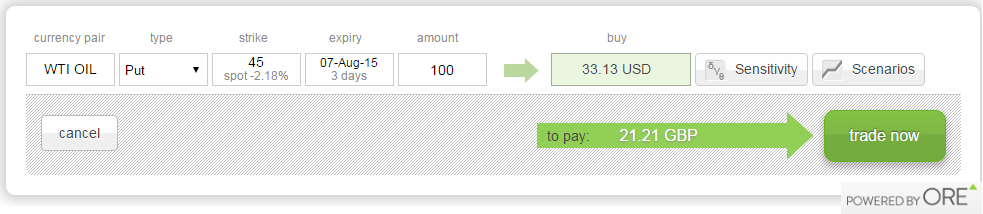

If you think the EIA's data tomorrow will be higher than expected and Oil prices will continue trending down this week, to take advantage of lower prices you may buy a Put, which gives you the right to sell Oil at a determined price within a set period. When trading on ORE’s Web-Platform, from the add new position page chose WTI OIL under pair, under type select Put, choose an expiry date and under ‘amount’ chose how many barrels you want to sell.For example, you may choose to sell 100 barrels at the predetermined price of $45 until Friday as displayed in the trade image below. This Put option will cost you a premium of 33.13 USD, this is also your maximum risk in the trade.

If the price of oil falls below $45 by Friday the Put option will gain in value and you may profit. If oil does not fall then a limited loss will be made and you cannot be stopped-out of the position.

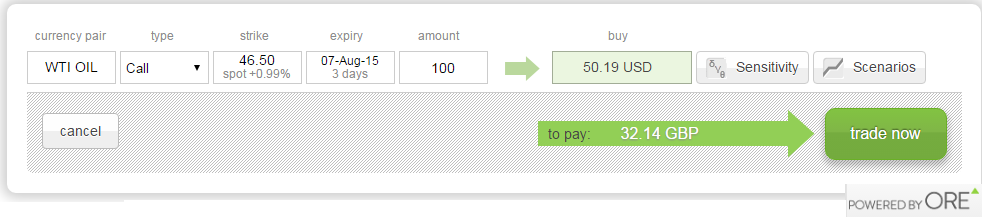

On the other hand if you think Oil is set for a correction in price and will rebound to higher prices over the next week, to take advantage of this you may buy a Call which gives you the right to buy Oil at a determined price over a set period.

For example, you may choose to buy 100 barrels at the predetermined price of $46.50 until Friday as displayed in the image below. This Call option will cost you a premium of 50.19 USD, this is also your maximum risk in the trade.

If the price of oil rises above $46.50, the Call option will gain in value and you may make a profit. If Oil does not rise then a limited loss will be made and you cannot be stopped-out of the position.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.