Higher Interest Rates Ahead in the US

The FOMC will be having its regular monthly meeting this Wednesday and most forecasts are for keeping interest rates on hold. Higher interest rates in the US may push the USD up and devalue the Euro which has interest rates close to zero, where they look like remaining at least another year. In the US the higher GDP growth rate and larger job creation numbers have given the Fed cue to raise interest rates to defend against inflation. In Yellen’s recent speech to congress she made it clear that rates would go up at some point before the end of 2015. Given that inflation numbers have been very stable and failed to show any signs of rising, it would seem very likely that Wednesday’s meeting will serve more to analyze data and prepare the markets with more talk as to when exactly to expect a hike in rates. Yellen’s speech after the meeting should give more indications of future action from the Fed; talk on a hike as early as September may send EUR/USD down sharply whereas talk of further delays to the end of the year should give Euro a boost. Of course her wording may not be as clear as one hopes.A delayed rise in interest rates in the US and a solid solution to the Greek crisis could give the Euro some more room to strengthen further in the coming weeks and continue its retracement upwards from its low of 1.0460 on March 12th this year.

A Look at Technicals

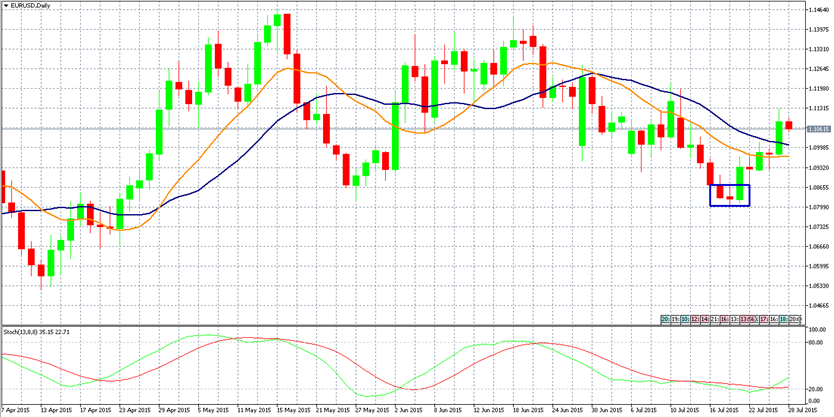

Looking at the EUR/USD daily chart we can see a three day reversal pattern, in the blue box, which has since been followed by 4 days of higher highs and lows. Together with the much oversold indication on the Stochastic Oscillator, bottom chart, may lead to further price increases over the coming week or so.

How to Trade

Buying options may be an ideal position when an outcome is unknown or if volatility is expected (which is common over FOMC meetings). This is because through buying an option your risk is limited and you cannot get stopped-out by large market swings; you are not required to place a wide stop-out to manage risk instead you pay a premium for the option upfront. The premium paid is your maximum exposure no matter the market move. The following provides two option trade examples.If you expect the Fed to keep interest rates on hold and their language will show probabilities of delays, then to take advantage of higher EUR/USD you may buy a Call option. A Call gives the right to buy at a certain level (strike) for a certain period of time.

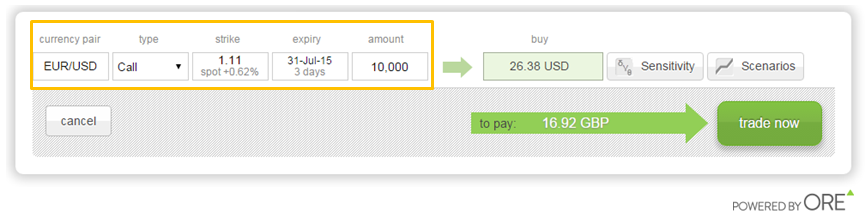

The image below is a trade setup on the ORE Web-Platform, it is a 3-day Call to buy 10,000 EUR at 1.1100 (as highlighted by the orange box). It costs a premium of 26.38 USD to buy this option which is also the maximum risk in the trade. If the EUR/USD rises above 1.11 by expiry, Friday at 14:00 GMT, the option will payout. If the pair does not rise then the option will lose by the premium (26.38 USD).

On the other hand, if you think the Euro rally may be over and Yellen’s speech on Wednesday may show signs on raising rates much sooner than later then to take advantage of a decreasing EUR/USD you may buy a Put option. A Put gives you the right to sell at a certain level (strike) for a certain period of time.

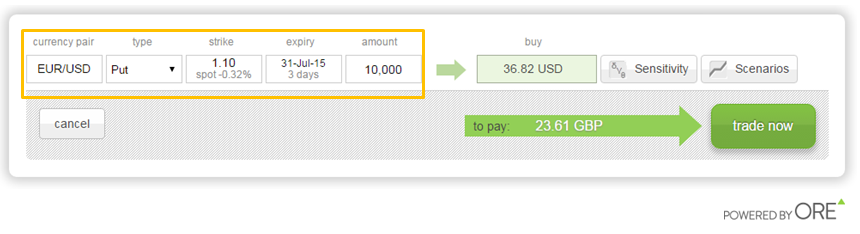

The image below is a trade setup on the ORE Web-Platform, it is a 3-day Put to sell 10,000 EUR at 1.10 (as highlighted by the orange box). It costs a premium of 36.82 USD to buy this option, this is also the maximum risk in the trade. If the EUR/USD falls below 1.10 by expiry, Friday at 14:00 GMT, the option will payout. If the pair does not rise then the option will lose by the premium (36.82 USD).

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.