Trading does not always have to be a straight forward buy or sell deal. There are others instruments and tactics available to trade a moving price and volatility. Vanilla options, that is Call and Put contracts, allow you to trade direction and/or volatility because an options price depends on both of these factors. When a market expects more volatility an option price rises, hence buying options is buying volatility. The vice-versa is also true, you may sell options to trade an expected decrease in volatility.

A Call option gives the right, but not the obligation, to buy a currency pair at a specified price over a certain period of time. That specified price is known as the strike. As the currency pair's market price moves above the strike the option gains in value. The options value also increases as volatility increase. Hence, through buying a Call you are trading an UPWARD direction and increase in volatility.

The advantage of buying options is that risk is limited to the amount paid for the option and you do not have to utilise a stop-loss, i.e. you avoid getting stopped-out. However, it is important to note that the market must rise above your strike, by expiry, for the option to be 'in-the-money' and payout.

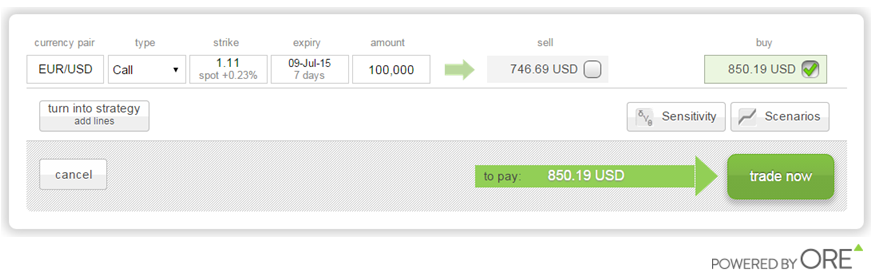

For example, to trade an outlook that EUR/USD will rise above 1.1100 over the next week you may buy a 7-day Call option with a 1.1100 strike for an amount of 100,000 EUR. That is, you have the right to buy 100,000 EUR at 1.1100 over the next week. This option is displayed in the image below:

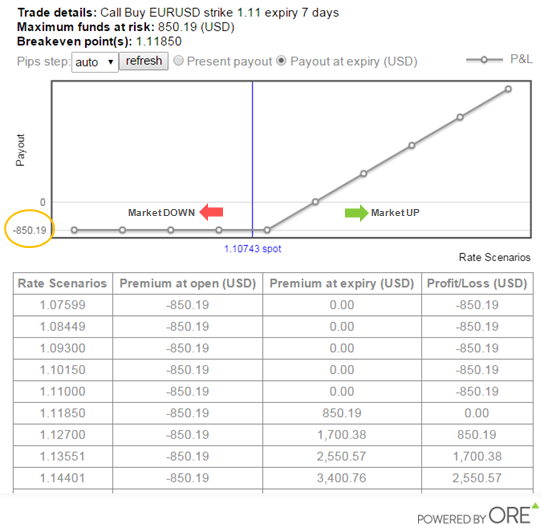

It would cost you around 850 USD to buy this option. 850 USD is also your maximum risk. The Scenario chart and table below show the trades profit/loss over a range of EUR/USD rates at expiry. The vertical axis is the profit/loss and the horizontal is the market rate. You can see as EUR/USD rises the option trade's profit rises and as EUR/USD falls the loss is limited to 850 USD.

On the upside, if you expect EUR/USD to only move as far as 1.1250 (150 pips above your strike), a key resistance level (see chart below) you may transform your Call trade into a Bull-Spread strategy.

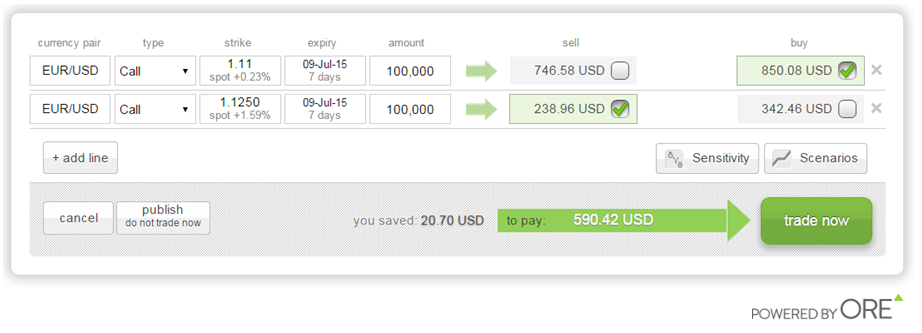

One way to trade a Bull-Spread is through buying a Call and, at the same time, selling a Call with a higher strike. Note that the Call options have the same expiry date and amount, only the strikes differ. In the image below, the strategy is to buy a Call with strike 1.1100 and sell a Call with strike 1.1250.

Through selling the option you will receive around 240 USD hence your maximum risk is reduced to 610 USD (money paid to buy call - money received to sell call = 850 - 240). Also, in this example, the platform gives a 20 USD discount on payment hence the final total risk is 590 USD.

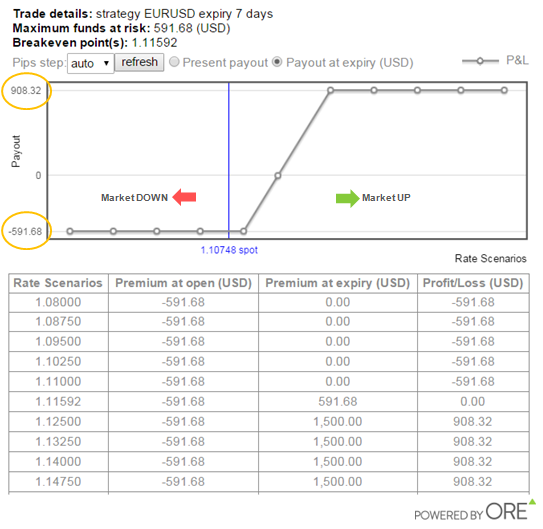

How does this strategy affect your profit potential? Your loss is limited, and has been reduced, but now your profit is limited. In this example, maximum profit of 908 USD is achieved if EUR/USD is trading at or above 1.1250 at expiry and a limited loss of 590 USD is made if the pair is trading below 1.1100. The Scenario chart and table below show the trades profit/loss over a range of EUR/USD rates at expiry.

It is also possible to trade a falling trend through buying Put options, because a Put gives the right, but not the obligation, to sell at a strike price over a certain period of time. You may also trade a Bear-Spread strategy which may allow you to benefit from a downward market with limited 'reduced' loss and limited profit. One way to trade a Bear-Spread is through buying a Put and, at the same time, selling a Put with a lower strike price. Note that the Puts must have the same expiry and amount.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.