You may have an outlook on EUR/USD volatility with no regard for direction. You may expect the pair to move dramatically either UP or DOWN, or on the other-hand, you may expect the pair to trade sideways over a certain period of time. The following article explains how you can trade these scenarios using FX options.

Trading increase in volatility

If you are expecting a large move in EUR/USD but you have no view on direction it is possible to trade this outlook through a Long Straddle strategy. This involves buying a Put and a Call option at the same time. If EUR/USD price falls the Put will profit and if the pair rises the Call will profit. In this position,you loss is limited yet your profit may be unlimited.

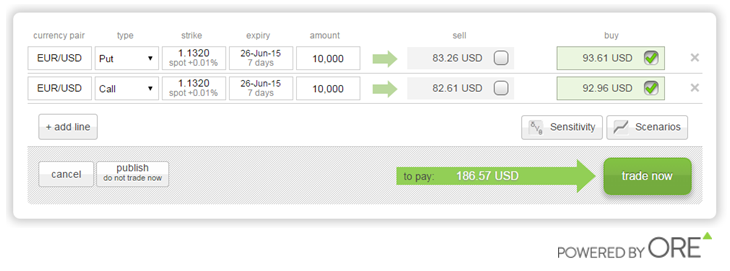

Below is a EUR/USD Long Straddle trade example, built in the optionsReasy platform. The Put and Call have the same strike rate (matching the current market at 1.1320), expiry date at 7 days and amount of 10,000 EUR. This position costs 186.57 USD to buy.

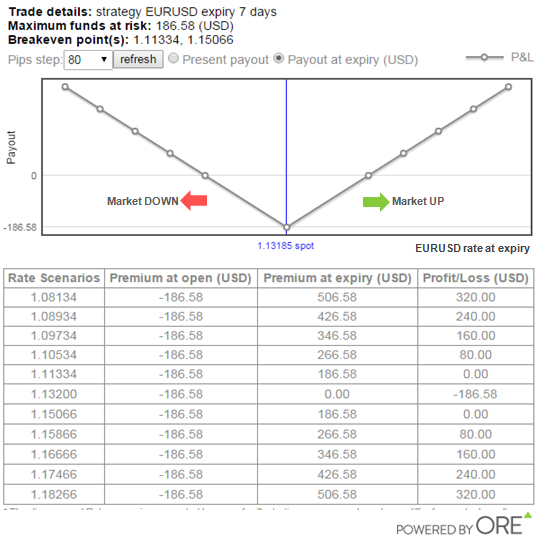

If EUR/USD moves significantly UP or DOWN in the next 7-days, the strategy may profit. If EUR/USD is still and remains trading at, or close-to, 1.1320 the maximum loss will be 186.57 USD.

The scenario chart below shows the profit or loss of the strategy, at its expiry, over a range of EUR/USD rates. If the pair moves DOWN and at expires at 1.0893 the strategy's profit will be 240 USD, if the pair does not move and remains at its current level of 1.1320 the loss is 186 USD, and if the pair moves UP and expires at 1.1746 the profit will be 240 USD.

Trading decrease in volatility

If you expect EUR/USD to become less volatile and it will continue trading around its current level, you may trade this outlook using a Short Straddle strategy. This is the opposite of a Long Straddle and involves selling a Put and a Call option at the same time. Each option should have the same strike rate and expiry date. If over the duration of the strategy, the EUR/USD price does not more (or only moves a little), both the Put and Call option generate a profit for the seller. More attention to risk management may be required when trading this strategy because potential loss is unlimited and profit is limited.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.