An options value declines over time. This is good for an option seller since they collect this as profit for each day that the option position is open. However, overall profit or loss will depend on other market factors as well.

Volatility also affects option price; if the market expects volatility in the underlying asset to fall then the option price falls. This is good for a seller.

In summary the three main factors to consider are time, volatility and underlying market direction. With the latter depending on the ‘type’ of option sold; a Call falls in value when the underlying market falls and a Put falls in value when the market rises.

Lastly, the profit from selling is limited since an option price can only fall as far as zero. However, potential loss may be significant since an option price can rise substantially (and infinitely for Calls). On MT4, risk can be limited using a stop-loss order or, by ‘covering’ through buying an identical option of the same type but at a different strike level or, through trading in the underlying asset.

Selling a Call (C) Option

When you sell an option you receive the price upfront. As a seller you are on the other side of the buyer's trade; if the buyer is making a profit, the seller is losing and vice-versa.

In terms of direction, the seller of a Call wants the underlying market rate to expire at or below the option's strike rate. When this happens the option expires worthless hence the seller has collected the entire option price (i.e. the price sold at open).

For example, a weekly EURUSD Call with a strike of 1.0900 is shown in the image below. If you sold this option you would receive 0.00328 (32.8 pips). If the underlying market expires at or below 1.0900, the Call option would be worthless, and as a seller, you would profit. The maximum profit potential is equal to the sell (bid) price at open (32.8 pips in this case).

Selling a Put (P) Option

In terms of direction, the seller of a Put wants the underlying market rate to expire at or above the option's strike rate. When this happens the option expires worthless hence the seller has collected the entire option price (i.e. the price sold at open).

For example, a weekly EURUSD Put with a strike of 1.0800 is shown in the image below. If you sold this option you would receive 0.00253 (25.3 pips). If the underlying market expires at or above 1.0800, the Call option would be worthless, and as a seller, you would profit. In this case, the maximum profit potential is 25.3.

Trading a Trend

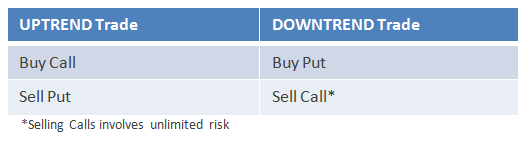

As demonstrated, you can buy or sell a Call or Put option to trade a trend in the underlying market.

Here is an overview:

Options trading is available on MT4 platforms, ask your broker for more details.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.