Still on the road that the moment and rather than comment on the ridiculous machinations of what the Greek Prime Minister said last night – that even if Greece votes no they can stay in the Euro – or even talk about the 3.6% falls in the DAX (nice charts lately hey) and the CAC, or the massive reversal in the Euro – setting up more gains possibly. I want to focus on the outlook for the S&P 500 today.

That’s because the S&P is the global stock market bellwether, the one all other markets look to for guidance.

Last night the S&P dropped 2.07% to close around 2058. That’s just above the 2053/55 region where, depending on who you ask, the 200 day moving average is sitting.

As you know the 200 day moving average is the simplest, and often the first, way many traders use to judge whether a market is in a bull or bear phase. Above it, buy the dip, below it sell rallies is what is often said.

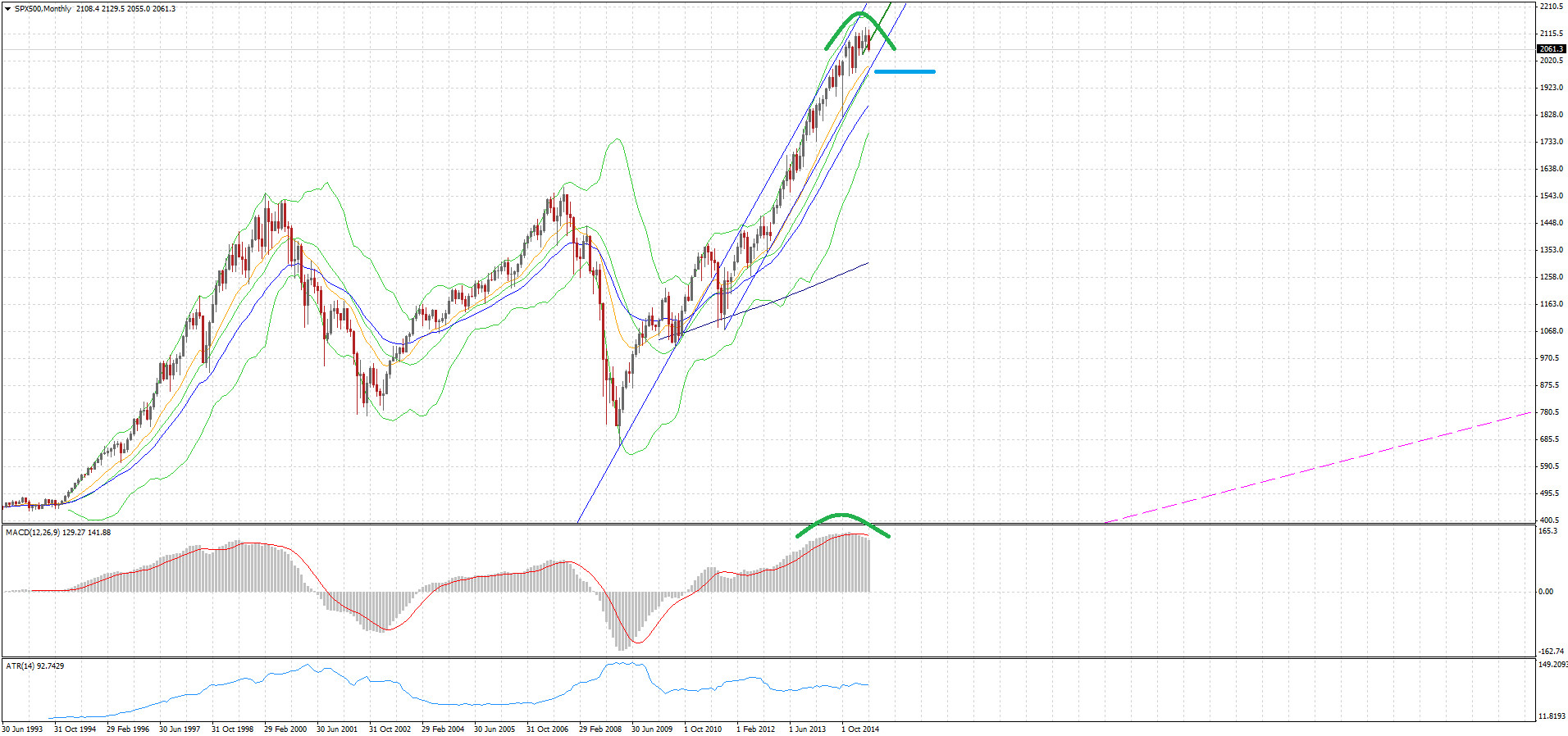

You can see in the chart above the break of recent trendline and then the support the 200 day moving average gave the market overnight.

As I wrote at Business Insider this morning:

The big question for fund and portfolio managers – and for traders and investors – is whether or not they try to get out of dodge early to avoid further losses or they hang on in the hope that like every other hiccup in the last 3 or 4 years, weakness gives way to a bounce.

The 200 day moving average is an important part of those deliberations. SO to is the 4 year uptrend on a weekly basis.

But I want you to also think about the overall market structure.

Have a look at the monthly S&P chart. Remind you of anything? Shanghai recently? Gold half a decade ago?.

This is a monthly chart so it will take a while to play out. But history and my system suggest winter is coming.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.