Introduction

The non-farm payrolls figure on Friday came in at 151k in comparison to 180k anticipated, largely due to the reduction in holiday season jobs that inevitably took place in January. USD did make some ground on Friday afternoon though as the market looked at the lower unemployment rate print, which came in at 4.9%. New year holidays take place in China and Hong Kong today and essentially all week, with holidays taking place in other nations nearby too. Expect low liquidity in CNY, CNH and other related currencies this week and potential moves that consolidate too.

Asian Session

AUD and CAD trade at .7110 and 1.3860 against the greenback at the moment. These are the two currencies that have risen most overnight in a sleep Asian session. ANZ bank released job advertisement info. for January which came in positively at 1.0%.

The Nikkei 225 index trades up over 1.0% as USD/JPY was contained largely within the 117.0 figure. Labour cash earnings data and the eco watchers’ surveys had little impact on markets.

The day ahead in Europe and NY

European investor confidence data is set to be released at 09:30 GMT today with EUR/USD currently trading at 1.1137. The currency pair moved to a 1.1246 high on Friday but calmed relatively soon after the figure release.

Housing starts and building permits data will be released at 13:15 GMT and 13:30 GMT respectively for Canada. BoC governing council member Timothy Lane speaks at 16:50 GMT today too.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1137 | -0.16% | 1.1162 | 1.1128 |

| USDJPY | 117.29 | -0.21% | 117.53 | 116.80 |

| GBPUSD | 1.4535 | 0.23 | 1.4547 | 1.4476 |

| AUDUSD | 0.7107 | 0.55% | 0.7116 | 0.7068 |

| NZDUSD | 0.6635 | 0.54% | 0.6646 | 0.6616 |

| EURCHF | 1.1068 | -0.20% | 0.9942 | 0.9909 |

| USDCAD | 1.3873 | 0.32% | 1.3908 | 1.3857 |

| USDCNH | 6.5741 | 0.001 | 6.5867 | 6.5692 |

FXO

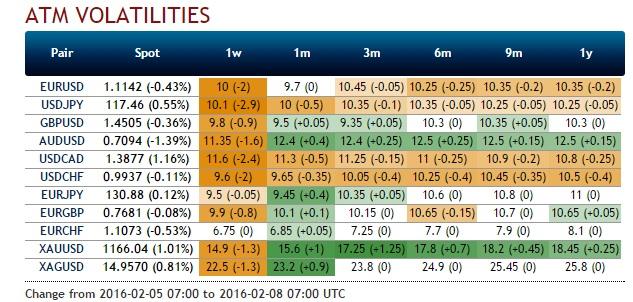

EUR/USD one month straddles kick off this morning with a mid. volatility of 9.5%. This is a reduction on Friday’s level. A number of volatilities have moved higher, particularly in the AUD/USD space.

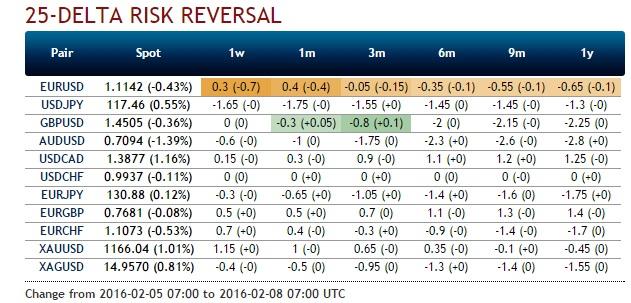

USD/JPY options sentiment within the retail space at Saxo Bank A/S shows a 70% bias for the downside, this is a move higher over the last twenty four business hours of 15%.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.