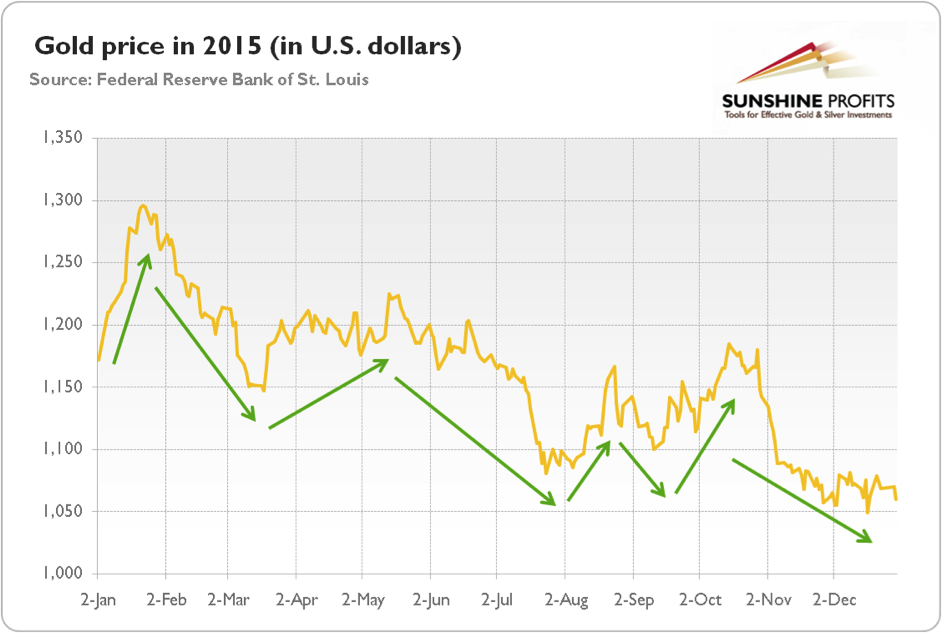

Chart 1: The price of gold in U.S. dollars in 2015 (London PM Fix)

Some analysts are calling this the bottom in gold, and they could be right. However, investors should remember that picking the bottom is often like catching a falling knife. If you have not mastered advanced contrarian strategies, do not fight the trend, which is your friend until it bends.

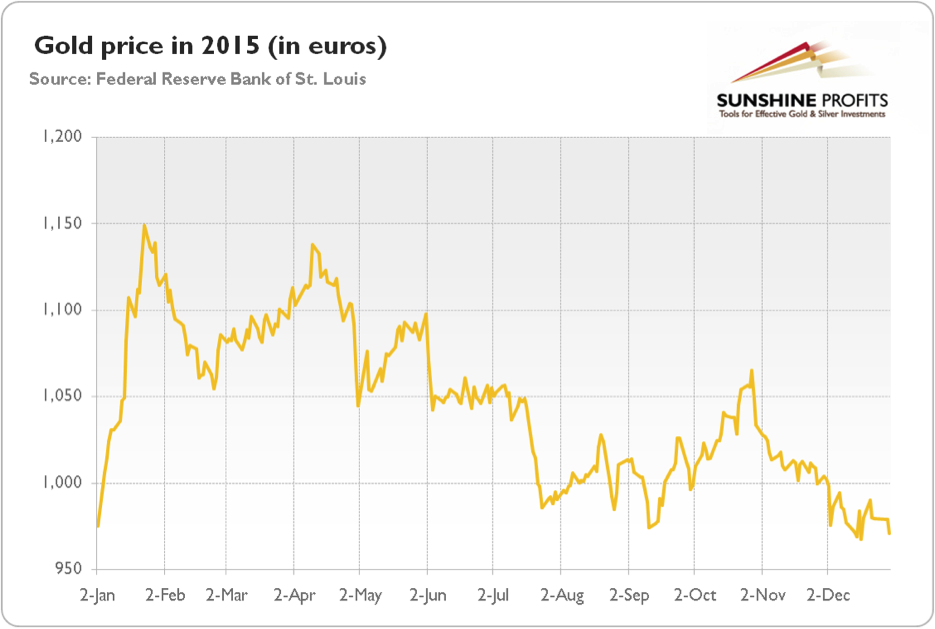

Second, two of the biggest drivers of the decline in the gold price were the rise in real interest rates and the appreciation of the U.S. dollar against other currencies, mainly against the euro. However, investors who bought gold with euros at the beginning of 2015, can sell it for about the same amount now (in several currencies the price of gold actually gained). The chart below shows the price of gold in 2015 expressed in euros.

Chart 2: The price of gold in euro in 2015 (London PM Fix)

The divergence in the gold prices quoted in different currencies shows that the downward move in the price of gold in 2015 simply reflects the strong greenback. It proves that the yellow metal may be considered as a bet against the U.S. dollar.

Third, the price of gold was not falling linearly, but fluctuated intensely in response to macroeconomic factors. As one can see in the first chart, there were six major periods in the gold market in 2015. In January, gold was rising and almost touched $1.300, mostly gaining from the uncertainty about the ECB’s quantitative easing, negative interest rates in Europe, global slowdown, the currency shock from Switzerland, and the falling real interest rates in the U.S.

As those concerns weakened, the gold price fell to $1,147 in mid-March on a strengthening U.S. dollar and rising real Treasury yields. But between mid-March and mid-May, after weak economic data was published (like disappointing nonfarm payrolls) and a dovish March FOMC meeting was held, the U.S. dollar index decreased more than 6 percent against the major currencies. Consequently, the price of gold rose 6.8 percent from $1,147 to $1,225.

The revival of the American economy, elevated expectations of the Fed’s hike in September, disappointing news about Chinese official gold reserves and an agreement between Greece and its creditors on the third bailout exerted downward pressure on the price of gold, which fell to $1100 just a few days before the FOMC meeting (to be more precise, the price of gold bottomed at the turn of July and August, then it was rising for most of August due to the stock market crash in China, and was falling afterwards).

Since the Fed officials didn’t raise interest rates in September, the U.S. dollar and real interest rates plunged, while the price of gold was rising for the second half of September and most of October, touching $1,184. Then, the Fed turned out to be surprisingly hawkish in its October meeting. As the U.S. central bank opened doors for an interest rate hike in December, the greenback and real interest rates accelerated again, while the yellow metal started its decline.

To sum up, the price of gold remained in a bear market last year. The main factors contributing to the 9.56-percent decline were the appreciation of the greenback and the rise in the U.S. real interest rates. The gold trade last year was essentially about the expected Fed's hike or – more generally – about the divergence in major central banks’ monetary policies, as those factors were shaping the U.S. dollar exchange rate and real interest rates. This observation is extremely valuable for investors wanting to enter the gold market this year. The gold trade will neither be about the geopolitics (last year, gold did not react significantly to geopolitical risks), nor China’s official gold reserves, nor European crises. The price of gold will be shaped by global macroeconomics and currency markets, with a very strong emphasis on the situation in the U.S. If the divergence in monetary policies between the Fed and the rest of world (especially the Eurozone) deepens, due to the next interest rate increase in the U.S., the price of gold will decline further. On the other hand, if investors consider the Fed’s move as a one-and-done hike, the U.S. dollar exchange value will stabilize and the price of gold will catch its breath.-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

AUD/USD defends 0.6400 after Chinese data dump

AUD/USD has found fresh buyers near 0.6400, hanging near YTD lows after strong China's Q1 GDP data. However, the further upside appears elusive amid weak Chinese activity data and sustained US Dollar demand. Focus shifts to US data, Fedspeak.

USD/JPY stands tall near multi-decade high near 154.50

USD/JPY keeps its range near multi-decade highs of 154.45 in the Asian session on Tuesday. The hawkish Fed expectations overshadow the BoJ's uncertain rate outlook and underpin the US Dollar at the Japanese Yen's expense. The pair stands resilient to the Japanese verbal intervention.

Gold: Buyers take a breather below $2,400 amid easing geopolitical tensions

Gold price is catching a breath below $2,400 in Asian trading on Tuesday, having risen over 1% in the US last session even on a solid US Retail Sales report, which powered the US Dollar through the roof. Easing Middle East geopolitical tensions and strong Chinese data could cap Gold's upside.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Israel-Iran military conflict views and takeaways

Iran's retaliatory strike on Israel is an escalation of Middle East tensions, but not necessarily a pre-cursor to broader regional conflict. Events over the past few weeks in the Middle East, more specifically this past weekend, reinforce that the global geopolitical landscape remains tense.