Talking Points:

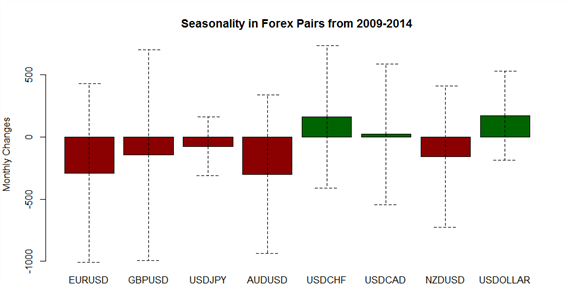

- May has produced strongest monthly performance for USD in QE era.

- Australian Dollar, Euro have typically led underperformers.

- Variation of returns is higher than other months; volatility is common.

The beginning of the month warrants a review of the seasonal patterns that have influenced forex markets over the past several years. In our previous study, we decided to once again focus only on recent performance during the QE era of central bank policies (2009-present).

For May, we continue to focus on the period of 2009 to 2014. The small sample size is not ideal, and we recognize that there is increased statistical stability with using longer time periods. However, because of the specific uniqueness of the past six years relative to any other time period in market history - the era of quantitative easing - we've elected to attempt to increase the stability of the estimates with the shorter time period.

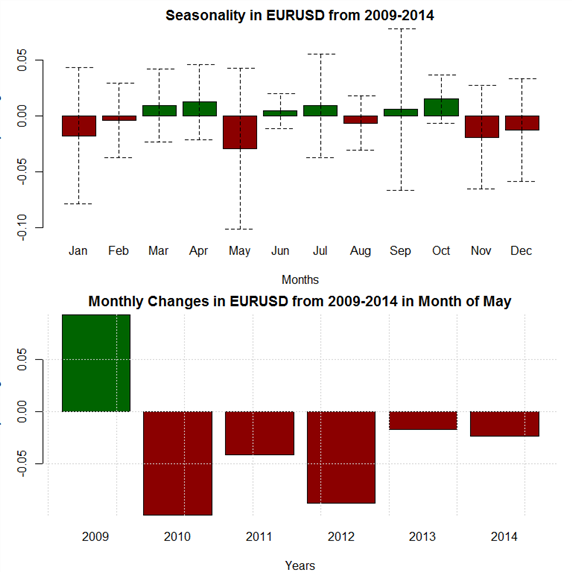

Forex Seasonality in Euro (via EURUSD)

The Euro has lost ground to the US Dollar in five consecutive years, with the only positive performance during the QE era coming in 2009. Accordingly, while the dispersion of returns is fairly wide, on balance, a modest loss has materialized. EURUSD has followed its QE-era seasonal tendencies closely thus far this year; and a continuation of this pattern would see the April gains reversed by the end of the month. The caveat may be the outsized net-short Euro position held by speculators in the futures market, which started unwinding in the middle of April.

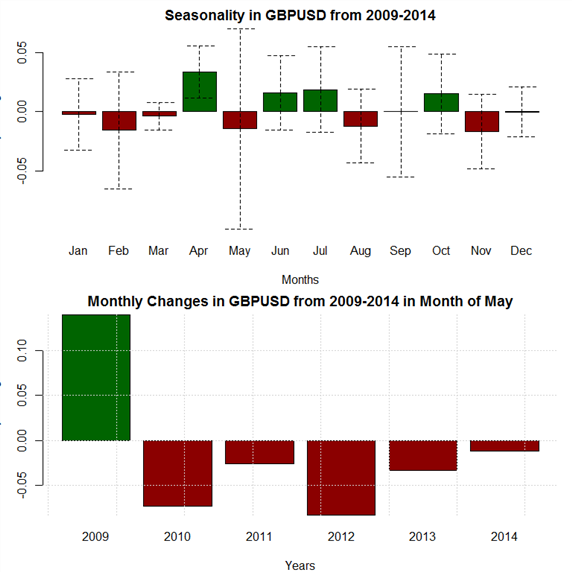

Forex Seasonality in British Pound (via GBPUSD)

Like EURUSD, GBPUSD has seen losses materialize in each of the past five years, with the only positive performance coming in 2009. Also like EURUSD, losses have been moderate on average, but the dispersion of returns is higher than in other months of the year due to the outsized gain at the start of the QE era. The most comparable year may be 2010, when the UK general election took place; the general election takes place this year on May 7, and may prove to be the most significant driver of GBPUSD over the next several weeks.

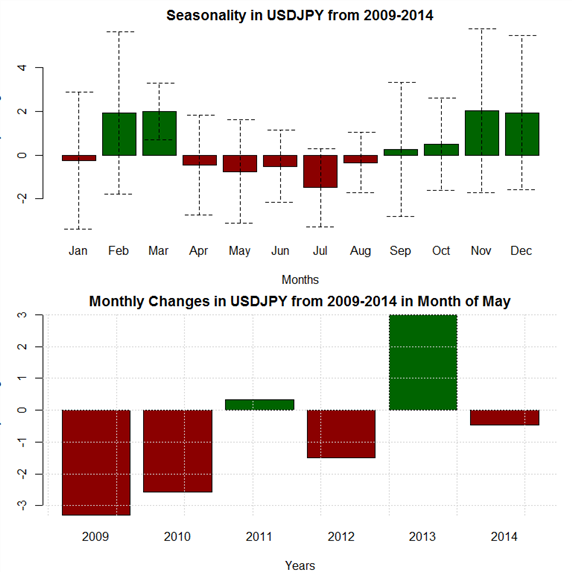

Forex Seasonality in Japanese Yen (via USDJPY)

Our seasonal forecast for USDJPY in May is neutral, if not slightly negative. The average performance calls for lower prices, although gains and losses have alternated since 2011; the average performance is dragged down by significant losses in 2009 and 2010. USDJPY is in the midst of its “bearish” stretch of the year, which has lasted from April to August during the QE era.

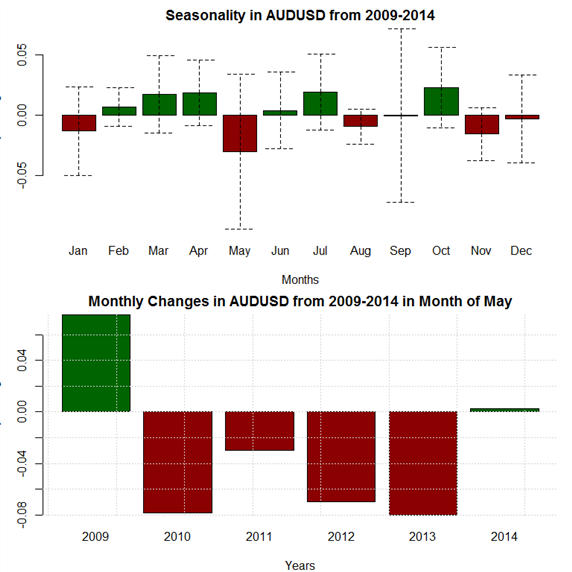

Forex Seasonality in Australian Dollar (via AUDUSD)

May has been the worst month of the year for Australian Dollar during the QE era, bar none. Last year was an outlier, with a slight gain; but the preceding four years produced significant losses. Discounting the broad-based US Dollar weakness seen in 2009, May has typically marked itself as the epicenter for AUDUSD weakness during the year.

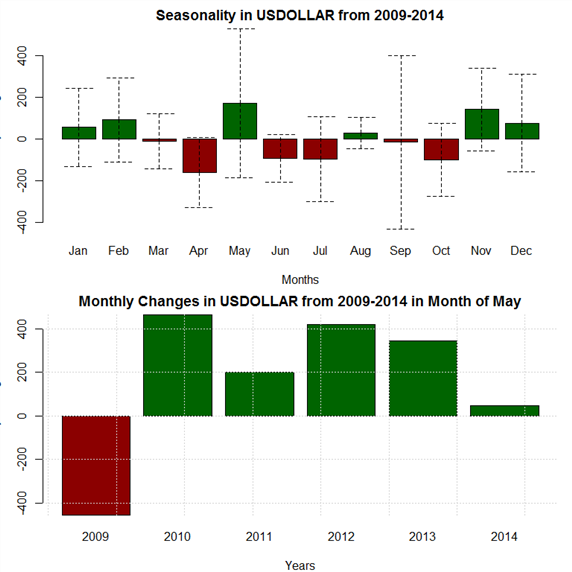

Forex Seasonality in USDOLLAR

May has been the best month of the year for the USDOLLAR Index (an aggregate of EURUSD, GBPUSD, AUDUSD, and USDJPY). 2009 produced the only loss during the QE era, leading to the wide range of outcomes. However, gains have been consistent in each of the past five years, although the lowest positive return developed last year. The caveat to an outright bullish forecast is the unwind going in the net-long US Dollar position in the futures market, following the best ten-month stretch for the greenback in market history.

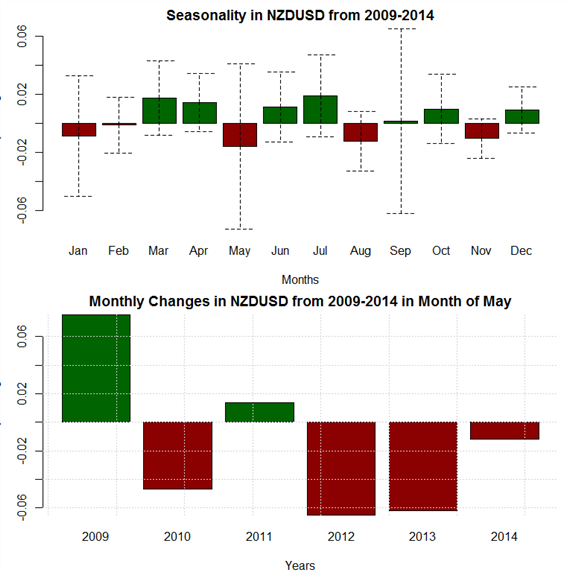

Forex Seasonality in New Zealand Dollar (via NZDUSD)

May has consistently a poor month for the New Zealand Dollar during the QE era, with losses coming in four of the past five years. Last year’s performance was only slightly negative, and thanks to an outsized gain in 2009, the dispersion of returns is high. Considering that there has been no consistency in the magnitude of losses, it’s safe to suggest that volatility may be a hallmark of NZDUSD trading over the course of the month.

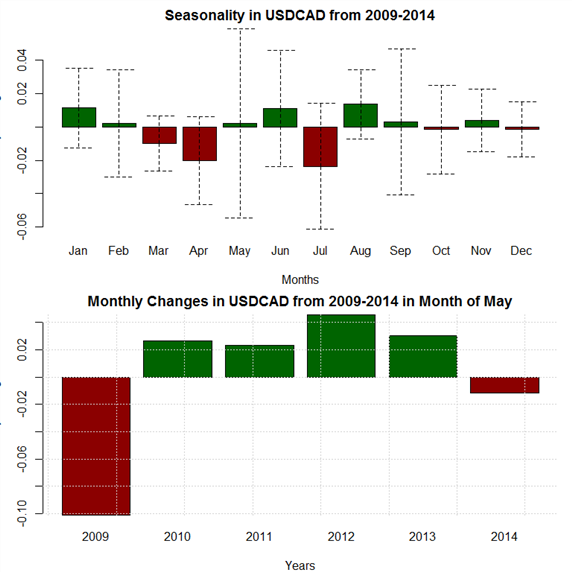

Forex Seasonality in Canadian Dollar (via USDCAD)

All things considered, May is a neutral month for the Canadian Dollar. Although the seasonal tendency has been for a very slight gain in USDCAD, the QE era May performances are bookended by a significant loss in 2009 and a slightly loss in 2014. If the US Dollar continues its positioning unwind, the Canadian Dollar appears to be among the best-suited to outperform.

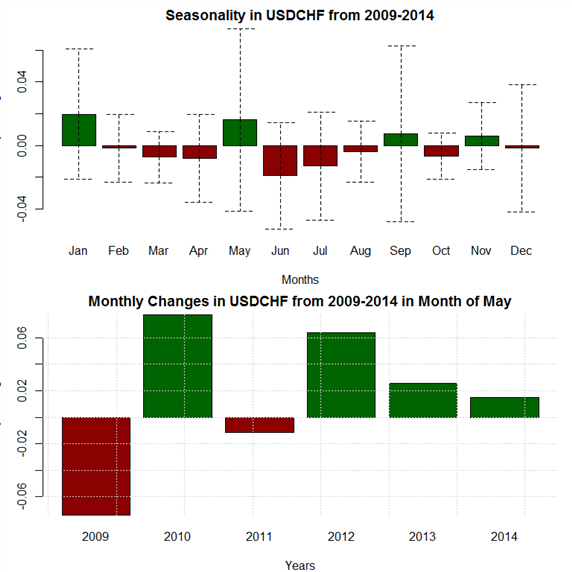

Forex Seasonality in Swiss Franc (via USDCHF)

Like the other major USD pairs, USDCHF has seen a wide range in terms of outcomes over the past six years. Although gains have materialized in each of the past three years, the magnitude of positivity has decreased through present day. While May has on average produced the second best return during the year for USDCHF, a more neutral forecast may be deemed appropriate.

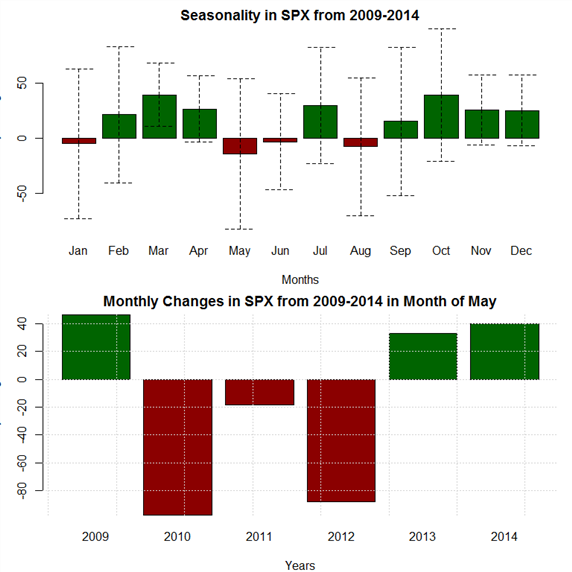

Forex Seasonality in S&P 500

‘Sell in May and go away?’ That may have been an appropriate axiom from 2010 to 2012, but investors living by that principle have been disappointed in each of the past two years. The average May performance has been on balance negative during the QE era (culminating in the worst month of the year for US equity markets); and like the USD-pairs, dispersion of returns has been high. Fundamental factors influencing markets this May are diverse: the Fed continuing its low rate policy, although it’s looking to raise rates at some point this year; corporate earnings have improved in recent years, but the slowdown in the US economy in Q1’15 has dampened consumer potential; and the return of inflationary pressures in a weak global demand environment has recently increased investor anxiety in recent weeks.

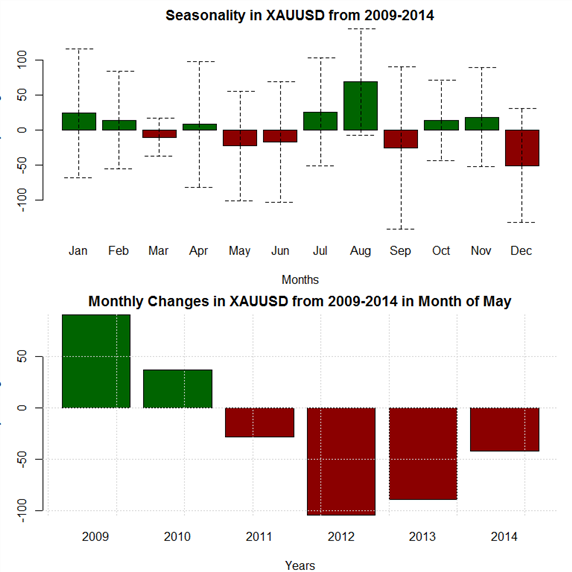

Forex Seasonality in Gold

As would be expected in a month when the US Dollar typically outperforms, Gold, a USD-denominated asset, has typically seen losses materialize in May during the QE era. Losses have developed in each of the past four year, albeit at a decreasing rate since 2012; and the only positive performances came in 2009 and 2010, as the Fed’s expansive QE programs were flooding the market with liquidity. It might be best to keep an eye on US yields; rising yields would buoy the US Dollar, decreasing the need for Gold as an inflation hedge or hedge against fiat dilution.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.