Talking Points:

US Dollar Index sets a 3-day high on RBA caution over Aussie

Greenback losses to Euro, Pound unwound despite a more peaceful Putin

A look back at the past 24 hours of Forex trading using movements in the US Dollar Index:

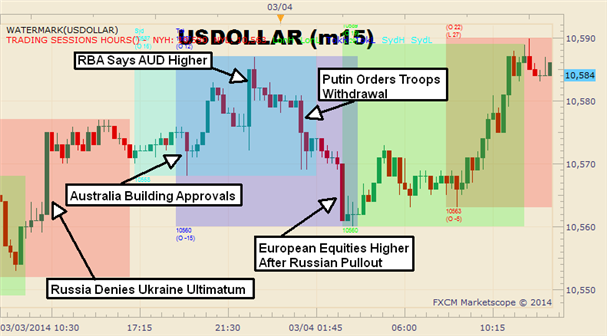

US Dollar 15-Minute 12:00 03/03 to 12:00 03/04 EST

The Dow Jones FXCM US Dollar Index has risen to a 2-day high in Tuesday’s trading despite some initial losses to the Euro and Pound on a less aggressive signal from Russia.

In the second half of NY trading on Monday, the US Dollar gained about 25 pips against the Euro and Pound, possibly signaling a worse sentiment regarding the tensions in Ukraine. Slightly before the greenback gains, Russian President Putin had denied that he set an ultimatum for Ukrainian soldiers to surrender in Crimea, but that news should have been slightly positive for European currencies.

The US Dollar then rose higher in the Tokyo session, as the RBA reported no change in monetary policy but commented that the Australian Dollar is higher by historical standards. The Australian Dollar initially rose 25 pips on the news of the unchanged policy, but AUD/USD was quickly slammed 30 pips lower on the currency comment.

Finally, the US Dollar Index fell below the Tuesday open, as Putin denied sending troops into Crimea. The less-aggressive tone from Putin seemed to quell market fears, and the Euro and Pound each rose higher. Those gains were furthered as European equities opened significantly higher following the most recent Ukraine related headlines.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.