September rate hike possibilities open The dollar initially fell following the release of the statement following the FOMC meeting. Although the discussion of the labor market showed more confidence than in June (“further improvement in the labor market”), the conclusion remained that “the Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced.” With no change there, investors thought no change overall and sold dollars.

However, then people noticed a very subtle change: in discussing the future path of rates, the statement changed “improvement” to “some improvement,” making the criteria for hiking a bit more vague. It now said that the committee expects to raise rates “when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.” Adding the term “some” lowers the bar for what constitutes improvement. It will make it easier for the Committee to justify a September tightening if they want to. As a result, fed funds rate expectations rose and the dollar firmed against all the G10 currencies and most of the EM currencies that we track too (the two exceptions being RUB, which recovered somewhat along with oil, and BRL, which gained along with commodities in general).

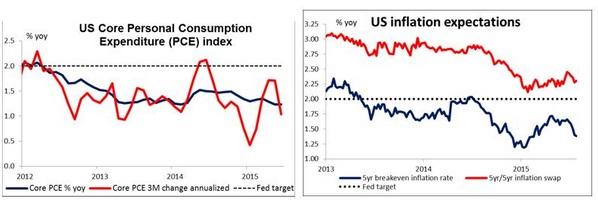

While labor market indicators are improving, the inflation outlook hasn’t changed that much. Inflation expectations continue to decline, despite what the Fed says, and the core personal consumption expenditure (PCE) index, the Fed’s preferred inflation indicator, still runs far below target. (That will be a major point of interest later today when the Q2 GDP figures are released – see below.) Nonetheless, I continue to believe that the FOMC is determined to hike this year if at all possible and will do so unless there is some external catastrophe. Their point is that zero interest rates are an extraordinary policy setting that is only appropriate for an emergency, and that emergency no longer exists. The start of a hiking cycle should be positive for the dollar, if history is any guide.

NZD is worst-performing currency How quickly sentiment turns! NZD had been the best-performing G10 currency when I was writing yesterday morning, but it’s been the worst-performing one over the last 24 hours. The enthusiasm apparently peaked shortly after Gov. Wheeler’s speech and the currency has steadily declined ever since. There doesn’t seem to have been any single trigger, just apparently people shared my view that the external situation wasn’t likely to change and therefore Gov. Wheeler was right – the currency is likely to decline. As Chinese imports of milk decline, Fonterra Cooperative Group Ltd., the country’s (and the world’s) largest dairy exporter, Thursday slashed its payments to New Zealand farmers almost in half, to NZD 4.40 per kg of milk solids from NZD 8.40 a year earlier. This is below the break-even level for most of the country’s 12,000 farmers, estimated at the low NZD 5.00/kg level. Another NZ milk company is forecasting a payment of less than NZD 4.00 for the current season. This fall in farm incomes is likely to cause considerable distress in the sector and makes further rate cuts more likely. It’s a big negative for the currency.

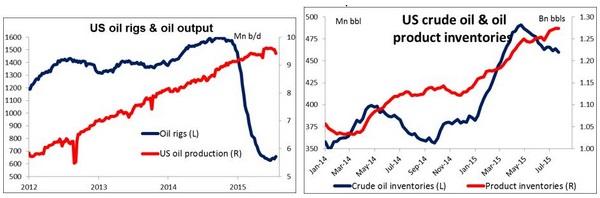

Oil rose as US production fell and inventories declined in the latest reporting week. However, I would argue that with the US rig count going back up and the Iran settlement likely to be implemented, the supply picture is still negative for oil. I expect oil prices to decline further and for the oil-related currencies to remain under pressure.

Today’s highlights: During the European day, the German CPI for July is coming out. As usual, we will look at the larger regions for a guidance on where the headline figure may come in and thereby as an indication for the near-term direction of EUR. A rise in the German CPI rate could indicate a rise in the Eurozone’s CPI to be released on Friday and strengthen EUR a bit. The country’s unemployment rate for July is also coming out.

In Sweden, the preliminary Q2 GDP is expected to show that the economy expanded a bit from Q1. Coming on top of the dip of the CPI back to deflation, a strong growth figure is needed to stave off pressure from the Riksbank to take further action.

From Norway, retail sales for June are expected to rise, a turnaround from the previous month. This could prove NOK-supportive.

In the US, the 1st estimate of Q2 GDP is expected to show that economic activity bounced back after slowing in Q1. This is in line with the Fed’s expectations for a stronger Q2 growth, and could provide a boost to USD. The annual revisions to GDP will also be released to data between 2012 and Q1 2015. As such, investors will be looking not only at the Q2 estimate, but at the revisions as well. We have mentioned several times that the dollar is becoming increasingly data-driven and significant positive data surprises are likely to keep USD in a bullish trend. The 1st estimate of the core personal consumption index, the Fed’s favorite inflation measure, is also coming out. Initial jobless claims for the week ended July 25 are also due to be released.

The Market

EUR/USD breaks back below 1.1020 post FOMC

EUR/USD fell sharply on Wednesday following the end of the FOMC policy meeting. In the statement, Fed officials noted that they see signs of an improving US labor market and economy and subtly lowered the bar to a September rate hike. The pair fell back below the 1.1020 (R1) hurdle, completing a failure swing top formation and turning the short-term picture back to the downside. I would now expect the pair to challenge the 1.0925 (S1) barrier in the near future. Our momentum studies support the case for further declines as well. The RSI fell below its 50 line, while the MACD has topped and fallen below its trigger line. Nevertheless, I see that the RSI turned up again, giving evidence that an upside corrective bounce could be looming before the next negative leg, perhaps to test as a resistance the 1.1020 (R1) line. As for the broader trend, as long as the pair is trading between 1.0800 and 1.1500, I would see a neutral longer-term picture. I believe that a move above the psychological zone of 1.1500 is the move that could carry larger bullish implications, while a break below 1.0800 is needed to confirm a forthcoming lower low on the daily chart and perhaps turn the overall bias back to the downside.

Support: 1.0925 (S1), 1.0870 (S2), 1.0810 (S3)

Resistance: 1.1020 (R1), 1.1085 (R2), 1.1130 (R3)

EUR/GBP falls below the 0.7050 barrier

EUR/GBP continued falling yesterday, falling below the short-term uptrend line and subsequently below the 0.7050 (R1) barrier. The short-term bias has now turned negative in my view, and therefore, I would expect the bears to continue driving the battle lower and perhaps challenge the psychological zone of 0.7000 (S1). Another break below that line is likely to open the way for the next support of 0.6970 (S2). Our momentum studies detect negative momentum and corroborate my view. The RSI fell below its 50 line and edged lower, while the MACD, already below its trigger line, has just obtained a negative sign. On the daily chart, I still see a longer-term downtrend, thus I would consider the short-term uptrend to be a corrective phase of the overall down path.

Support: 0.7000 (S1), 0.6970 (S2), 0.6935 (S3)

Resistance: 0.7050 (R1), 0.7100 (R2), 0.7160 (R3)

USD/JPY hits support at 123.40 and races higher

USD/JPY hit support at 123.40 (S1), raced higher, and now is testing the resistance of 124.15 (R1). A move above that obstacle is likely to bring into play the 124.45 (R2) line, but a break above the latter level is the move that could carry larger bullish extensions, perhaps for a test at 125.00 (R3). Our short-term momentum studies reveal upside speed and support the case that the pair could continue trading higher. The RSI emerged above its 50 line and is now headed towards its 70 line, while the MACD, already above its trigger line, has just obtained a positive sign. As for the broader trend, I still believe that the break above the downtrend line taken from the peak of the 5th of June signaled the continuation of the longer-term uptrend.

Support: 123.40 (S1), 123.00 (S2), 122.00 (S3)

Resistance: 124.15 (R1), 124.45 (R2), 125.00 (R3)

DAX futures are testing a short-term downtrend line

DAX futures rebounded from the 11035 (S1) support line and during the early European morning, they are testing the short-term downtrend line taken from the peak of the 21st of July. As long as the index is trading below that trend line, the short-term picture remains negative. However, taking a look at our short-term oscillators, I see signs that the bulls may break the trend line this time. The RSI edged higher after exiting its oversold territory, while the MACD, already negative, has bottomed and crossed above its trigger line. A break above 11280 (R1) would confirm the case and perhaps open the way for a test at 11415 (R2). As for the broader trend, given the 20th -27th July plunge, I would switch my stance to neutral. Only a daily close below 10670 would confirm a forthcoming lower low on the daily chart and turn the overall bias of DAX to the downside.

Support: 11035 (S1), 10900 (S2), 10800 (S3)

Resistance: 11280 (R1) 11415 (R2), 11555 (R3)

Gold still traded slightly below 1100

Gold continued to trade in a consolidative manner yesterday, staying slightly below the resistance hurdle of 1100 (R1). As long as the metal is printing lower peaks and lower troughs below the lower line of the short-term downside channel that had been containing the price action from the 18th of June until the 20th of July, I would consider the short-term outlook to remain negative. I would expect sellers to eventually take control again and aim for another test at the 1077 (S2) hurdle. Looking at our short-term oscillators, I see that the RSI turned down after hitting resistance at its 50 line, while the MACD, already negative, has topped and could fall below its trigger line soon. In the bigger picture, the plunge on the 20th of July triggered the continuation of the longer-term downtrend and kept the overall bias of the yellow metal to the downside in my view.

Support: 1088 (S1), 1077 (S2), 1072 (S3)

Resistance: 1100 (R1), 1110 (R2), 1120 (R3)

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.