Apparently there may have been more concrete results from Sunday’s meeting of European leaders than first appeared. Reuters reported that Greece’s creditors had drafted the broad lines of an agreement that they would put to Greek PM Tsipras today. A Greek government official said Tsipras would go to Brussels to meet with EC President Juncker this evening. It looks like Tsipras will have to accept the proposal and choose between a) submitting it to a vote in Parliament and risking a revolt in his party, or b) calling a snap referendum. Time is running short though. A Greek government official said the country would make a EUR 306mn repayment to the IMF on Friday as due if there was an agreement. That implies it might not make the payment if there isn’t an agreement.

The ECB's top banking supervisor, Daniele Nouy, said that Greece's banks remain solvent despite deposit outflows and the government's cash squeeze. This is significant because if the banks aren’t solvent, the ECB can’t lend to them. This indicates the ECB’s willingness to continue lending to the Greek banks. The ECB raised its Emergency Liquidity Assistance (ELA) to Greek banks by EUR 500mn yesterday, after refusing to raise it last week. This may be taken as a sign of encouragement to Greece: accept our conditions and we’ll help you.

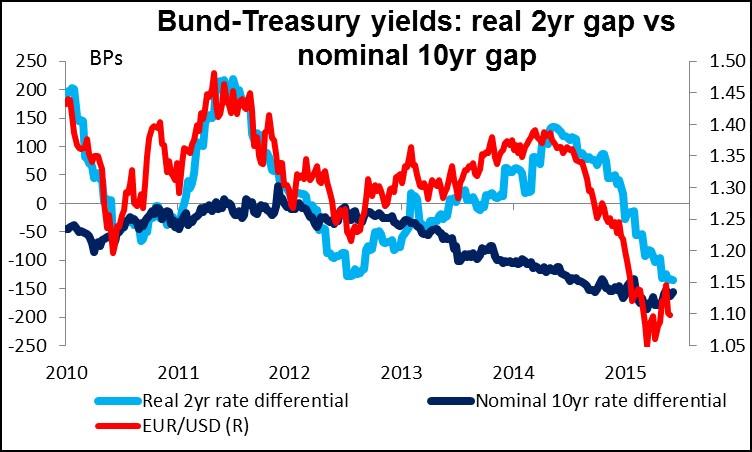

EUR, Bund yields soar on hopes of Greek deal The rise in Eurozone inflation and hopes of a successful resolution to the Greek drama sent the euro sharply higher in late afternoon European trading yesterday. The sudden surge in EUR/USD caused investors to cut positions all around and USD fell against all the G10 currencies and almost all the EM currencies we track, except the TRY, even as Fed funds rate expectations rose (Dec 2017 +5 bps) and bond yields jumped (10yrs +9 bps). The rise in US yields however was modest compared to the 17 bps jump in 10-year Bunds, with similar (but smaller) rises in other Eurozone bond yields. The narrowing nominal yield gap explains in part the support for EUR/USD. On the other hand, the rising inflation in the Eurozone means that real yields at the short end of the European yield curve are even more negative (nominal Bund yields are negative out to four years). The real 2-year spread between Bunds and Treasuries has widened out to -135 bps from -129 over the last month even while the nominal 10-year spread has narrowed to -156 bps from -160 bps. Currency rates seem more determined by real yield differentials at the short end than by nominal yield differentials at the long end, so I’m not sure how long this EUR strength can last from a fundamental point of view, although of course there is the Greece risk premium to consider. The US data were irrelevant.

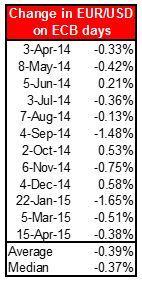

EUR/USD soared but was not able to break the recent peak of 1.1208, set on 22 May, when ECB Board member Benoit Coeure had said that the ECB would front-load bond buying in May and June. The course of the market today depends on what ECB President Draghi has to say (see below). Usually he is successful in calming the market. The historical pattern is that EUR/USD declines on ECB days (see table) and so I would expect EUR/USD to decline today too afterwards. It’s true though that “calming the market” today may mean reassuring investors on Greece, which could be EUR-positive, but I would expect comments on the topic to remain uncompromising so as not to take any of the heat off of Greece as the deadline nears.

Australia GDP Australia’s Q1 GDP rose 0.9% qoq from 0.5% qoq previously, beating expectations of +0.7%. Even so, growth slowed to +2.3% yoy from +2.5%. The slowdown is in line with the Bank’s view that the economy is likely to be operating with a degree of spare capacity for some time yet. Nonetheless AUD jumped on the news. It’s coming off the highs but remains above its pre-announcement level. The details show a continued slowdown in non-mining activity, which is disappointing. The news may be enough for the RBA to keep its neutral stance but won’t get them to shift to a tightening bias. It is thus positive, but limited, impact.

Today’s highlights: ECB meeting The big event of the day is of course the ECB meeting. No changes in policy are expected but ECB President Draghi could use the press conference after the meeting to counter upwards pressure on yields and EUR. He could also reiterate a clear commitment to continue the QE program at least until the scheduled ending date of Sep. 2016 and maybe even longer if necessary. He will have to convince the market that QE is working and the economy is improving, yet somehow warn against a sharp rise in rates and in the euro that could dampen the recovery prematurely. Another key point of interest will be any comments on the Greece debt crisis following the talks with EU leaders and the IMF on Monday. In particular, we will want to hear what his view on providing ELA to Greek banks is. The new round of staff projections will also be in focus. The ECB could revise up a bit its inflation and growth forecasts. Any comments on the Council’s commitment to the QE program is likely to have already being priced in, in my view. Instead investors could focus on any upward revision in inflation projections and a positive tone over Greece developments that could strengthen EUR.

As for the indicators, we get the final service-sector PMIs for May from the countries we got the manufacturing data for on Monday. As usual, the final forecasts for France, Germany and Eurozone are the same as the initial estimates. Eurozone’s retail sales and unemployment rate, both for April are coming out as well.

The UK service-sector PMI is forecast to have slid to 59.2 in May from 59.5 in April. After the mixed manufacturing and construction PMIs for May, a slide in the service-sector PMI is very likely. Another disappointment would add to concerns over growth in Q2. This could be GBP-negative.

In the US, ADP employment report for May is coming out two days ahead of the nonfarm payroll release. The ADP report is expected to show that the private sector gained more jobs in May than it did in the previous month. The Markit service-sector PMI and ISM non-manufacturing composite are also due to be released. Fed’s Beige book is also coming out.

As for the speakers, besides ECB’s Draghi press conference, Chicago Fed President Charles Evans speaks and Riksbank Governor Stefan Ingves holds press conference where conclusions from the Financial Stability report will be presented.

The Market

EUR/USD above the 1.1045/65 zone

EUR/USD surged on Tuesday breaking three resistance lines in a row. The move was halted few pips below the 1.1200 (R1) resistance hurdle marked by the peak of the 22nd of May. A decisive break of this territory could have larger bullish implication and might target 1.1265 (R2) resistance next. Looking at our short-term momentums however, we could see a minor pullback for a test of the 1.1065 (S2) area before the next leg high. The RSI found resistance just above its 70 line and turned down, while the MACD, although above its zero and trigger lines, show signs of topping and could turn down. Nevertheless, given the fact that we have an ECB meeting later in the day, I would prefer to stay on the sidelines as the ECB President Draghi could counter upward pressure on EUR, while the new economic forecasts could push the rate even higher.

Support: 1.1115 (S1), 1.1065 (S2), 1.1000 (S3)

Resistance: 1.1200 (R1), 1.1265 (R2), 1.1330 (R3)

GBP/USD broke above the downside channel

GBP/USD rose on Tuesday breaking above the black downside channel it was trading since 27th of May, to find resistance at the 1.5365 (R1) area. During the European morning Wednesday, the pair is trading few pips below that zone and a break of it could target our next resistance at 1.5440 (R2). However, I would be skeptical for further advances as our short-term momentums suggest an ease in the upside speed. The RSI found resistance just above 50 and turned down, while the MACD, although above its trigger line show signs of topping below the zero level. On the daily chart, the rate rose above the 80-day exponential moving average, which turned the broader picture positive again.

Support: 1.5230 (S1) 1.5160 (S2), 1.5100 (S3) .

Resistance: 1.5365 (R1), 1.5440 (R2), 1.5525 (R3).

USD/JPY just above 124.00 again

USD/JPY dipped on Tuesday after finding resistance near the key psychological barrier of 125.00 (R1). The pair found support around the 124.00 (S1) zone and a break of that level could extent the decline towards our next support of 123.50 (S2). Even though the short-term picture remains positive, there is still negative divergence between our short-term momentum indicators and the price action that support further declines. The RSI lies above its 50 territory and points down, while the MACD fell further below its trigger line. In the bigger picture, the pair lies above both its 50- and 200-day moving averages that keep the longer-term bullish trend intact.

Support: 124.00 (S1), 123.50 (S2), 122.80 (S3).

Resistance: 125.00 (R1), 125.80 (R2), 126.60 (R3).

Gold near found resistance several times at the 1195

Gold rose after finding support at the upper boundary of the black downside channel and the support level of 1185 (S1). The precious metal found resistance several times at the 1195 (R1) zone but none of them had the necessary strength to break that hurdle. So we have to wait and see whether the bulls are strong enough to start a new attempt to cross that next level and push the price higher towards the psychological figure of 1200 (R2). Looking at our short-term momentum indicators the RSI lies on its 50 line pointing sideways, while the MACD just above its trigger line moves along the zero line. These indicators amplify our neutral view to wait for a break of the 1195 (R1) resistance line to trigger higher extensions.

Support: 1185 (S1), 1180 (S2), 1170 (S3).

Resistance: 1195 (R1), 1200 (R2), 1209 (R3).

WTI remains above 60

WTI surged on Tuesday breaking above the resistance-turned-into-support level of 60.70 (S1). WTI found resistance at our 61.35 (R1) level and retreated somewhat to test the 60.70 (S1) as a support this time. If the bears prove unable to push the price below that level, I would expect for another test of the 61.35 (R1) resistance and a break of it could extend towards our next resistance of 61.80 (R2). Our short-term momentums support this notion, as the RSI lies just below its 70 line and could move higher, while the MACD remains above its zero and trigger lines pointing sideways. On the daily chart, I would repeat that the break above 55.00 on the 14th of April signalled the completion of a double bottom formation, something that could carry larger bullish implications in the not-too-distant future. Therefore, I would treat any declines that stay limited above 55.00 as a corrective phase for now.

Support: 60.70 (S1), 59.55 (S2), 58.60 (S3) .

Resistance: 61.35 (R1), 61.80 (R2), 62.60 (R3) .

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.