The key theme this week has been the slowdown in global growth. At first it was just Asia. The week started out with the People’s Bank of China cutting its reserve requirement ratio by an unusually large 100 bps. The price of copper gapped higher at the opening Monday in response to the cut, but then trended lower for the rest of the week, indicating that investors decided that the RRR cut was aimed at bringing policy into line with the slowing growth prospects, rather than encouraging higher growth.

The RRR cut was followed by two unusual developments in Chinese finance: first Kaisa Group became the first Chinese real estate developer to default on a USD-denominated bond, then power-equipment maker Baoding Tianwei Group made history of a sort when it was the first-ever Chinese state-owned company to default on its debt. While both were small deals that had no economic impact, the message that policy makers sent was impossible to miss: China is going to allow a lot more companies to go to the wall. In the long term that’s necessary for the healthy development of the economy but in the short term it’s bound to be bad for growth.

Then on Thursday the HSBC Markit manufacturing PMI for China for April declined further into contractionary territory. At the same time, the Japan manufacturing PMI for April fell below 50 too, for the first time in nearly a year. The weakness continued into Europe, where the European flash PMIs fell instead of rising as expected. Both France and Germany missed expectations by a significant amount.

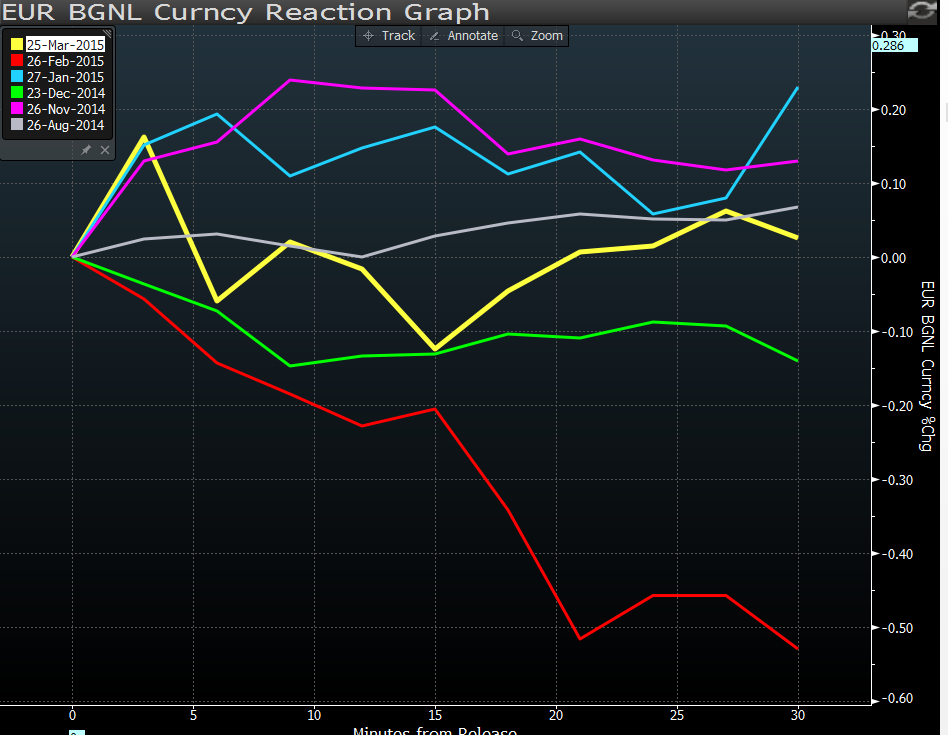

Finally, yesterday’s US indicators were also all around disappointing: jobless claims edged higher (for the week that the payrolls survey will be carried out), new home sales down sharply, Kansas City Fed index (which covers several oil-producing states) down for the fourth consecutive month and the US Markit PMI fell too. Fed funds rate expectations fell slightly and 10-year bond yields declined 2 bps, although stocks rose and the NASDAQ finally managed to regain the 5,000 level and make a new record high (its peak closing level during the internet bubble of 2000 was 5,048.62). Thus the pressure is really on for today’s US durable goods orders (see below) to demonstrate that yes, the US is still the global engine of growth. If durable goods disappoint too, USD would probably come under further selling pressure. On the other hand, given that so many indicators have disappointed and USD has declined, a positive surprise here would probably be the bigger shock to the market and send the currency up sharply. You can see from the graph, which shows the movement of EUR/USD in the 30 minutes after the release of the indicator, that the biggest move was on February, when the indicator surprised on the upside.

Currencies correlated with growth Meanwhile, I looked at what currency pairs are most closely correlated with the copper price, as a proxy for global growth. The table to the right is the result. (Correlation of one-week change over the last 10 years.) This analysis suggests that AUD and NZD are likely to weaken further. The central European currencies are also sensitive to growth. Note that the picture can be confused by the performance of oil, which rose yesterday on news of a Saudi air strike on Yemen (see technical section below). That explains why CAD, a growth-sensitive currency, was among the best performing currencies yesterday.

Jobless claims still consistent with above-200k NFP Although jobless claims edged higher yesterday, the four-week moving average is still only 285k, which is below the 305k for the March employment survey period. The historical relationship between the two since 2010 suggests the four-week moving average could move to 350k before the nonfarm payrolls would fall below 200k. Jobless claims below 300k seems fairly safe for NFP. As long as NFP is above 200k, expectations of Fed tightening will remain alive and the dollar should remain underpinned.

Get ready for a gold strike? The press reported yesterday that South Africa’s National Union of Mineworkers (NUM) plans to demand a 75% increase in the basic pay for entry-level workers. NUM represents 57% of the workers in the gold sector. Two weeks ago the union signed a three-year deal with Gold Fields that provided a 21% increase for the lowest-paid workers, but it still has to negotiate with several other companies that have two-year agreements expiring in June. I assume that employers would deny the extremely high demand (inflation in South Africa is only 4% yoy) and a strike could result. That would be bullish for the gold price.

Today’s highlights: During the European day, the main indicator will be the German Ifo survey for April. The overall strong ZEW indices on Tuesday increase the likelihood of robust Ifo indices as well. This could add to evidence that Eurozone’s growth engine is gathering steam, despite the weak preliminary manufacturing and service-sector PMIs on Thursday. The positive developments from low oil prices and a weaker euro is likely to slowly feed through the real economy going forward and could provide further support to domestic sentiment.

In the US, durable goods for March are coming out. The headline figure and durable goods excluding transportation equipment are estimated to have risen after both falling in February. The big thing would be if nondefense capital goods excluding aircraft orders, referred to as “core capital goods orders,” managed to rise. They’ve fallen for seven of the last eight months. If they rise, as some forecasters expect, that would be seen as the possible start of a turnaround in business investment and would be considered very bullish for the dollar.

The big event of the day is probably the informal meeting of EU finance ministers and central bankers where Greece’s progress in its reform pledges will be the main topic of discussion. Even though Greek Finance minister told to reporters earlier this week that there was a “convergence” with creditors, no deal is expected to come Friday and investors might have to wait until the formal meeting on 11th of May. Nonetheless, investors will want to hear what conclusion if any the officials reach about Greece and whether their patience is still holding up.

Separately, Swiss National Bank President Thomas Jordan speaks.

The Market

EUR/USD rebounds from 1.0660

EUR/USD rallied on Thursday after finding support at the 1.0660 (S2) area. Nevertheless, the surge was halted slightly below the 1.0860 (R1) barrier, near the 200-period moving average. Subsequently, the rate retreated somewhat. Although the rate is still trading below the lower line of the near-term upside channel, yesterday’s rebound confirmed my view to take the sidelines and wait for a break below 1.0660 (S2) to get confident on the downside. On the upside, a violation above 1.0860 (R1) would be necessary to shift the short-term bias back to the upside. Note that the 1.0860 (R1) barrier stands very close to the 61.8% retracement level of the 6th – 13th of April decline. A break above that resistance zone could set the stage for extensions towards 1.0965 (R2). Taking a look at our short-term oscillators, I see negative divergence between both of them and the price action. This gives me another reason to maintain my flat stance and wait for a move above 1.0860 (R1) to get confident on the upside. In the bigger picture, EUR/USD is still trading below both the 50- and the 200-day moving averages. However, a clear close below 1.0460 is needed to confirm a forthcoming lower low and trigger the resumption of the larger downtrend. On the other hand, a close above 1.1045 could signal the completion of a double bottom and perhaps set the stage for larger bullish extensions.

Support: 1.0730 (S1), 1.0660 (S2), 1.0575 (S3)

Resistance: 1.0860 (R1), 1.0965 (R2), 1.1045 (R3)

GBP/JPY finds a halt at 180.40

GBP/JPY traded somewhat lower on Thursday, after hitting resistance at 180.40 (R1). However, the pair is still trading within a short-term upside channel, and this keeps the short-term picture positive in my view. Taking a look at our oscillators though, I would be careful that further downside correction could be in the works before the bulls seize control again. The RSI exited its oversold territory and is now pointing down, while the MACD has topped and fallen below its trigger line. On the daily chart, the rate is back above both the 50-and the 200-day moving averages and this supports the continuation of the short-term uptrend. Our daily oscillators corroborate that view as well. The RSI emerged above its 50 line, while the MACD, already above its trigger line, just poked its nose above its zero line.

Support: 179.30 (S1), 178.50 (S2), 177.55 (S3).

Resistance: 118.40 (R1), 181.00 (R2), 181.75 (R3).

USD/CAD plunges

USD/CAD tumbled yesterday, falling below the support (now turned into resistance) of 1.2215 (R1) and reaching our 1.2145 (S1) hurdle. The plunge came after the pair hit resistance near 1.2300 (R1), which happens to be the 38.2% retracement level of the 13th – 17th of April fall, and confirmed my view that the outlook is negative and that the recovery from 1.2085 (S2) was just a corrective move. I would now expect the rate to continue lower and challenge again the 1.2085 (S2) line. As for the broader trend, the downside violation of the 1.2385 (R3) key barrier confirmed the negative divergence between our daily oscillators and the price action and turned the medium-term bias to the downside, in my view. I believe that we are likely to see the bears reaching the 1.2000 (S3) round figure in the not-too-distant future, which also happens to be the 38.2% retracement level of the July – March longer-term uptrend.

Support: 1.2145 (S1), 1.2085 (S2), 1.2000 (S3).

Resistance: 1.2215 (R1), 1.2300 (R2), 1.2385 (R3).

Gold hits resistance at 1197

Gold rebounded on Thursday to hit resistance at 1197 (R1). However, the short-term picture remains somewhat negative in my view. Therefore, I would expect the forthcoming wave to be to the downside, perhaps for a test at 1180 (S1) this time. Looking at our short-term oscillators, I see that the RSI hit resistance at its 50 line and turned down, while the MACD appears to be finding resistance at its signal line. These signs support the case for a negative wave. A clear break below 1180 (S1) could prompt further bearish extensions, probably towards the 1165 (S2) obstacle. As for the bigger picture, the price is still trading below the 50% retracement level of the 22nd of January - 17th of March decline. This still makes me believe that the 17th of March – 06th of April recovery was just a corrective move and that we will see gold trading lower in the not-too-distant future.

Support: 1180 (S1), 1165 (S2), 1150 (S3).

Resistance: 1197 (R1), 1210 (R2), 1220 (R3).

WTI climbs above 57.20

WTI shot up yesterday after Saudi Arabia resumed bombing in Yemen. The price broke above the upper bound of a short-term downside channel. The violation of the 57.20 (S1) resistance (turned into support) signalled a forthcoming higher high and turned the short-term bias to the upside, in my view. However, our hourly momentum indicators show signs that a pullback could be in the works before the next leg north. The 14-hour RSI exited its overbought territory and is now headed towards its 50 line, while the hourly MACD has topped and fallen below its signal line. On the daily chart, I still see a positive medium term outlook. The break above 55.00 on the 14th of April signalled the completion of a double bottom formation, something that could carry larger bullish implications in the not-too-distant future. A possible move above 58.80 (R2), a resistance defined by the peak of the 16th of April, could open the way for the round figure of 60.00 (R3).

Support: 57.20 (S1), 56.55 (S2), 55.75 (S3).

Resistance: 58.00 (R1) 58.80 (R2), 60.00 (R3).

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.