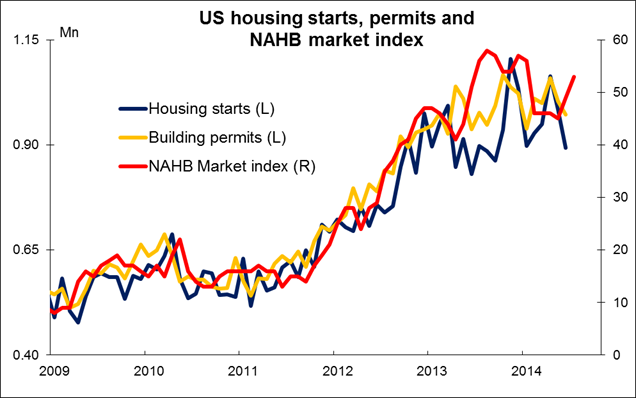

Home builder sentiment underpins USD The dollar gained broadly over the past 24 hours, boosted by better-than-expected figures from the National Association of Home Builders.

The only G10 currency to gain vs USD was AUD, which rose after the Reserve Bank of Australia (RBA) released the minutes of its latest policy meeting. This seems almost inexplicable to me, given that the minutes emphasized the uncertainties ahead and the difficulties caused by the strong currency. About the only explanation I can think of is that it said “cumulative movements in interest rates since the start of the year amounted to a noticeable easing in financial conditions,” which could be interpreted as making future rate cuts less likely. But in my view, that line was outweighed by comments about the “significant uncertainties around the growth forecast and the importance of considering the risks to the forecast…” especially after the RBA cut its forecasts for growth in the August Statement on Monetary Policy. Personally, I would fade this rally as I think it is ill-founded and could be reversed tomorrow, when RBA Gov. Stevens presents his semi-annual testimony to the House of Representatives Economics Committee. (See technical comment below).

On the other hand, NZD was the weakest of the G10 currencies after the PPI fell on a qoq basis and the government cut its forecasts for economic growth and government budget surpluses. I’ve been bullish on NZD based on expected Chinese demand for its commodities, and indeed Chinese purchases of milk continue to be strong. China now consumes over half the world’s whole-milk powder, New Zealand’s biggest export. However this demand hasn’t been enough to shore up milk prices, which recently hit a two-year low. I am resigned to a period of NZD weakness until milk demand recovers enough to start boosting prices.

In contrast to its general gains against the G10 currencies, the dollar was mixed vs EM as carry trades continue to attract selective attention. The traditional carry currencies BRL and TRY gained, but another carry favorite – ZAR – was the worst performing of the EM currencies we track, so it cannot be said to be an indiscriminate move into carry trades. The biggest gainer was RUB, which rose as tensions in Ukraine subsided a bit. The gains did not extend to other Eastern European currencies though as HUF and CZK fell (but only against USD – they were higher vs EUR). USD/PLN was fairly steady, meaning EUR/PLN was lower. In other words, the Eastern European currencies are coming back but their strength is masked by the rise in the dollar. Investors interested in putting on carry trades might want to look at buying them vs EUR or JPY. PLN and HUF pay much lower interest than RUB, but they are better underpinned fundamentally as oil prices come down and only indirectly exposed to events in Ukraine.

Today’s schedule: During the European day, the only indicator we get is the single currency bloc’s current account for June. The region’s large current account surplus is one reason for the strong EUR, although the report tends not to be market-moving. The Eurozone trade figures out Monday had no impact on the currency.

In the UK, the CPI is forecast to have slowed a bit to +1.8% yoy in July from +1.9% yoy in June, while the nation’s PPI for the same period is forecast to have remained unchanged. Last month GBP/USD rose approximately 0.40% at the release of the unexpected high CPI reading, boosting the case for the Bank of England to increase interest rates. This month however the expected slowdown in inflation adds to the growing body of evidence that the UK economy is losing momentum. Only the BoE meeting minutes on Wednesday may be able to reverse this view.

In the US, the CPI for July is expected to slow down in pace to +2.0% yoy, from +2.1% yoy in the previous month. While inflation at the Fed’s target rate might normally be expected to boost the dollar, at this point I think the focus is on the employment data, not the inflation data, and I wouldn’t expect this figure to be market-affecting. Housing starts and building permits for July are also coming out. Both figures are forecast to have increased, adding to the evidence of strength in the housing market from Monday’s better-than-expected NAHB survey.

We have no speakers scheduled on Tuesday.

The Market

EUR/USD still ranging

EUR/USD declined on Monday, but remained within the range it’s been trading since the beginning of August. Although the rate remains within the long-term blue downside channel, EUR/USD continues to oscillate between the support line of 1.3330 (S1) and the resistance of 1.3415 (R1), justifying my decision to continue sitting on the sidelines. I will stick to the view that I would like to see a dip below 1.3300 (S2) before regaining confidence in the longer-term downtrend. Such a dip could pave the way for the 1.3200 (S3) zone. Moreover, I still see positive divergence between the 14-day RSI and the price action, while the daily MACD lies above its signal line. This adds to my flat view as the pair could be preparing for a rebound and the beginning of a corrective phase.

Support: 1.3330 (S1), 1.3300 (S2), 1.3200 (S3).

Resistance: 1.3415 (R1), 1.3445 (R2), 1.3500 (R3).

GBP/JPY still in a downtrend

GBP/JPY moved higher on Monday, breaking above the 171. 45 line (resistance turned into support), but remained below the blue downtrend line, drawn from the peak of the 30th of July. A slowdown in the UK CPI for July (coming out today), could cause the bears to take advantage of the renewed selling opportunity and push the rate back below 171.45 (S1), keeping the recent downtrend intact. As long as the rate remains below the key resistance obstacle of 172.50 (R1), the possibility of a lower high still exist and I would see a mildly negative picture. My only concern is that I can identify positive divergence between both the momentum studies and the price action, which indicates that the momentum of the downtrend is slowing.

Support: 171.45 (S1), 170.45 (S2), 169.60 (S3).

Resistance: 172.50 (R1), 173.50 (R2), 174.20 (R3).

AUD/USD higher after RBA’s meeting minutes

AUD/USD moved higher after the minutes of the latest RBA meeting were released, breaking above the critical barrier of 0.9330 (S1) (resistance turned into support) and confirming the positive divergence between the MACD and the price action. Such a move could target the resistance hurdle of 0.9375 (R1). However, I would adopt a neutral stance ahead of Governor Stevens’ testimony tomorrow. Since it’s too early to argue for a reversal and a newborn uptrend, Stevens’ testimony could be a reason for a lower high and the reinforcement of the prevailing downtrend.

Support: 0.9330 (S1), 0.9290 (S2), 0.9250 (S3).

Resistance: 0.9375 (R1), 0.9415 (R2), 0.9455 (R3).

Gold finds support at 1295 again

Gold moved marginally lower to touch once again the support line of 1295 (S1), before rebounding slightly to trade virtually unchanged. As long as the precious metal remains below 1305 (R1), the lower bound of its prior sideways path, I would consider the near-term outlook cautiously to the downside. A clear move below the 1295 (S1) hurdle is likely to target the next support level, at 1280 (S2). However, on the longer-term time frames, I still see a trendless picture and this is confirmed by the fact that both the 50- and 200-day moving averages are still pointing sideways, while both our weekly momentum studies lie on their neutral lines.

Support: 1295 (S1), 1280 (S2), 1267 (S3).

Resistance: 1305 (R1), 1323 (R2), 1345 (R3).

WTI forms a higher low

WTI declined somewhat yesterday, but rebounded from 95.80 (S1), printing a higher low. This enhances my concerns about the recent downtrend’s strength, and although the trend remains intact, I will maintain my neutral stance. If the bears are willing to take action below the blue short-term downtrend line, they are likely to target once again the recent lows of 95.25 (S2). On the other hand, a decisive move above 97.30 (R1) could signal a forthcoming higher high and pave the way for the next resistance, at 98.65 (R2). In the bigger picture, the price structure remains lower highs and lower lows within the purple downside channel, thus I would see any short-term reversal as a corrective wave of the longer-term downtrend.

Support: 95.80 (S1), 95.25 (S2), 93.65 (S3).

Resistance: 97.30 (R1), 98.65 (R2), 99.45 (R3).

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.