Big day ahead of us Fixed income markets were in the forefront yesterday as yields in several European countries – Germany, France, Spain and Italy – hit record lows. US Treasury yields got dragged down with them. Yet the dollar managed to gain against most G10 and EM currencies as well, with significant demand from both companies and trend-following hedge funds. EUR/USD hit a new low for the year as US consumer confidence rose sharply with employment measures improving. The stronger dollar prevented gold from breaking through its 200-day moving average and the metal moved lower despite rising tensions in Ukraine, which indicates weak underlying demand for gold. Today’s economic events seem likely to keep the dollar well bid, while the technicals largely reinforce that view (see below).

Japanese industrial production collapsed in June, dropping 3.3% mom as companies cut back production in response to the drop in consumer spending after the rise in the consumption tax. Nor are exports picking up the slack. The figures, which were the worst since the 2011 tsunami, were in sharp contrast to neighboring South Korea, where IP was up 2.9% mom in June. This poor performance calls into question the Bank of Japan’s inflation target and simply reaffirms my view that the BoJ will have to take further action to weaken the yen later this year. The news had no immediate impact on USD/JPY but over the longer term should keep the pair moving higher. I remain bearish JPY.

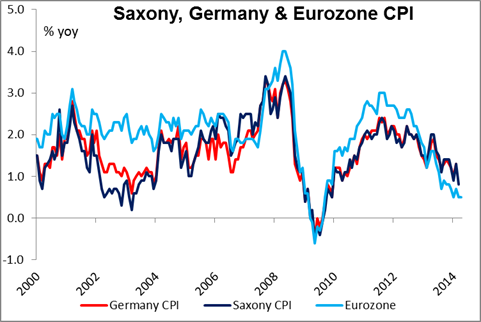

Today’s action: During the European day, the preliminary German CPI for July is expected to have fallen to 0.8% yoy, down slightly from 1.0% yoy in June. As usual the drama will start several hours earlier when the CPI for Saxony is released ahead of the country’s headline CPI. I don’t think a decline in German inflation would increase the likelihood of any new measures at next week’s ECB meeting, because the ECB probably wants to have time to gauge the impact of its already-announced measures before taking new steps. Nonetheless a further decline in inflation on top of last week’s poor German Ifo readings would probably raise questions about the underlying health of the Eurozone’s strongest economy and add to the sense that the bloc’s only hope is a weaker currency. I remain bearish on EUR.

Elsewhere in the region, Eurozone’s final consumer confidence and French consumer confidence indices, both for July are also coming out. Sweden’s preliminary Q2 GDP will be announced and the forecast is for a rebound from Q1. In Norway, the AKU unemployment rate for May is forecast to have risen slightly.

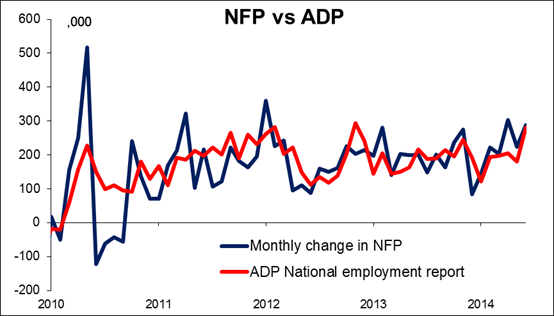

Then a huge day in the US! The ADP employment report is expected to show that the private sector gained 230k jobs in July, almost the same as the 231k NFP consensus forecast. The average miss for the ADP report over the last year has been 41k or around 25% of the NFP number, so this is an imperfect guide at best. Nonetheless I expect that if the ADP does come in as expected, it would support USD as it would imply that the US labor market continues to perform well (average 214k a month new jobs for the last six months).

Then 15 minutes later we get the flash estimate of US GDP for Q2. It’s expected to rise +3.0% qoq SAAR, a rebound from the unexpected 2.9% drop in Q1. It may be hard to play the GDP figures as the reaction is not particularly consistent. Of the last four positive surprises, USD/JPY was unchanged or lower an hour later in three cases, while USD/JPY moved slightly higher in one of the last four lower-than-expected prints. The GDP data will be accompanied by the annual revisions. These typically produce large changes in quarterly GDP and therefore the trend patterns, although not particularly big changes in the annual growth rates.

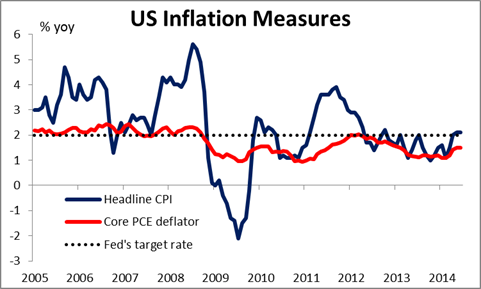

The GDP figures also bring the first estimate of the core personal consumption index, the Fed’s favorite inflation measure. It’s forecast to jump to +1.9% qoq from +1.2% qoq, close to the Fed’s 2% target. A jump like that would make it more likely that the FOMC members will have to move up their inflation forecasts and therefore accelerate the timing of the first rate hike as well. It would be significantly USD-bullish, in my view.

Then later in the day, the FOMC ends its two-day policy meeting. There are neither updates to the forecasts nor a press conference following the meeting, just the release of the statement. I expect they will update the section describing the economy to bring it into line with the more robust data that’s been released recently, but I doubt whether it will include any new clues to when the Committee might raise rates. Neither the economy overall nor inflation specifically have been firm enough recently to warrant any change in the FOMC’s message. Although several of the more hawkish members have been making their views known quite clearly, I do not expect anyone to dissent from the statement yet. Nonetheless insofar as the statement should reflect the improvements in the economy, I expect it will be USD-positive.

From Canada, we get the industrial product price for June. We have no speakers scheduled on Wednesday.

Finally, the most frightening thing I’ve ever read: In yesterday’s FT there were several articles about the ruling that Russia would have to pay Yukos’ shareholders USD 50bn. The article ended on this chilling note: One person close to Mr Putin said the Yukos ruling was insignificant in light of the bigger geopolitical stand-off over Ukraine. “There is a war coming in Europe,” he said. “Do you really think this matters?”

The Market

EUR/USD finds support marginally above 1.3400

- EUR/USD declined slightly on Tuesday after finding support 3 pips above our support barrier of 1.3400 (S1). The pair continues to print lower peaks and lower troughs below both the moving averages, thus I still see a negative short-term picture. A decisive move below 1.3400 (S1) could target our next support level at 1.3350 first. Nevertheless, I can see positive divergence between the rate and both our momentum indicators, indicating that the trend is losing some downside momentum. As a result, I would consider a dip below 1.3400 (S1) more reliable if it is accompanied with accelerating momentum signs, such as the elimination of the positive divergence. On the daily chart, the 50-day moving average lies below the 200-day one, adding to the negative picture of the currency pair.

- Support: 1.3400 (S1), 1.3350 (S2), 1.3300 (S3)

- Resistance: 1.3425 (R1), 1.3445 (R2), 1.3485 (R3)

USD/JPY continues higher

USD/JPY edged higher, breaking above the resistance (turned into support) of 101.95. This confirms the exit of the downside channel and turns the bias to the upside. As I said yesterday, a move above that level could pave the way towards the resistance of 102.25 (R1). A decisive break of the 102.25 (R1) is likely to have larger bullish implications and could pave the way towards the resistance zone of 102.65/75. My concern is that, zooming on the 1-hour chart, the 14-hour RSI left its overbought zone and moved lower, while the MACD fell below its signal line. Having that in mind, I would be cautious for a possible pullback before the bulls shift the gear up again.

Support: 101.95 (S1), 101.70 (S2), 101.60 (S3)

Resistance: 102.25 (R1), 102.65 (R2), 102.75 (R3)

EUR/GBP consolidates

EUR/GBP moved sideways yesterday, remaining between the 0.7905 (S1) and 0.7935 (R1) barriers. Although the overall trend remains to the downside (marked by the downtrend line drawn from back the 11th of April), the positive divergence between the MACD and the price action remains in effect, confirming the inability of the bears to push the rate lower. Also, the positive divergence I see on the daily chart between the price action and both the daily MACD and the 14-day RSI is still in effect. This supports my view that this downtrend is not that firmly established. I would regain my confidence on the downtrend upon a dip below 0.7875 (S2). Such a dip would confirm a forthcoming lower low and could trigger extensions towards 0.7815 (S3)

Support: 0.7905 (S1), 0.7875 (S2), 0.7815 (S3)

Resistance: 0.7935 (R1), 0.7980 (R2), 0.8030 (R3)

Gold still trendless

Gold tried to move higher, but after hitting 1312 (R1), which coincides with the 200-day moving average, it moved lower to find support at the prior trend line. Although the positive divergence between both our momentum studies and the precious metal is still in effect, the 50-period moving average moved somewhat below the 200-period one. Bearing in mind these mixed technical signals, I would remain to the sidelines. On the daily chart, both the 50-day and 200-day moving averages are still pointing sideways, corroborating my flat view, at least for now.

Support: 1290 (S1), 1285 (S2), 1265 (S3)

Resistance: 1312 (R1), 1325 (R2), 1345 (R3)

WTI rebounds near 100.45

WTI tumbled yesterday but after finding some buy orders slightly below 100.45 (S2), the 61.8% retracement level of prior near-term advance, it rebounded to trade once again above 101.00 (S1). As I mentioned in previous comments, I would like to see a clear move below that bar before getting really bearish on oil. Such a move could target the area of 98.65 (S3), the low of the 15th of July. As long as WTI is trading within the downside channel the minor-term outlook remains cautiously to the downside. A move above 102.50 (R1) would dampen the bearish bias and would confirm that the recent decline was just a 61.8% retracement of the aforementioned up move.

Support: 101.00 (S1), 100.45 (S2), 98.65 (S3)

Resistance: 102.50 (R1), 103.35 (R2), 104.50 (R3)

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'