Today’s the day There are several big things on the schedule today and an unusual number of smaller ones as well:

ECB Policy Board meeting: Following last month’s radical moves, I think it’s highly unlikely that the ECB would take any further steps this month. The easing measures that it announced last month won’t even be fully implemented until September, when they hold the first of their targeted long-term refinancing operations (TLTRO). The ECB is likely to be on hold until they start to have some idea how the entire package of measures is performing in terms of stimulating lending. That means several more months (at least) during which the anticipation ahead of the ECB meetings is much less than it was previously and volatility on the day is likely to be much lower than at the last several meetings.

The focus today will probably be on the details of the TLTRO, which have not yet been made clear. The big question is going to be how restrictive the terms are – how much “conditionality” there is. The more restrictive the conditions are, the less money banks will have available for other investments, such as buying bonds of the peripheral European countries (one of the main uses of the previous LTRO). The impact on the euro is debatable. On the one hand, if it looks like the funds will be available to buy bonds, then outside investors may rush in to front-run these purchases and the euro might strengthen. In other words, the less conditionality is attached to the funds, the better for the euro near-term. On the other hand, the more conditionality is attached to the funds, the fewer loans the banks are likely to make. That means less balance sheet expansion by the banks and the ECB, lower inflation expectations, and higher real yields, which would be bullish for the euro longer-term. Plus the yield on peripheral bonds would probably rise (as has been happening recently, perhaps in anticipation of relatively strict conditionality), thereby making these bonds more attractive to investors. In sum, I think that loose conditions attached to the loans could be bullish for the euro short-term, while strict conditions could be bullish longer term.

Riksbank meeting: The Riksbank on the other hand is widely expected to lower its repo rate to 0.5% from 0.75%. The headline CPI has been in deflation all this year, but high household indebtedness and the possibility of a housing bubble have kept the Riksbank from easing. The key then will be not whether they cut rates, but how they see the rate path progressing afterwards – whether they still think there is a chance of further easing or do they assume they are now at the bottom. The market has not yet priced in any easing past this month, but if inflation remains low, the Riksbank could lower rates further, which would tend to weaken the SEK – which is what I expect.

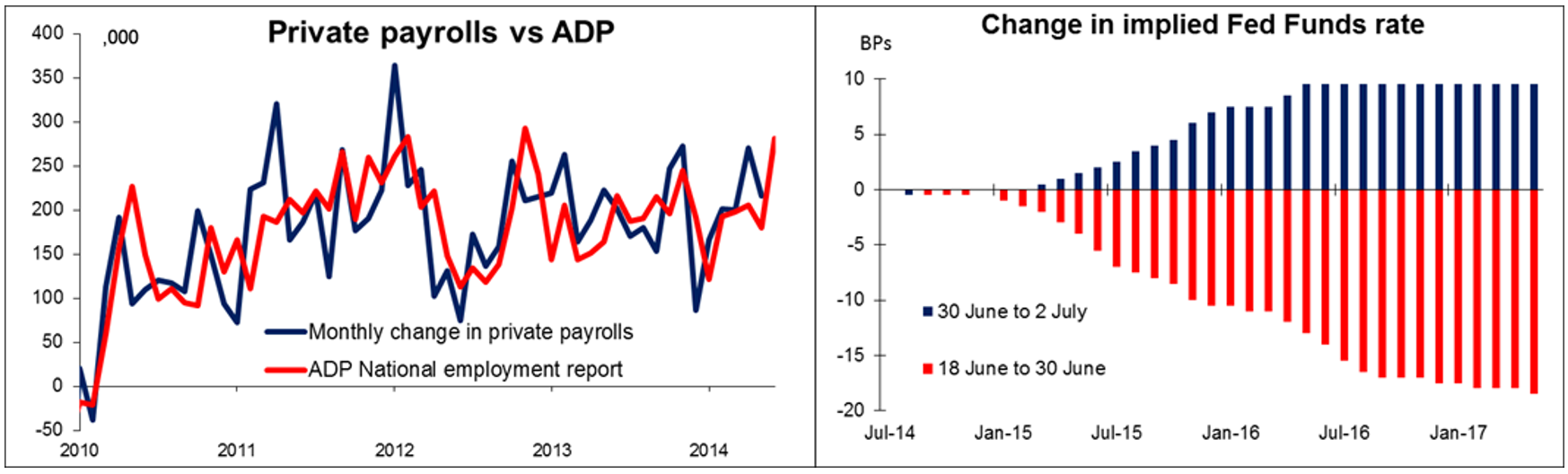

Nonfarm payrolls: With inflation in the US creeping up towards the Fed’s target level, the employment data are even more important than usual as the main thing left standing between the FOMC and a rate hike. Before yesterday’s ADP report, the market was going for a 215k increase in NFP, about the same as in May (217k). However after the ADP report came with a much higher-than-expected 281k, many firms revised up their forecasts for NFP to around 230k. Expected interest rates on Fed Funds for mid-2016 and later rose by 6 bps, so a good figure is already discounted in the market. The unemployment rate is expected to stay at 6.3%.

Wage growth will also be important. Fed Chair Janet Yellen has pointed to wages as an indicator of tightness in the labor market. That is, if the wages are not rising, then by definition the labor market is still slack. Average hourly earnings are expected to rise by 1.9% yoy in June, a slowdown from 2.1% yoy in May, which would tend to confirm that there is still slack in the labor market and the Fed has yet to achieve its goals.

For those interested in playing the figures, USD/JPY is probably the most appropriate currency pair to use as it is the one that sees the most increase volatility. EUR/USD and GBP/USD see much less of an increase in volatility, particularly on negative surprises. I don’t recommend taking a position ahead of the figures as it’s usually a 50-50 bet whether they beat or miss expectations. However there do seem to be patterns after the figures come out. Generally speaking, when the figure beats expectations, USD/JPY seems to make its peak around 20 minutes after the announcement, and then retreats somewhat, while if the figure is worse than expected, it seems that USD/JPY plunges in the first five minutes or so after the number but then tends to rebound. Of course past performance is no guarantee of future performance and a trading strategy that was successful in the past might not be successful in the future.

Also to be released are the service-sector PMIs for June from the countries we got the manufacturing data for on Tuesday. The UK service-sector PMI is expected to have declined, while in the US, the ISM non-manufacturing index for the month is expected to remain unchanged.

In the US, initial jobless claims for the week ended June 28 is estimated to be more or less in line with the forecast, while trade deficit is anticipated to have slightly narrowed in May, although the employment data will take precedence over these.

As for speakers, ECB President Mario Draghi is a busy man today! Besides his press conference after the ECB meeting, he speaks at an event with German Chancellor Angela Merkel and Irish Prime Minister Enda Kenny, and another event with German Finance Minister Wolfgang Schaeuble. RBA Governor Glenn Steve also speaks.

THE MARKET

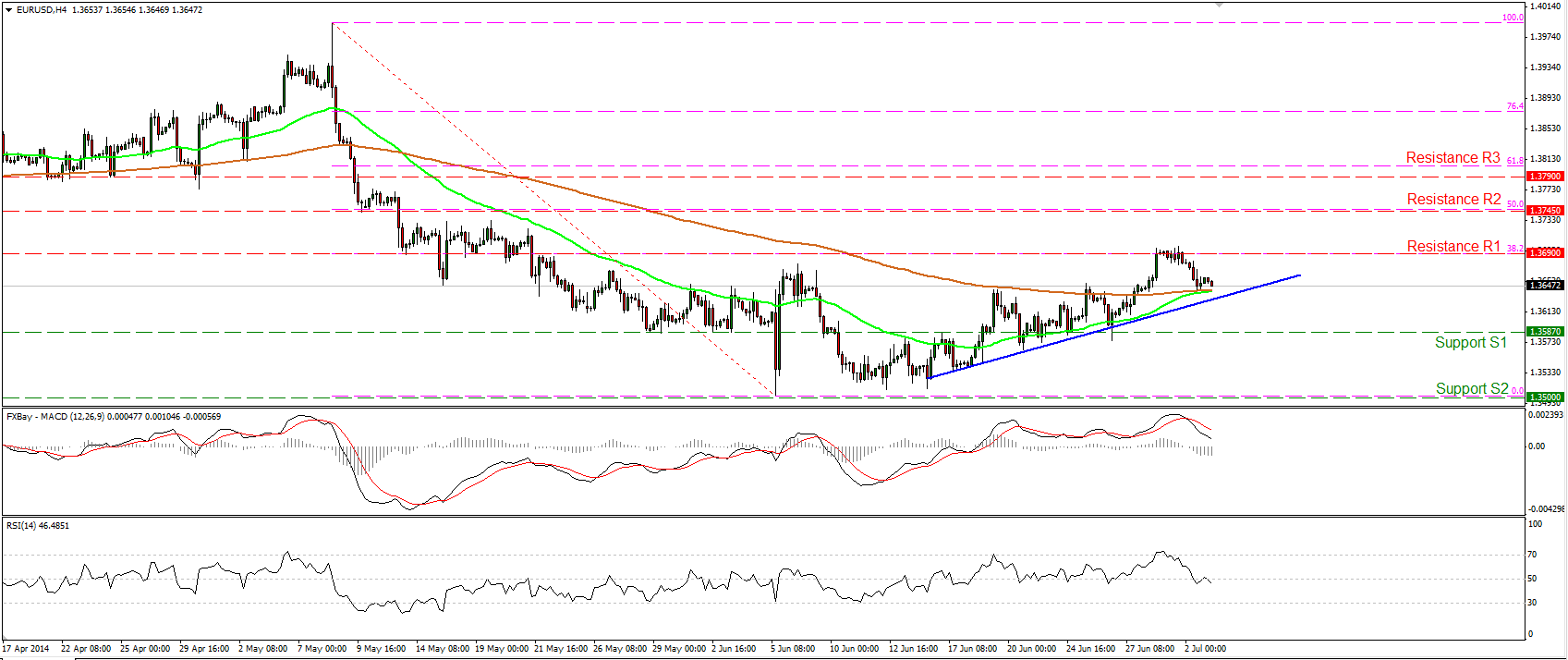

EUR/USD lower after the 1.3690 resistance zone

EUR/USD moved lower on Wednesday, after consolidating near the 38.2% retracement level of the 8th May- 5th June decline. The rate remains above both the moving averages and above the blue support line, keeping the upside correcting phase in effect. Nonetheless, the MACD fell below its trigger line, while the RSI crossed below its 50 barrier. In light of the mixed signs provided by our technical studies, I would see a neutral picture for now. A rebound near the blue support line may target once again the 1.3690 (R1) resistance zone, while a dip below 1.3587 (S1) may signal that the retracement is over and could pave the way towards the key support of 1.3500 (S2).

Support: 1.3587 (S1), 1.3500 (S2), 1.3475 (S3).

Resistance: 1.3690 (R1), 1.3745 (R2), 1.3790 (R3).

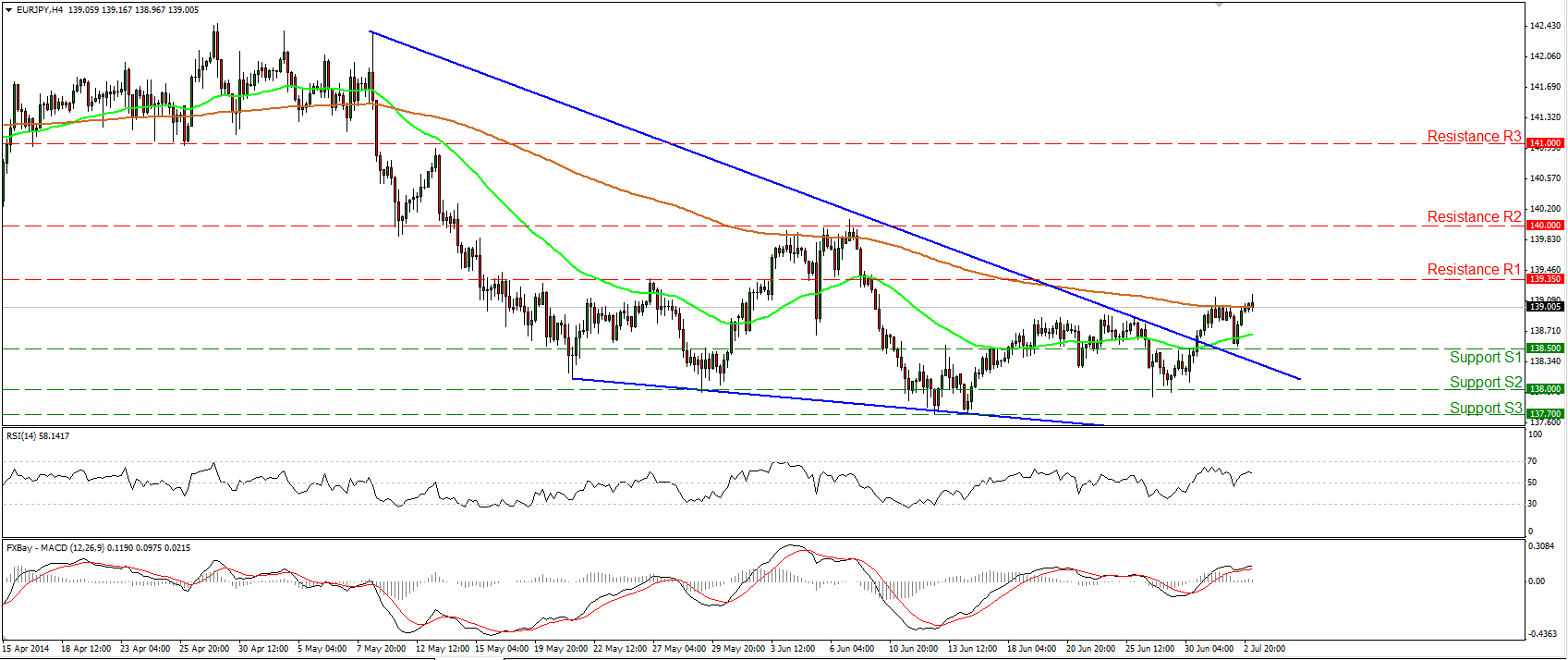

EUR/JPY rebounds from the 138.50 area

EUR/JPY rebounded from the 138.50 area, remaining above the upper boundary of the falling wedge formation. As long as the rate is trading above the upper bound of the pattern, I see a positive short-term technical picture, and a decisive move above the 139.35 (R1) resistance hurdle could trigger extensions towards the psychological barrier of 140.00 (R2). Both our momentum studies moved higher, with the MACD remaining above its signal and zero lines. This confirms the recent bullish momentum and increases the possibilities for further advance in the near future. In the bigger picture, the long-term path of the rate remains to the sideways since we cannot identify a clear trending structure.

Support: 138.50 (S1), 138.00 (S2), 137.70 (S3).

Resistance: 139.35 (R1), 140.00 (R2), 141.00 (R3).

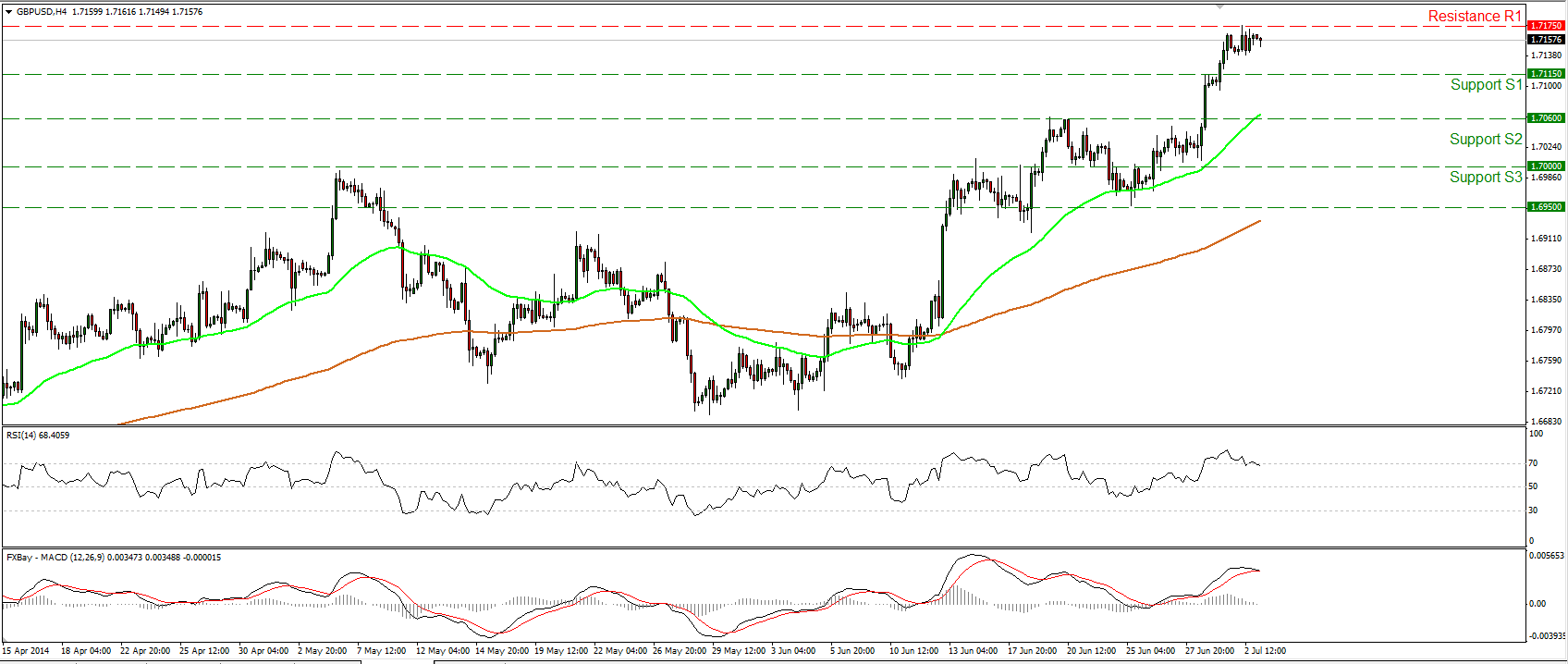

GBP/USD continues higher

GBP/USD emerged above the 1.7115 barrier but the advance was halted at 1.7175 (R1). The next resistance hurdle is at 1.7200 (R2) where a decisive upside violation could pave the way towards the 1.7300 (R3) zone. Considering though that the RSI exited its overbought territory and that the MACD fell below its signal line, I would expect some consolidation or a pullback before the longs take control again. In the bigger picture, the 80-day exponential moving average provides reliable support to the lows of the price action, keeping the long-term path to the upside.

Support: 1.7115 (S1), 1.7060 (S2), 1.7000 (S3).

Resistance: 1.7175 (R1), 1.7200 (R2), 1.7300 (R3).

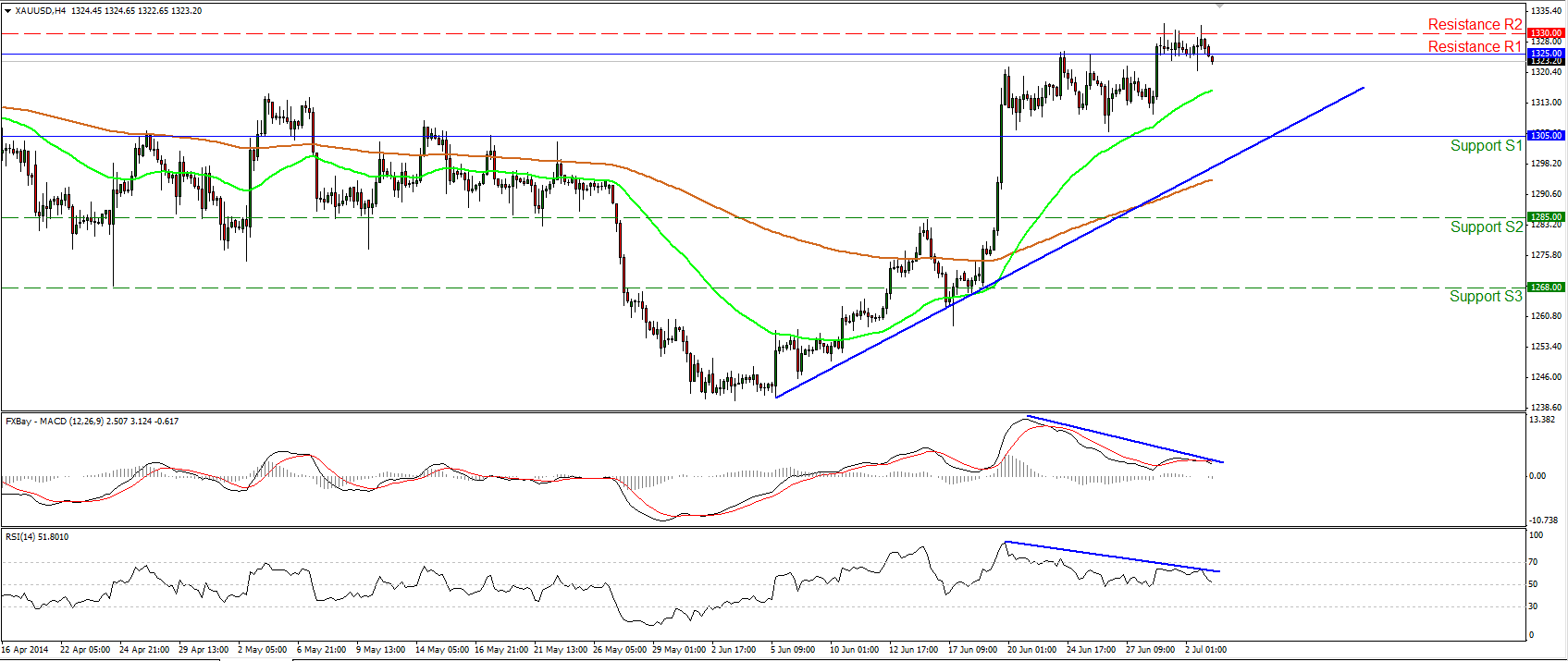

Gold pulls back below 1325

Gold moved below the 1325 barrier yesterday. Having in mind the negative divergence between our momentum studies and the price action, I cannot rule out the continuation of the decline, maybe towards the support of 1305 (S1). Nevertheless, as long as the precious metal is trading above both the moving averages and above the blue uptrend line, the overall technical picture remains positive and I would see any further declines a renewed buying opportunity, at least for now. On the daily chart, we can identify a spinning top candle followed by a doji. This amplifies the case for the continuation of the pullback.

Support: 1305 (S1), 1285 (S2), 1268 (S3).

Resistance: 1325 (R1), 1330 (R2), 1342 (R3).

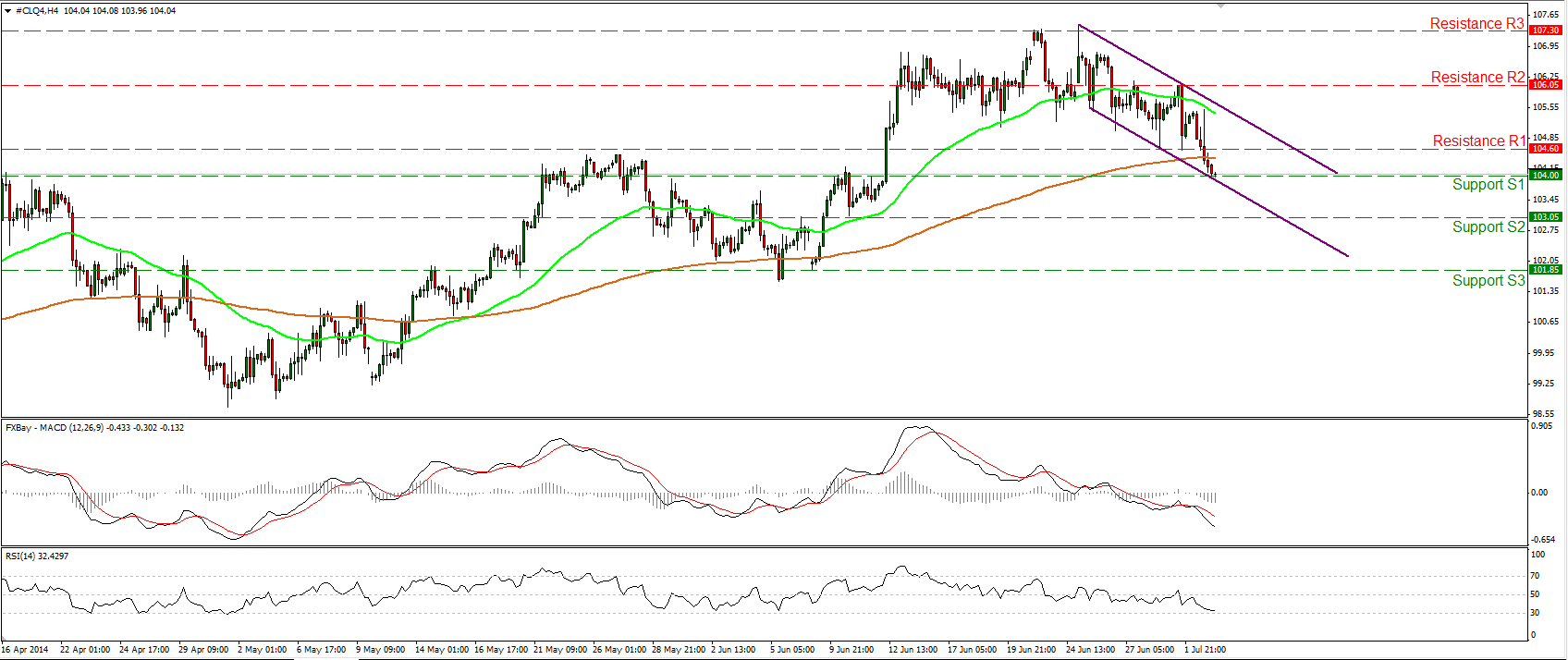

WTI finds support at 104.00

WTI tumbled on Wednesday, breaking below the 104.60 barrier and reaching our next support at 104.00 (S2), near the lower boundary of the purple downward sloping channel. The MACD remains below both its zero and trigger lines, while the RSI fell below its 50 level, confirming the recent bearish momentum. As long as WTI is printing lower highs and lower lows within the downward sloping channel, the short-term outlook is to the downside. However, zooming on the 1-hour chart, the 14-hour RSI found support at its 30 level and is pointing up, while the hourly MACD seems ready to cross above its trigger line. As a result, I would expect the forthcoming wave to be an upside corrective wave within the downtrend channel.

Support: 104.00 (S1), 103.05 (S2), 101.85 (S3).

Resistance: 104.60 (R1), 106.05 (R2), 107.35 (R3).

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.