The numbers speak louder than Yellen The dollar trended largely lower after US Fed Chair Janet Yellen emphasized the Fed’s flexibility on when to raise interest rates rather than reiterating her previous comment that they could start raising rates six months or so after they end quantitative easing. Speaking to the Economic Club of New York, Yellen said, “We need to be alert to what is happening in the economy and to respond to what we see happening, and not a fixed idea that we perhaps held at some earlier time about what will come to pass.” Instead, she said how long the Fed would keep the current target range for Fed Funds would depend on how far employment or inflation are from their targets. Currently, the unemployment rate is 6.7%, which is more than 1 percentage point higher than the top end of the FOMC’s estimate of full employment, while the core personal consumption expenditure deflator, the Fed’s favored inflation gauge, is only rising 1.1% yoy, about half the target of 2.0%. At the same time she also said that the causes of low inflation are only temporary and the Fed expects to meet these two goals by the end of 2016. That comment, plus stronger-than-expected industrial production for March and comments in the Beige Book that indicate the economy is indeed on track, sent the implied interest rates on the Fed Funds futures up 5.5 bps in the long end. In short, interest rate expectations moved higher regardless of Yellen’s comments about flexibility.

Nonetheless the dollar was generally lower against both the G10 currencies and the EM currencies.

Investors should remember that while the Fed nowadays gives forward guidance, it usually leaves itself some wriggle room in case the economic situation changes. For example, even now the Fed emphasizes that the monthly reductions in its bond-buying program are not a preset course, but in fact they are on a preset course, or rather they follow Newton’s first law of motion, which says that a body in motion tends to stay in motion unless acted upon by some external force. In other words, the “tapering” of the Fed’s bond buying program is on a preset schedule unless something occurs to interfere with it, and we know from statements by officials that that “something” would have to be quite serious. With tightening too, the FOMC has a schedule in mind and will probably stick with it so long the members believe the economy is on track to meet their forecasts, in my view. That should eventually start to underpin the dollar as the moment of policy turning approaches.

The Fed Funds futures are now forecasting a 0.5% Fed Funds rate by October 2015. That would be a year before the Fed hits its targets. It’s reasonable to expect the Fed to start normalizing rates before it reaches its targets, with the idea that it might be somewhere around a normal, neutral level of rates when it reaches its targets. The current Fed Funds futures forecast that Fed Funds will hit 1.8% at the end of 2016, when the Fed forecasts reaching its targets. This would still be a negative real rate, which is quite stimulative historically; the average real Fed Funds rate (including periods of recession) was 1.7% before the 2008 financial crisis, which would imply a nominal Fed Funds rate closer to 3.7% or almost double what the market is forecasting. While the Fed has said that “economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run,” I wonder if this includes a negative real rate for Fed Funds. I expect the market to continue to revise up its expectations for US rates and that this will support the dollar.

In Canada however the Bank of Canada held rates unchanged at 1.0%, as was generally expected, and reaffirmed its concern over the low level of inflation, currently running around 1.1% yoy vs the target of 2.0%. The Bank also revised down its growth forecast and noted that growth prospects hinge critically on a rise in exports, which in turn depends in part on a weaker CAD. As a result, CAD was one of the few currencies to ease vs USD and I would expect it to continue to lose ground further. Watch today’s CPI for March, which is expected to accelerate to +1.4% yoy from +1.1% yoy.

A relatively light calendar follows on Thursday. The European day starts with Germany’s PPI for March, which is expected to be down 0.7% yoy after falling 0.9% yoy in February.

In the US, initial jobless claims for the week ended on April 12 are expected to rise to 315k vs 300k the previous week. Nonetheless this will bring the 4wk moving average down to 314k from 316.25k, a level last seen back in 2007. Continuing claims for the week ended on April 5 are expected to have risen slightly to 2778k from 2776k. The Philadelphia Fed Business activity index for April is also coming out and is expected to rise.

ECB Executive Board member Yves Mersch speaks in a press conference.

THE MARKET

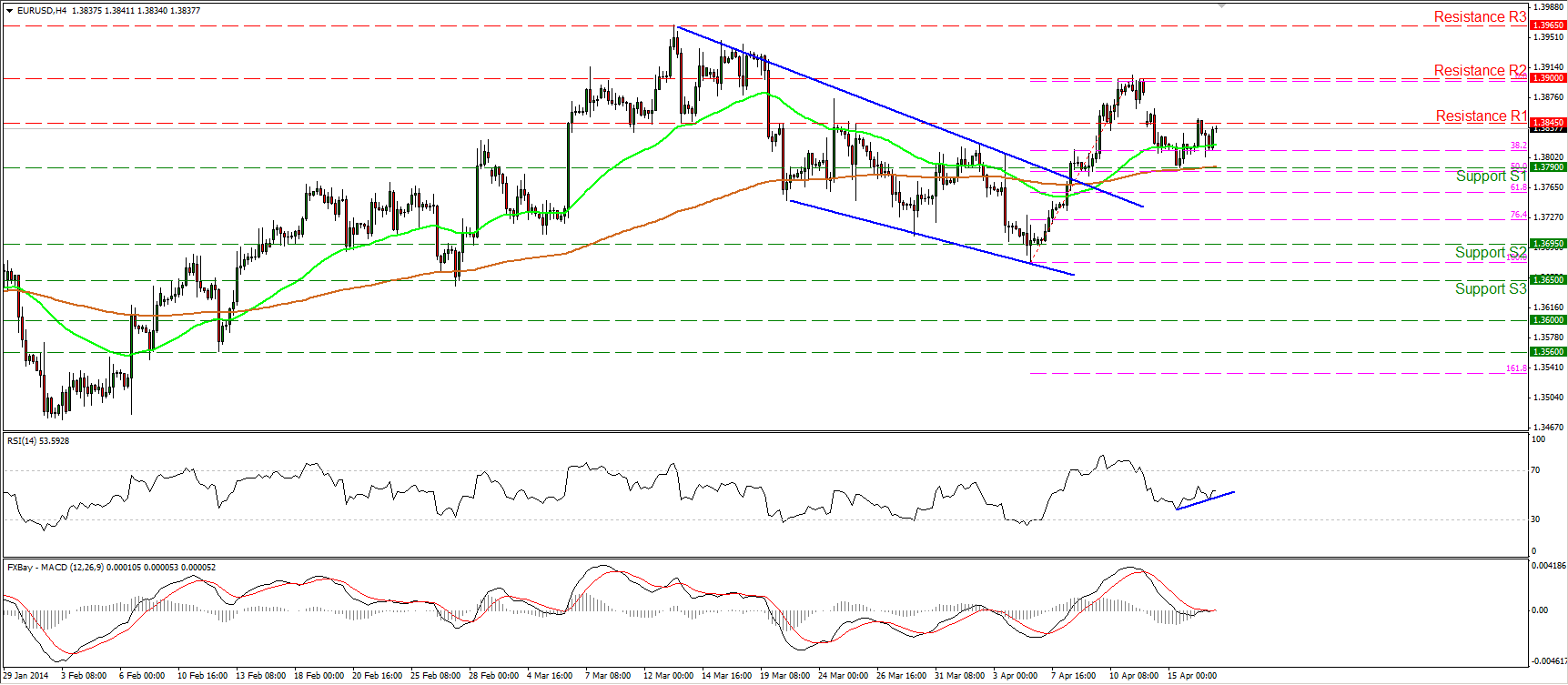

EUR/USD

EUR/USD moved slightly higher to challenge the resistance bar of 1.3845 (R1). A clear move above that hurdle may confirm the rebound from the 1.3790 (S1) bar and probably challenge the resistance of 1.3900 (R2). A break above those highs would signal the continuation of the upside path and perhaps pave the way towards the 1.3965 (R3) obstacle. Our momentum studies provide mixed signals. The RSI started following an upward path, but the MACD remains near its neutral line.

Support: 1.3790 (S1), 1.3695 (S2), 1.3650 (S3).

Resistance: 1.3845 (R1), 1.3900 (R2), 1.3965 (R3).

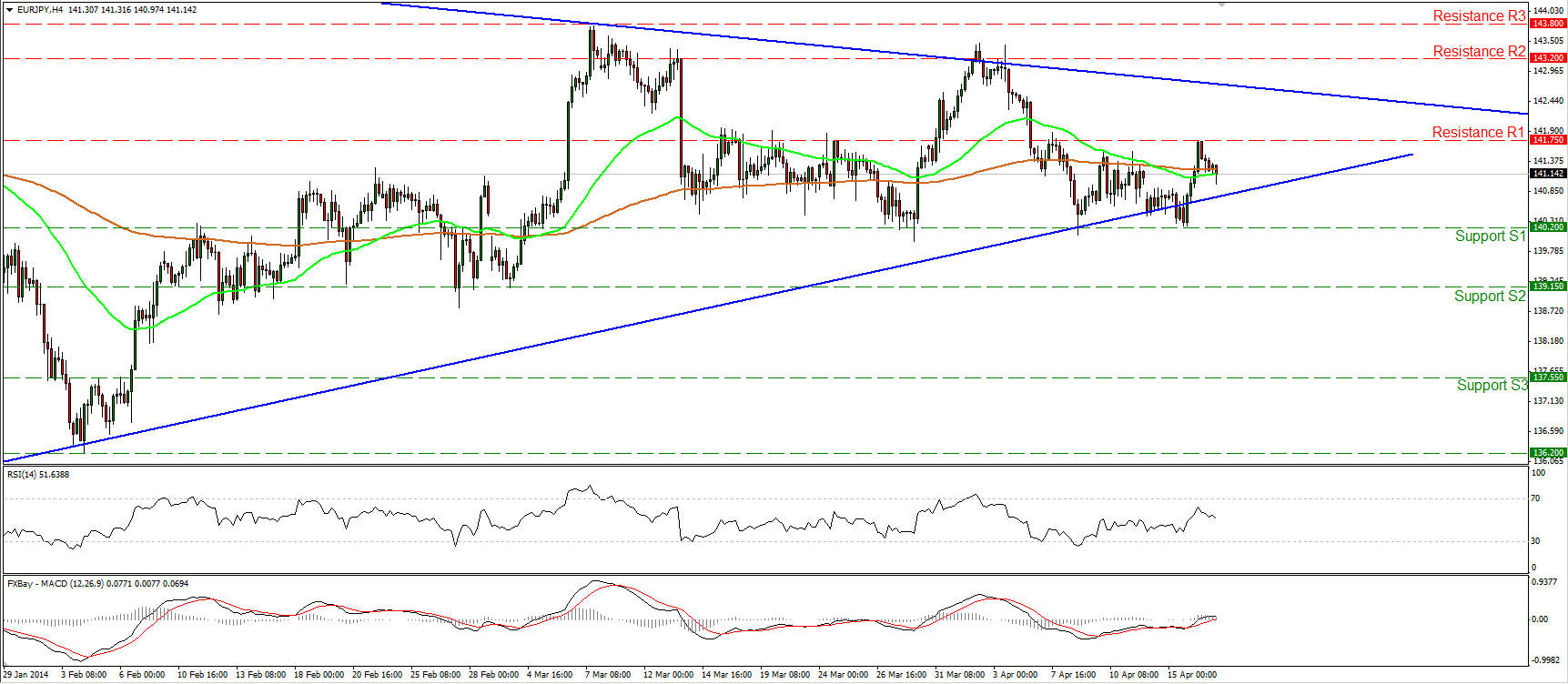

EUR/JPY

EUR/JPY moved higher but found resistance at 141.75 (R1) and retreated. The rate continues its sideways path and this is confirmed by the neutral readings of the daily MACD and the daily RSI. The non-trending mode is also confirmed by both the moving averages, which are pointing sideways. In the bigger picture, the rate remains within the triangle formation identified on the daily chart.

Support: 140.20 (S1), 139.15 (S2), 137.55 (S3).

Resistance: 141.75 (R1), 143.20 (R2), 143.80 (R3).

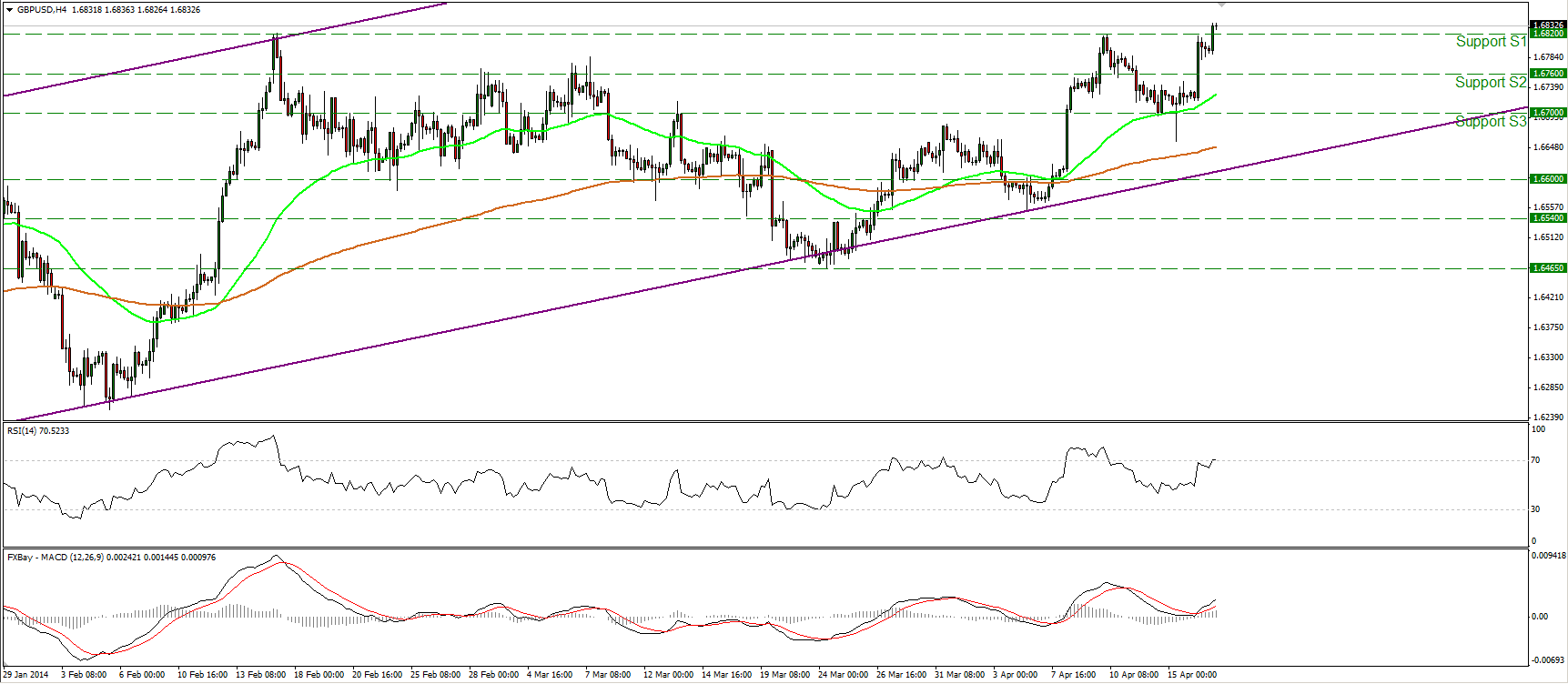

GBP/USD

GBP/USD rallied to meet and break the barrier of 1.6820. Such a move confirms a forthcoming higher high and I would expect the rate to move higher and challenge the resistance of 1.6885 (R1). The MACD lies above both its trigger and zero lines, confirming the recent bullish momentum. In the bigger picture, cable remains within the upward sloping channel, keeping the long-term outlook to the upside.

Support: 1.6820 (S1), 1.6760 (S2), 1.6700 (S3).

Resistance: 1.6885 (R1), 1.7000 (R2), 1.7500 (R3).

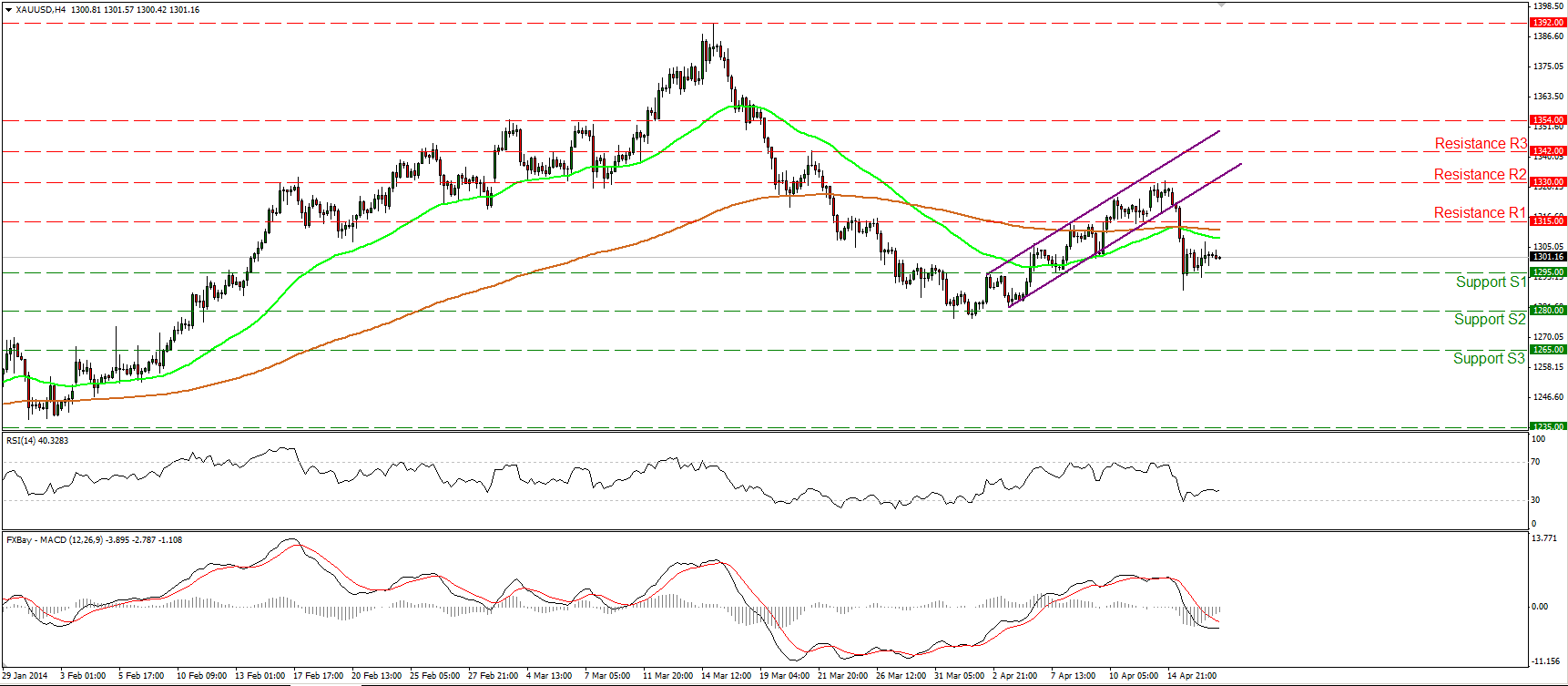

GOLD

Gold moved in a consolidative mode, remaining slightly above the support of 1295 (S1). If the bears are strong enough to drive the battle below 1295 (S1), I would expect them to target the next hurdle at 1280 (S2). The MACD remains below both its trigger and zero lines, keeping the momentum to the downside. As long as the precious metal is trading below both the moving averages and the resistance bar of 1315 (R1), the short-term outlook remains negative.

Support: 1295 (S1), 1280 (S2), 1265 (S3).

Resistance: 1315 (R1), 1330 (R2), 1342 (R3).

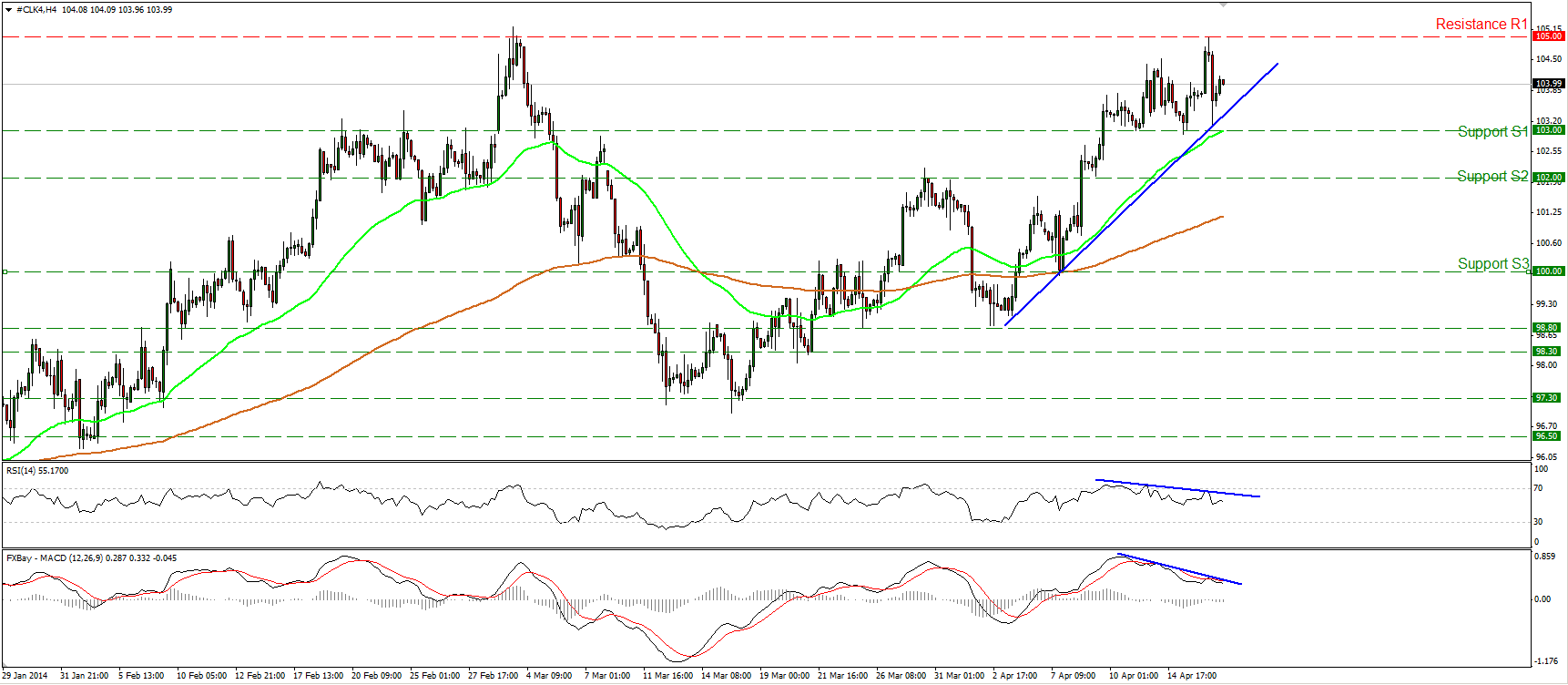

OIL

WTI moved higher to meet the key resistance of 105.00 (R1). This confirms a higher high and keeps the uptrend intact. However, considering that the negative divergence between our momentum studies and the price action remains in effect, and the fact that the last time WTI touched 105.00 (R1) it fell sharply, I would wait for a clear move above that bar to expect further extensions. A move above 105.00 (R1) may have larger bullish implications targeting the 108.00 (R2) area. On the downside, a move below 103.00 (S1), would confirm the aforementioned divergence and may target the 102.00 (S2) bar, first.

Support: 103.00 (S1), 102.00 (S2), 100.00 (S3).

Resistance: 105.00 (R1), 108.00 (R2), 110.00 (R3).

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.