Fear winning out In the perennial battle of fear vs greed, those two great motivating factors in the market, fear seems to have won out temporarily, at least in the stock markets. Stock markets continued to fall yesterday on no particular macroeconomic news, even though Fed Funds expectations continued to retreat (down another 5 bps in the long end). AUD and CAD, two growth currencies, were generally weaker, while all other G10 currencies gained against USD.

Nonetheless this “risk off” episode is different from previous ones in that EM currencies continue to gain, probably on expectations of lower US rates. BRL rose sharply as the Brazilian stock market was one of the few in the world to gain yesterday (+2.1!). TRY and ZAR continued their recent recovery as well. On the other hand, RUB was the big loser among the EM currencies as events in Ukraine heated up again.

The big question for me is when the market will start paying attention to Ukraine again. The country’s leaders yesterday warned that their country was at risk of being torn apart as armed pro-Russian separatist occupied government buildings in three eastern Ukrainian cities, according to the FT. Although Ukraine’s acting president blamed Moscow for the unrest, Russian politicians have avoided suggesting that their country intervene militarily. Nonetheless I think these events warrant our attention, because the initiative may now be with individuals on the ground rather than politicians in the capital, and people on the ground tend not to think of the larger implications of what they do. An ill-thought-out action by a few hotheads could have larger geopolitical implications that would impact the FX market. It strikes me as potentially negative for EUR/USD, although the pair is back above the 1.37 level this morning.

It’s noticeable that despite the weaker dollar, lower interest rate expectations and increasing tensions in Ukraine, gold continues to fall. Although the technical picture remains bullish, fundamentally it looks as if something has changed in investors’ perception. CHF was the best-performing G10 currency overnight, indicating some drive for safe havens, yet apparently gold does not feature very high among those safe-haven assets any more. This contrasts with the behaviour of silver, which gained on the day.

The Bank of Japan Policy Board finished its two-day meeting and refrained from adding any additional stimulus. Also the current account returned to surplus by JPY 613bn in February from the record JPY 1.6trn deficit in January. JPY was higher nonetheless, probably due more to the 1.5% fall in the TOPIX rather than any reaction to the BoJ meeting or the current account figures, which were both as expected. I still expect the BoJ to take some action as the economy slows following the consumption tax hike this month.

During the European day, Switzerland’s unemployment rate for March is forecast to have remained unchanged at 3.2% on a seasonally adjusted basis. From the UK, industrial production is expected to have accelerated to +0.3% mom in February, from +0.1% in January. This indicator can have a substantial effect on GBP, especially when it misses estimates.

In Canada, housing starts for March are forecast at 192k, as in February, while building permits for February are estimated to have declined 2.0% mom, after rising 8.5% in January.

We have four speakers scheduled on Tuesday. Philadelphia Fed President Charles Plosser delivers a keynote speech titled "Enhancing Prudential Standards in Financial Regulations", Minneapolis Fed President Narayana Kocherlakota will deliver a speech to the Rochester Chamber of Commerce, and Chicago Fed President Charles Evans will be speaking at a symposium titled "Managing the Transition to Normality - Implications for Fiscal Policy.” ECB’s Governing Council member Jens Weidmann speaks in Berlin at 20th German Banking Congress Program.

THE MARKET

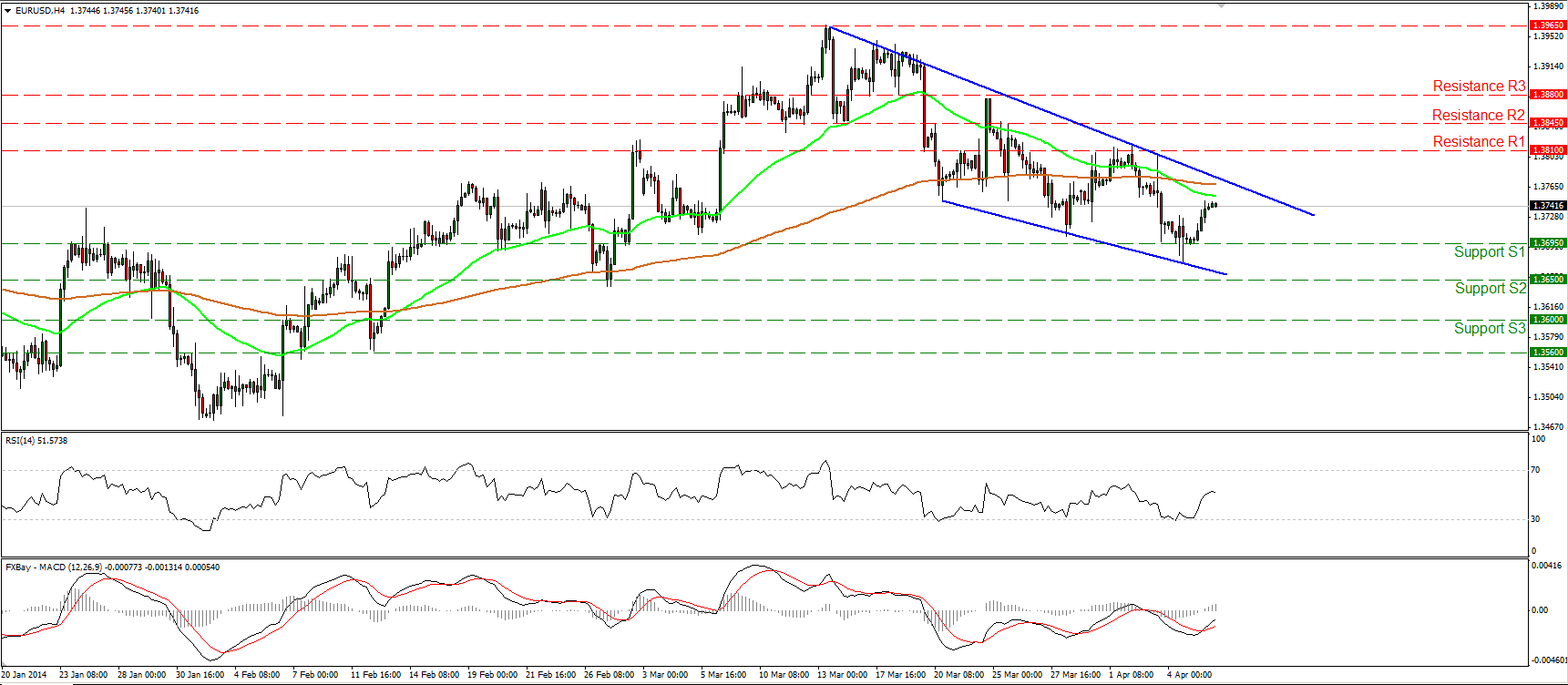

EUR/USD

EUR/USD moved higher on Monday and is trading once again above 1.3700. Nonetheless, since the rate is still trading below both the moving averages and the downtrend line, I would consider the recent advance as a corrective wave and the short-term downside path to be intact. A dip below 1.3695 (S1) would confirm a lower low and will probably challenge the support of 1.3650 (S2).Only a move above the prior high of 1.3810 (R1) could change the outlook of the currency pair.

Support: 1.3695 (S1), 1.3650 (S2), 1.3600 (S3).

Resistance: 1.3810 (R1), 1.3845(R2), 1.3880 (R3).

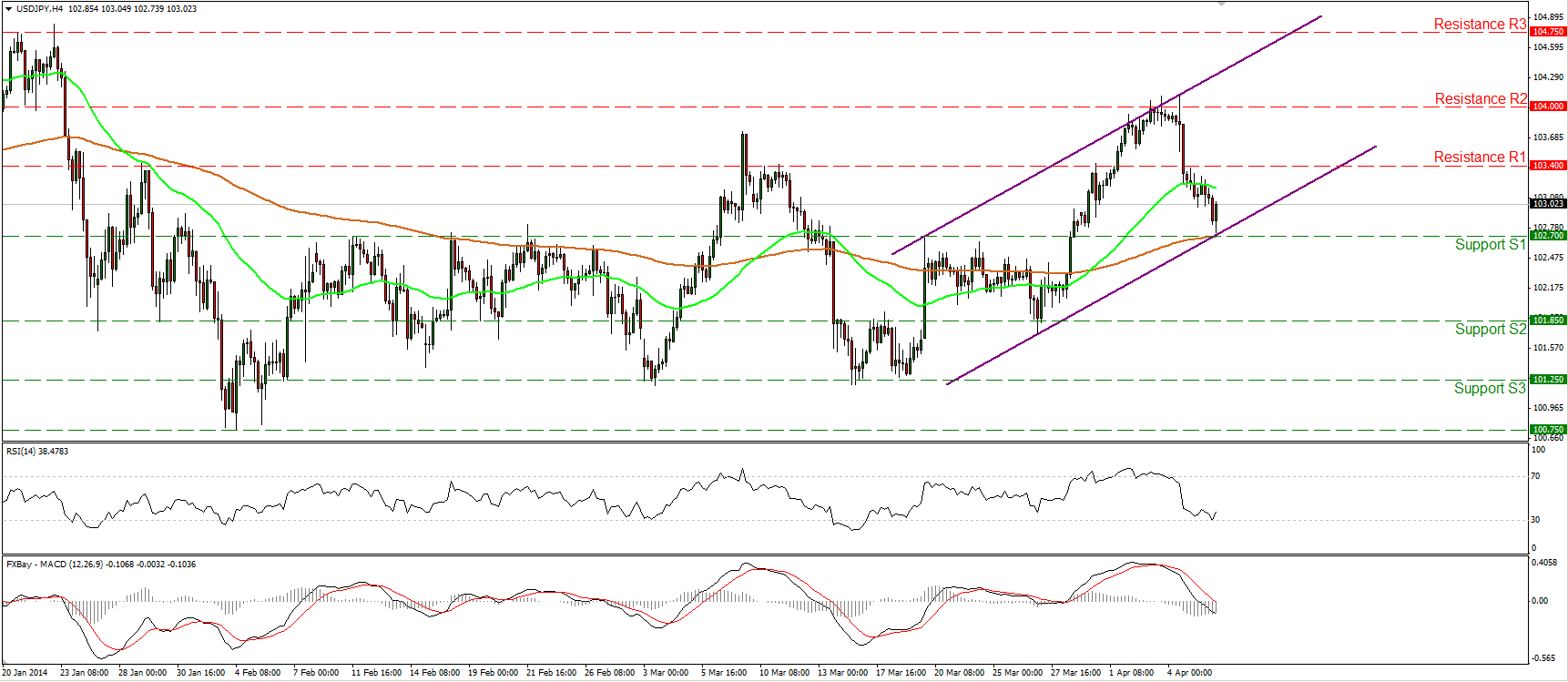

USD/JPY

USD/JPY fell after finding resistance at 104.00 (R2), but the decline was halted slightly above the support of 102.70 (S1) and the 200-period moving average. A rebound near that support zone could challenge the 103.40 (R1) resistance where an upward violation may pave the way for another test at the 104.00 (R2) hurdle. The MACD lies within its negative territory, confirming the recent bearish momentum, but the RSI met support at its 30 level and moved higher, increasing the possibilities for a forthcoming rebound.

Support: 102.70 (S1), 101.85 (S2), 101.25 (S3).

Resistance: 103.40 (R1), 104.00 (R2), 104.75 (R3).

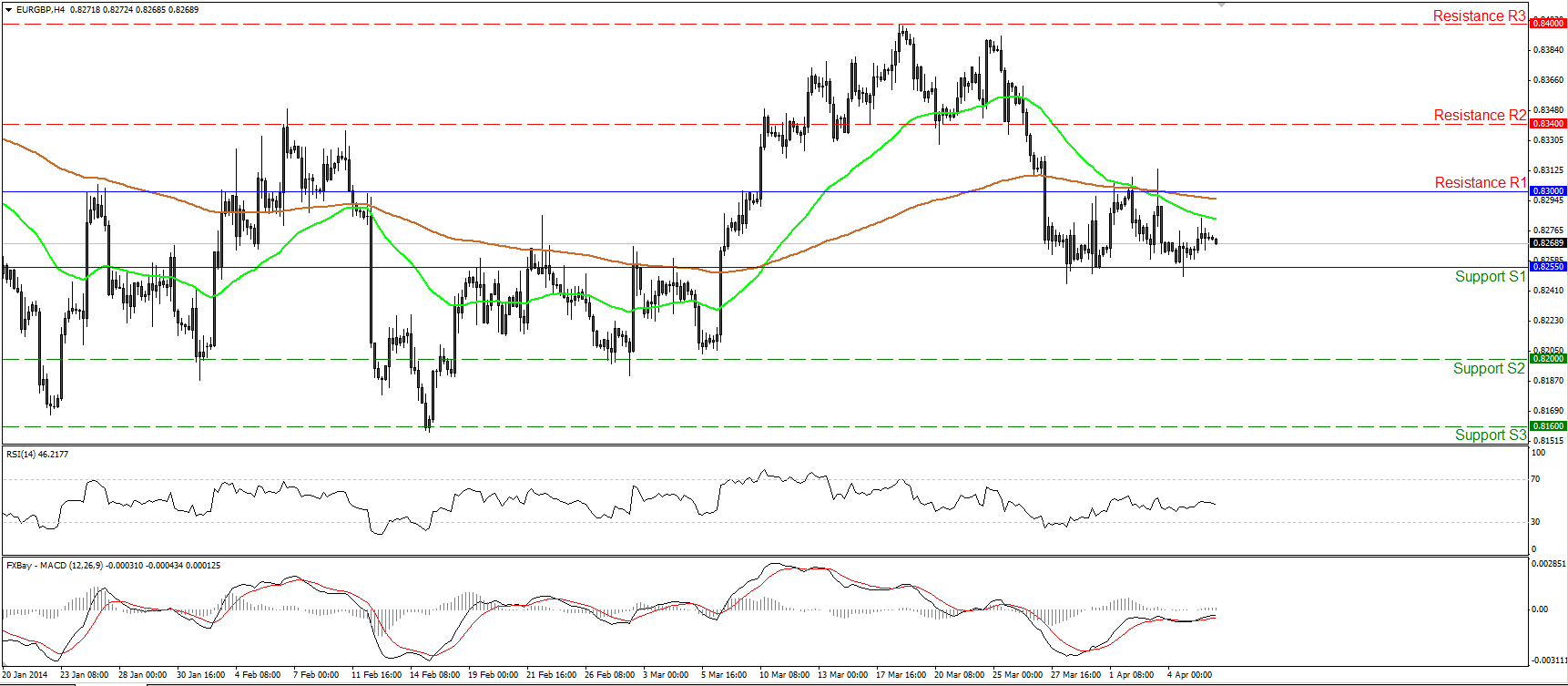

EUR/GBP

EUR/GBP remains within the range between the support of 0.8255 (S1) and the resistance of 0.8300 (R1). The rate met resistance near the 50-period moving average yesterday and moved slightly lower. A clear dip below the support of 0.8255 (S1) may have more bearish implication and open the way towards the next hurdle at 0.8200 (S2). On the upside, a move above the resistance of 0.8300 (R1) may trigger extensions towards the 0.8340 (R2) obstacle. Both the RSI and the MACD are moving in a sideways mode, indicating neutral momentum at the moment.

Support: 0.8255 (S1), 0.8200 (S2), 0.8160 (S3).

Resistance: 0.8300 (R1), 0.8340 (R2), 0.8400 (R3).

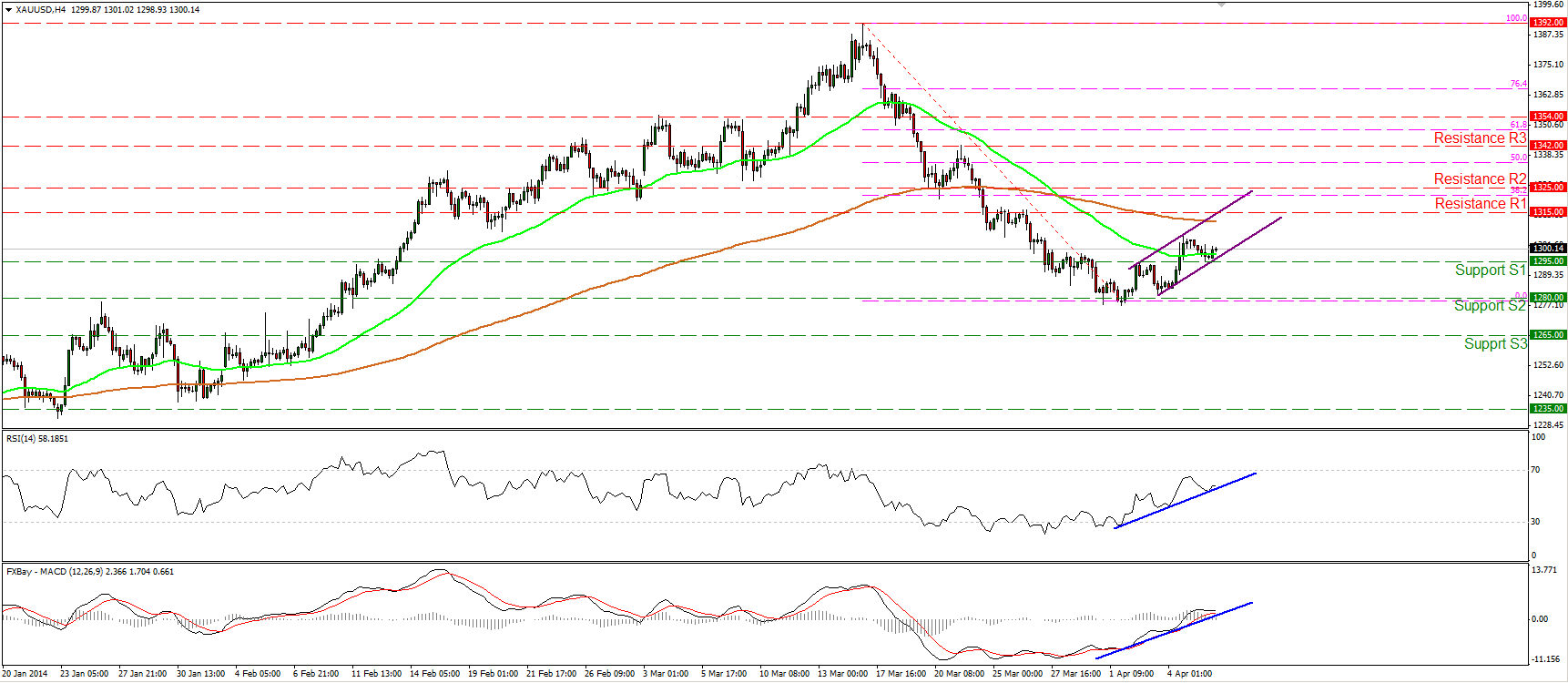

GOLD

Gold moved slightly lower to meet support at the 1295 (S1) hurdle. If the bulls are strong enough to push the precious metal higher I would expect them to target the 1315 (R1) resistance, where a break may see the next one at 1325 (R2), near the 38.2% retracement level of the 17th Mar. - 1st Apr. short-term downtrend. Both our momentum studies follow upward paths, while the MACD lies above both its trigger and zero line, confirming the recent positive momentum of the metal.

Support: 1295 (S1), 1280 (S2), 1265 (S3).

Resistance: 1315 (R1), 1325 (R2), 1342 (R3).

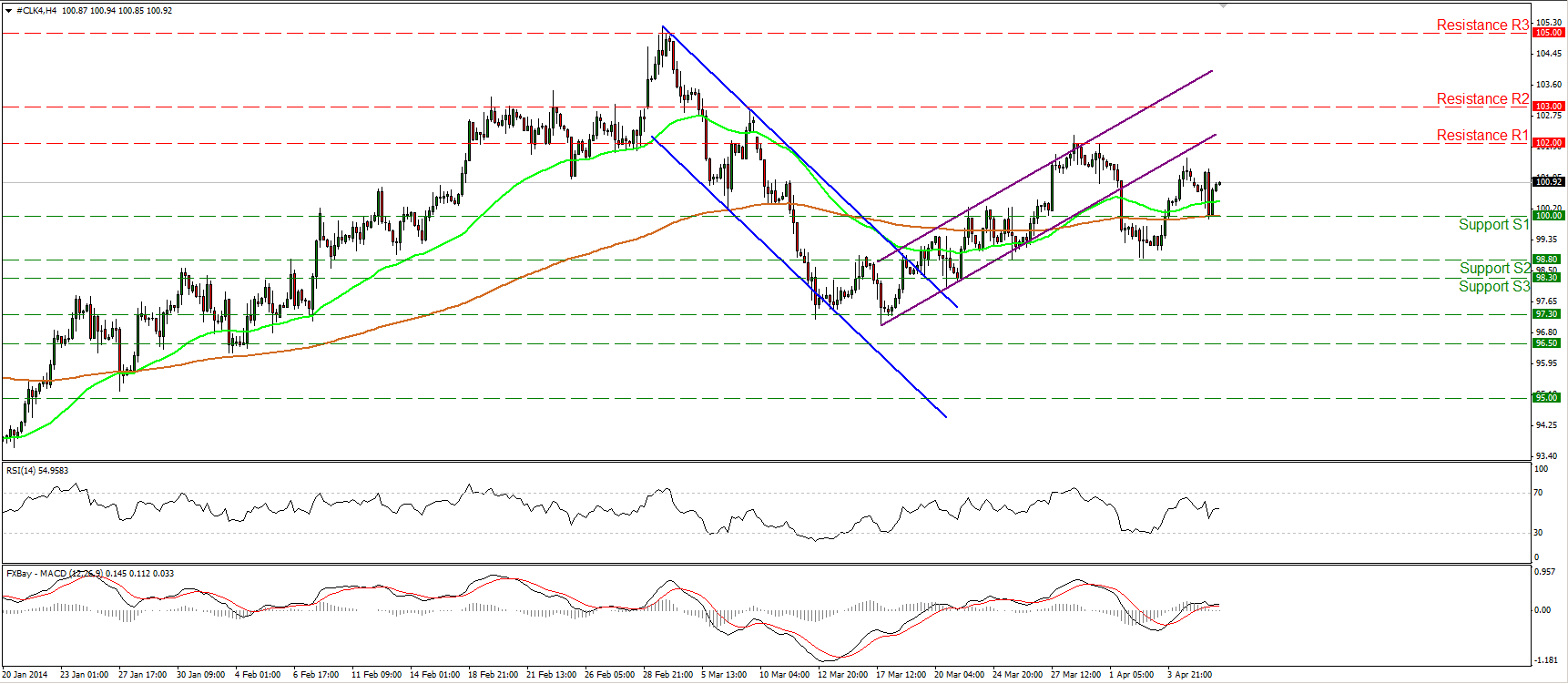

OIL

WTI moved lower but after finding strong support at the 100.00 (S1) key barrier and the 200-period moving average, moved higher. The price remains between the 100.00 (S1) support and the resistance of 102.00 (R1). Both the moving averages are pointing sideways, thus I would maintain my neutral view. A move below the 98.80 (S2) support would confirm a lower low and may turn the picture negative, while a move above 102.00 (R1) may reinforce the prior short-term uptrend.

Support: 100.00 (S1), 98.80 (S2), 98.30 (S3).

Resistance: 102.00 (R1), 103.00 (R2), 105.00 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.