Risk on or risk off? A mixed day during which it was hard to discern a consistent trend. Stocks were lower, US bond yields fell sharply and JPY gained, indicating general risk aversion as European leaders joined US President Obama in warning Russia that it would face further sanctions if it failed to de-escalate the crisis in Ukraine. The auction of US Treasury five-year notes came at a level through the market and saw the lowest dealer takedown in history, indicating significant end-investor demand for the bonds, as Fed Funds expectations retreated nearly 5 bps in the long end, suggesting that the tightening concerns generated by the recent FOMC meeting are fading. Yet gold fell yet again despite the fall in interest rates and the commodity currencies were the biggest gainers among the G10, while most EM currencies gained against USD, which are hardly risk-off trades. Rather confusing!

The euro weakened as next week’s inflation report and ECB meeting are starting to weigh on the common currency. Perhaps the various comments by various officials about the strength of the currency are starting to have an impact. While ECB officials have insisted that the Eurozone isn’t at risk of falling into deflation, in fact that depends on how you measure prices. Many EU countries have had to raise their consumption taxes in order to improve the government’s finances. If we strip out the effect of taxes, then in fact the EU is already in deflation! The harmonized indices of consumer prices at constant tax rates show that both the Eurozone and the European Union as a whole are already suffering from deflation. And the financially troubled countries are suffering particularly badly from deflation on this measure. Higher taxes are not a particularly good way of raising prices – they simply diminish demand from the household sector. That does help to improve the country’s trade balance, but doing so by repressing demand from your voters is not a healthy way to manage the economy. I still expect the ECB to loosen policy further this yeiar in order to deal with this problem.

On Thursday, the Norges Bank decides on its deposit rate. While the market expects no changes in interest rates, the focus will be on the press conference after the decision and any statements about when the Bank will be ready to increase rates. After the last meeting, the krona fell on the Bank’s dovish statement that it was not considering a rate hike until Q4 2015. In September the central bank said it would start raising rates in Q4 2014.

Eurozone’s M3 money supply is forecast to have grown at a +1.3% yoy pace in February, a slight acceleration from +1.2% yoy in January. This will keep the 3-month moving average unchanged at +1.2%. The market will also be watching to see whether the slowdown in the pace of decline of lending and credit creation that we saw in January continues.

French consumer confidence for March is expected to remain at 85, while Italy’s business confidence for the same month is forecast to rise to 99.5 from 99.1.

In the UK, the Bank of England publishes the statement from its March 19 Financial Policy Committee meeting. Meanwhile UK retail sales excluding autos are forecast to have risen +0.3% mom in February, a turnaround from -1.5% mom in January. That would be positive for the GBP.

From the US, we have the third estimate of GDP for Q4 which is expected to be revised up to +2.7% qoq SAAR from the second estimate of +2.4% qoq. Initial jobless claims for the week ended on March 22 are expected to be up at 324k vs 320k the previous week. Nonetheless, this will bring the 4-week moving average down to 321k from 327k. Pending home sales for February are forecast to have accelerated to +0.2% mom from +0.1% mom in January. All in all this would be solid news that should give USD a boost.

During the European day, Cleveland Fed President Sandra Pianalto, ECB Governing Council member Erkki Liikanen and ECB Governing Council Member Carlos Costa will speak.

THE MARKET

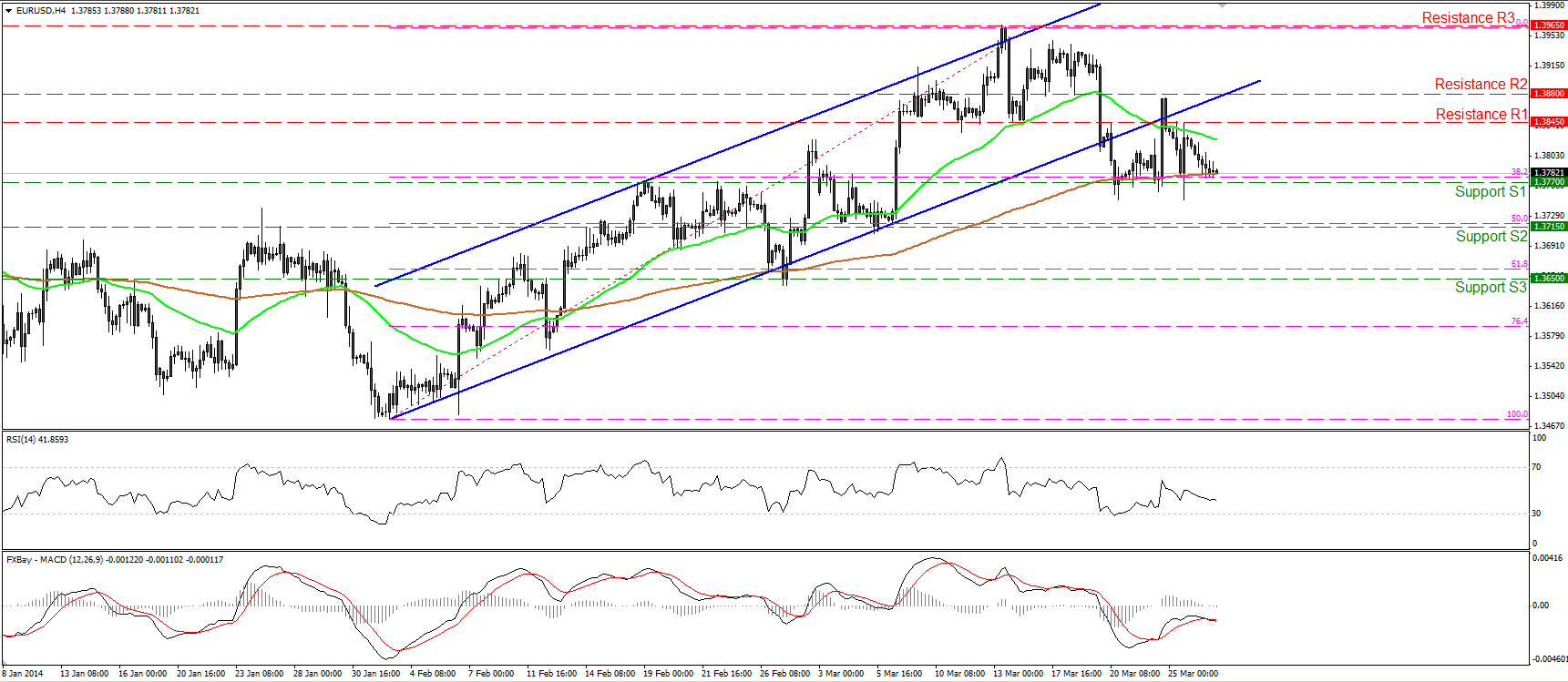

EUR/USD

EUR/USD moved lower and is once again near the 1.3770 (S1) support and the 200-period moving average. A clear dip below the aforementioned support zone would confirm a forthcoming lower low and may trigger extensions towards the next support at 1.3715 (S2), near the 50% retracement level of the 3rd Feb. – 13th Mar. short-term uptrend. On the other hand, an upward violation of the 1.3965 (R3) resistance may confirm that the recent decline was just a 38.2% retracement of the prevailing uptrend.

Support: 1.3770 (S1), 1.3715 (S2), 1.3650 (S3).

Resistance: 1.3845 (R1), 1.3880 (R2), 1.3965 (R3).

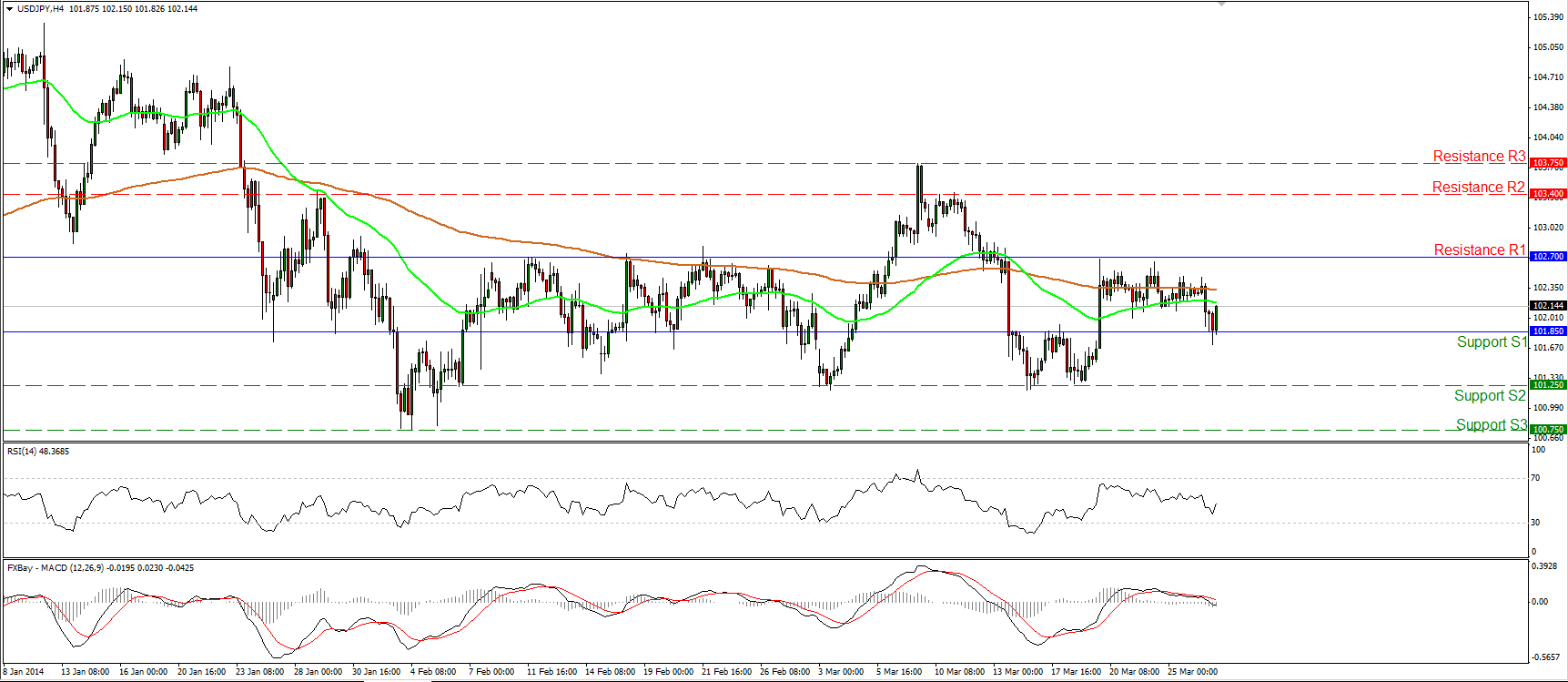

USD/JPY

USD/JPY moved lower but met support at the 101.85 (S1) bar and moved higher. The rebound may challenge the resistance of 102.70 (R1). Nonetheless, the overall outlook of the currency pair remains neutral, since the rate is trading between those boundaries since the 20th of March. Both the moving averages are pointing sideways, while on the daily chart, both the daily MACD and the daily RSI lie near their neutral levels, confirming the sideways path of the currency pair.

Support: 101.85 (S1), 101.25 (S2), 100.75 (S3).

Resistance: 102.70 (R1), 103.40 (R2), 103.75 (R3).

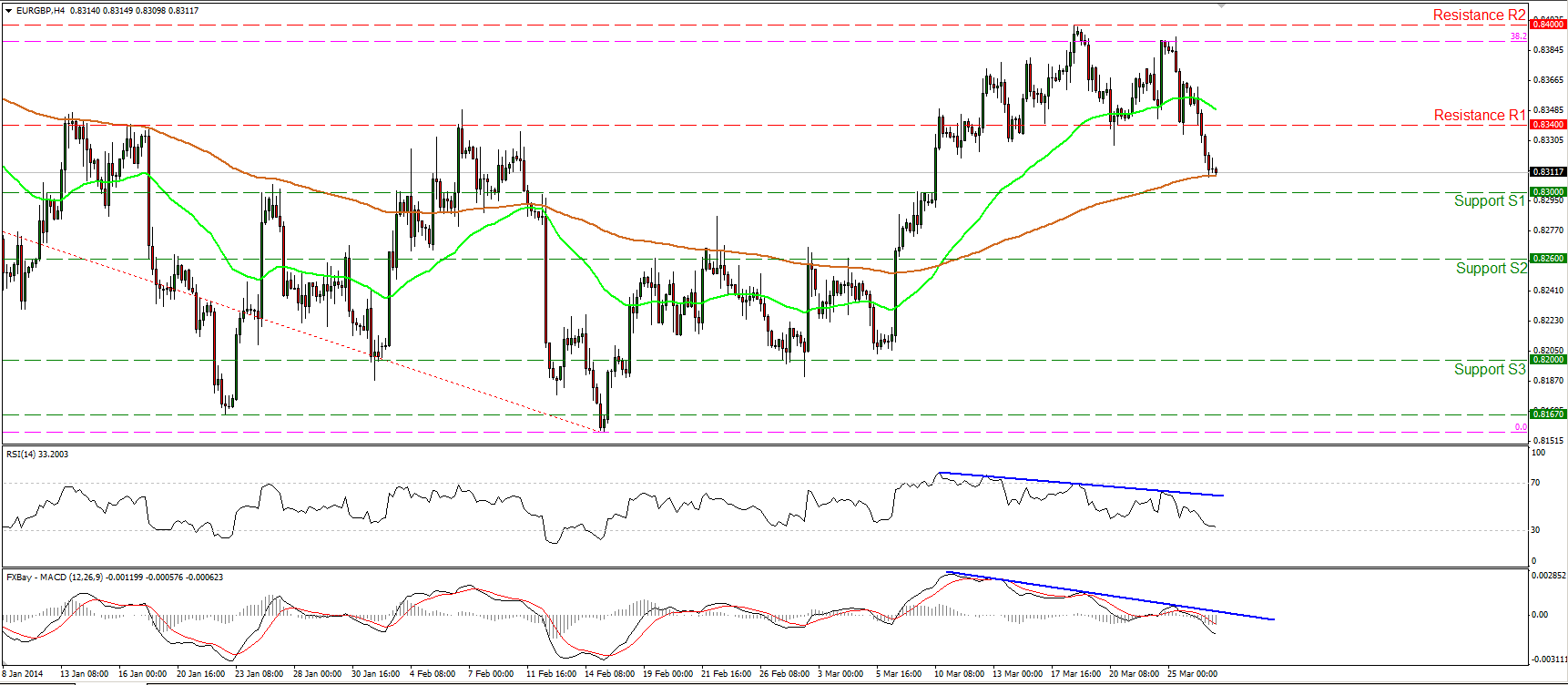

EUR/GBP

EUR/GBP fell below the 0.8340 barrier, completing a possible double top formation. The rate is now trading slightly above the 0.8300 (S1) support and a clear break below it may extend the decline and challenge the next support bar at 0.8260 (S2). Both our momentum studies continue their downward paths, while the MACD lies below both its signal and zero lines, confirming the recent bearish momentum.

Support: 0.8300 (S1), 0.8260 (S2), 0.8200 (S3).

Resistance: 0.8340 (R1), 0.8400 (R2), 0.8460 (R3).

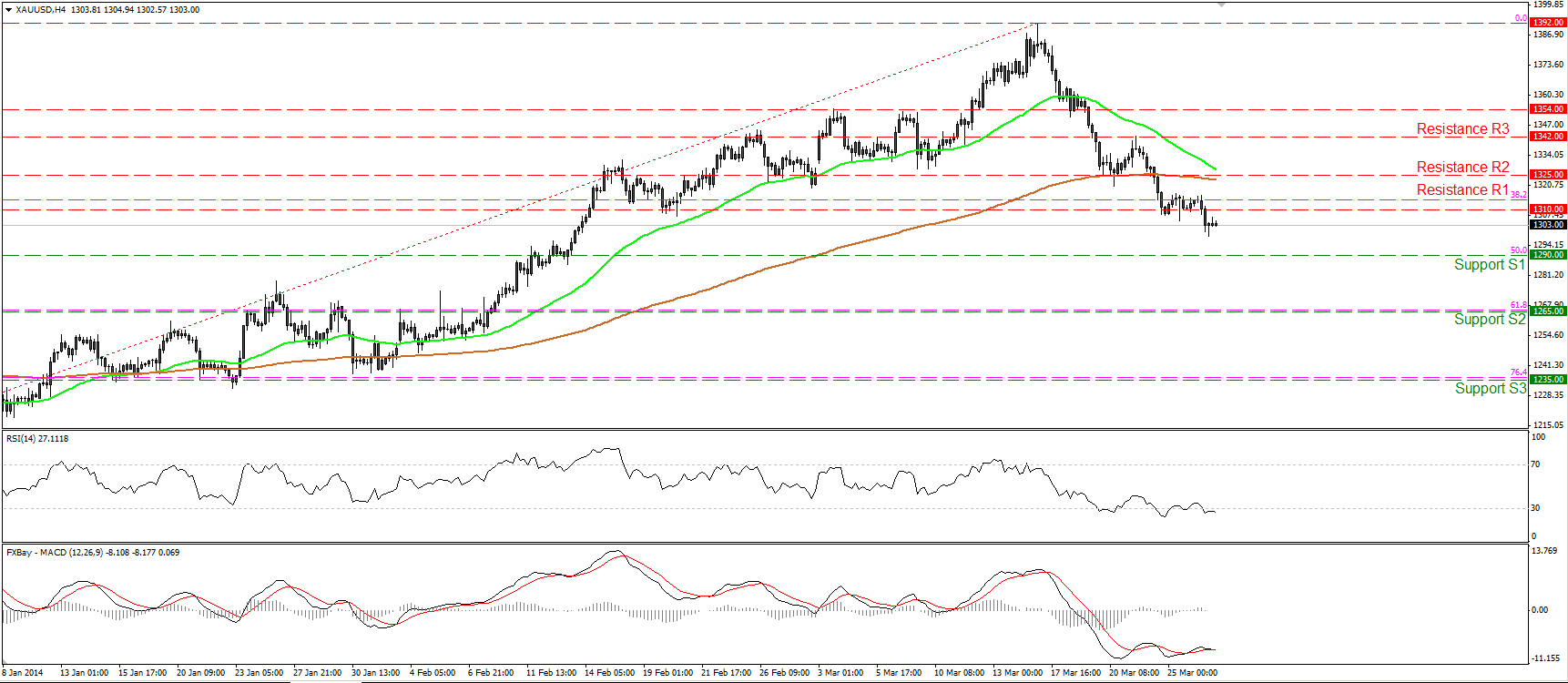

GOLD

Gold fell below the 1310 hurdle on Wednesday. If the bears are strong enough to maintain the price below that bar, I would expect them to challenge the support at 1290 (S2), which coincides with the 50% retracement level of the 20th Dec. - 14th Mar. advance. The 50-period moving average is getting closer to the 200-period one and a bearish cross in the near future would be an additional negative indication. As long as the metal is printing lower highs and lower lows below both the moving averages, the short term outlook remains to the downside.

Support: 1310 (S1), 1290 (S2), 1265 (S3).

Resistance: 1325 (R1), 1342 (R2), 1354 (R3).

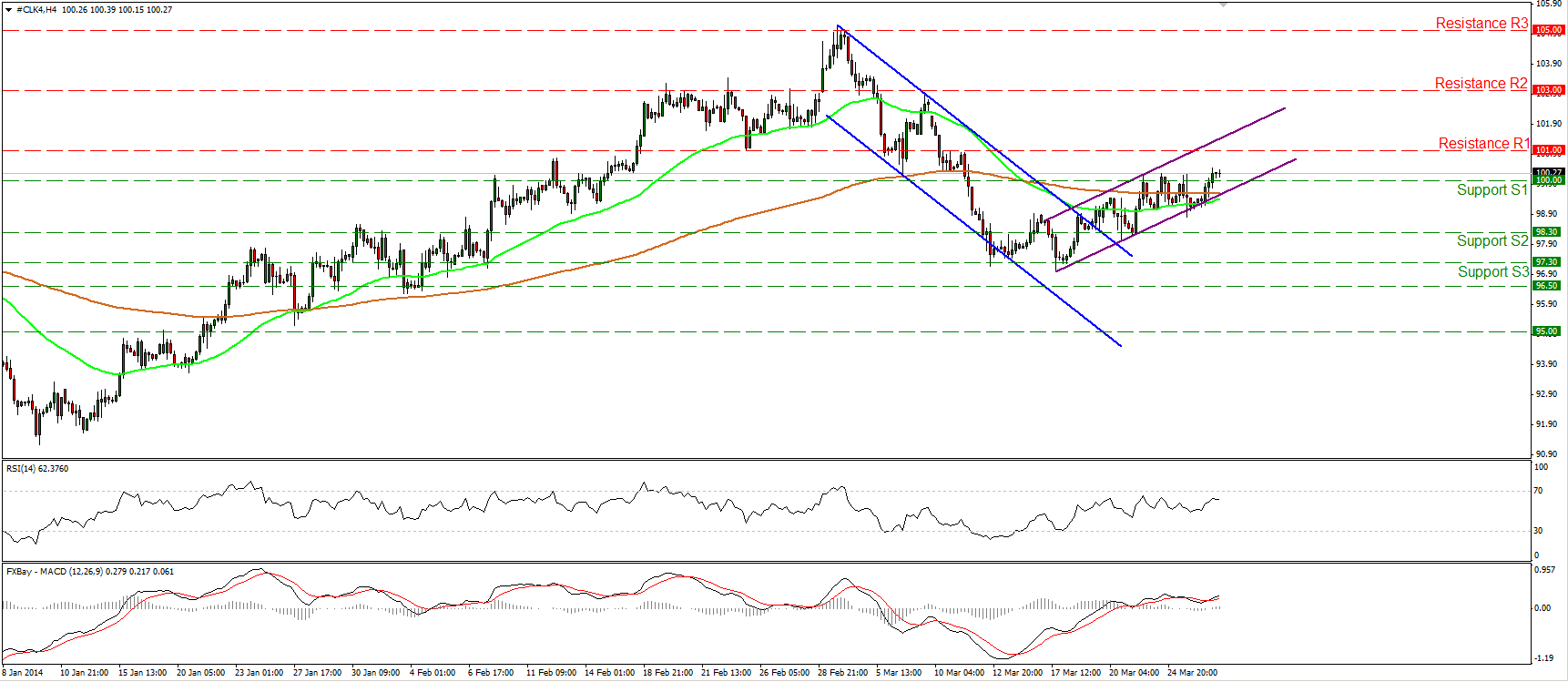

OIL

WTI moved higher and managed to emerge above the 100.00 barrier. I would expect the price to continue its advance and challenge the resistance hurdle of 101.00. The MACD, already in its bullish territory, crossed above its trigger line, confirming the upside momentum of the price action. As long as WTI is trading within the purple upward sloping channel, the short-term picture remains positive.

Support: 100.00 (S1), 98.30 (S2), 97.30 (S3).

Resistance: 101.00 (R1), 103.00 (R2), 105.00 (R3).

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.