The dollar is generally stronger against the G10 currencies this morning, the main exception being the two safe-haven currencies, JPY and CHF. Their gains come against the background of sharp falls in stock markets on Friday that continued this morning in Asia. The rout in emerging market currencies also contributed to the flight to safety as most of the EM currencies that we track depreciated against the dollar, with the RUB and ZAR falling again by more than 1% and the INR not far behind. EM CDS rates were generally wider as well, which suggests that investors are worried about the impact of the FX market movements on the economies of these countries. Gold also benefitted from the insecurity, but silver and the other precious metals failed to gain.

Japan’s trade deficit in December was narrower than expected on a seasonally adjusted basis, but this was probably due to imports being lower than expected; exports also missed expectations. The country had a record trade deficit for 2013 nearly double that of the previous year (JPY 11.5tn vs JPY 6.9tn). Imports have now exceeded the level of before the financial crisis, but exports are still only 81% of their previous peak. While market turmoil may temporarily cause short-covering in short JPY positions, I believe the fundamentally weak trade position of Japan is likely to undermine the yen over the longer term. The problems facing EM countries as the Fed tapers and EM currencies weaken presents another headwind for Japan. Many of Japan’s major markets are EM countries: China (#1 export market for Japan), South Korea (#3), Thailand (#4), Singapore (#6), Indonesia (#7), Malaysia (#9).

For today, the main item in the European agenda is the German Ifo survey for January. All the business climate, expectations and the current assessment indices are expected to have risen from December. Positive sentiment in Eurozone’s engine might be an extra boost for EUR/USD. From the US, new home sales for December are forecast to have continued declining, but at a slower pace than in November, while the Dallas Fed manufacturing survey for January is forecast to rise modestly.

As for the speakers, ECB’s Constancio and BoE’s Cunliffe speak at a conference and ECB’s Jens Weidmann speaks in Stuttgart

For the rest of the week, the spotlight will be the FOMC meeting that ends on Wednesday. The market expects the Fed officials to continue scaling back their bond purchases by another USD 10bn. There is no press conference scheduled for after the meeting, so initially the statement will be all that we have to go on. Subsequent speeches by Fed officials will therefore be a major point of interest afterwards. There is also an RBNZ meeting the same day; a few economists think that they may raise rates, but most don’t. Assuming that they do decide to continue with their tapering, I would expect the dollar to rebound somewhat, because there apparently are some market participants who are assuming that they won’t (10yr Treasury yields are down 16 bps since the Dec. 18th FOCM meeting).

On Tuesday, UK releases its preliminary GDP for Q4. From US, durable goods orders for December, the S&P/Case-Shiller home price index for November, the Conference board consumer confidence index for January and the Richmond Fed manufacturing survey for the same month, are coming out. On Wednesday, we have the UK Nationwide house price index for January and Eurozone’s M3 for December. On Thursday, HBSC publishes the final Chinese manufacturing PMI for January. This is the figure that upset markets so much last Thursday when the preliminary version came out so there is likely to be a lot of attention paid to it. From Germany we get the unemployment rate and the preliminary CPI, both for January. The German CPI is a major indicator as inflation in the Eurozone falls sharply. ECB President Draghi has dismissed fears of deflation, but the market will still be sensitive to any further declines. From the UK, mortgage approvals for December are coming out. From Eurozone, we have the final consumer confidence for January and from US, the preliminary GDP figures for Q4. Finally, on Friday, during the Asian morning, we have the usual end-of-month data dump from Japan. From Eurozone, the unemployment rate for December and the preliminary CPI data for January are due out. In US, we have the personal income and spending for December and the University of Michigan final consumer sentiment for the current month. Elsewhere, Norway releases its unemployment rate for January and Canada its GDP for November.

THE MARKET

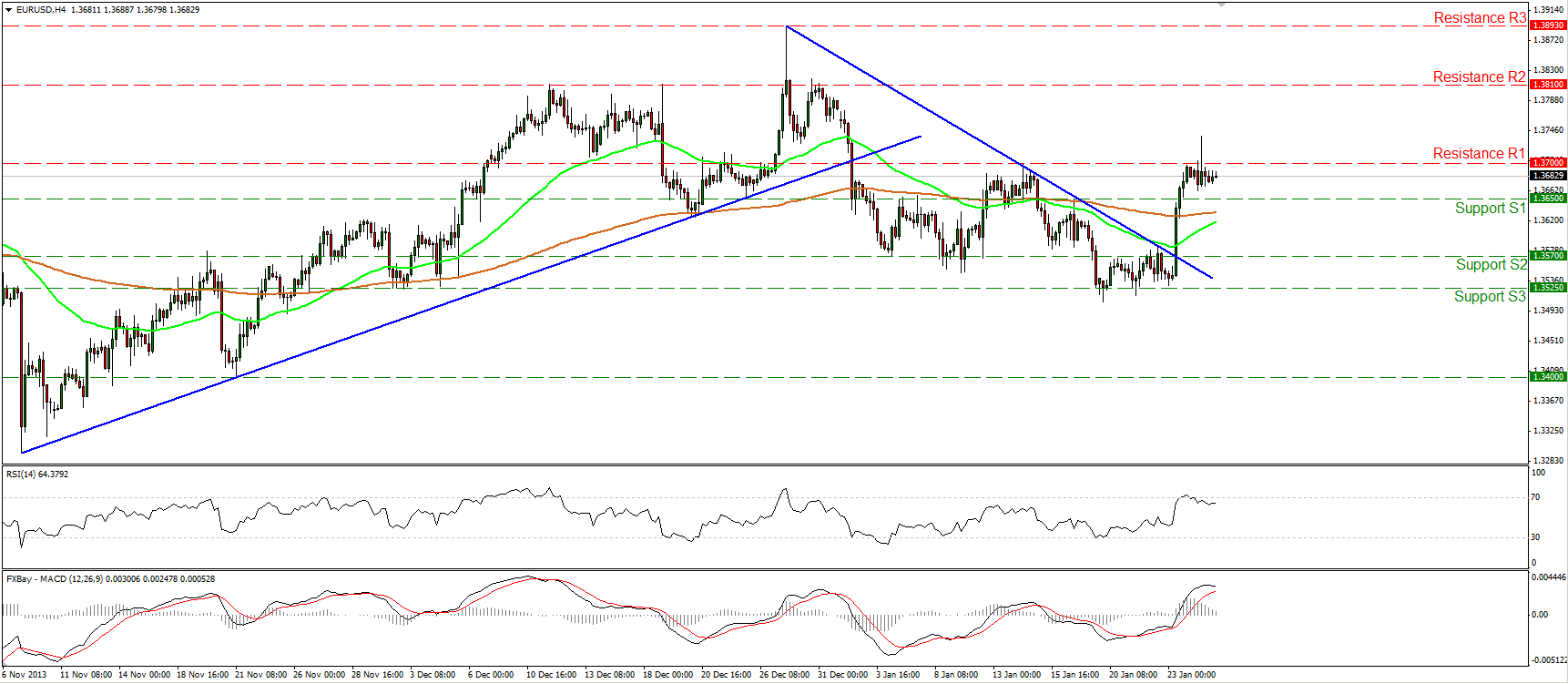

EUR/USD

EUR/USD tried to overcome the 1.3700 (R1) resistance on Friday, but the longs were not strong enough to maintain the rate above the barrier. The pair now consolidates below that hurdle and if the German Ifo Survey for January comes out better than in December (as estimated), then I would expect another attempt for the violation of the aforementioned resistance. A clear break may open the way towards 1.3810 (R2). Alternatively, a dip below 1.3650 (S1) may result in a challenge once again of the support area between the 1.3525 (S3) and 1.3570 (S2) barriers.

Support: 1.3650 (S1), 1.3570 (S2), 1.3525 (S3).

Resistance: 1.3700 (R1), 1.3810 (R2), 1.3893 (R3).

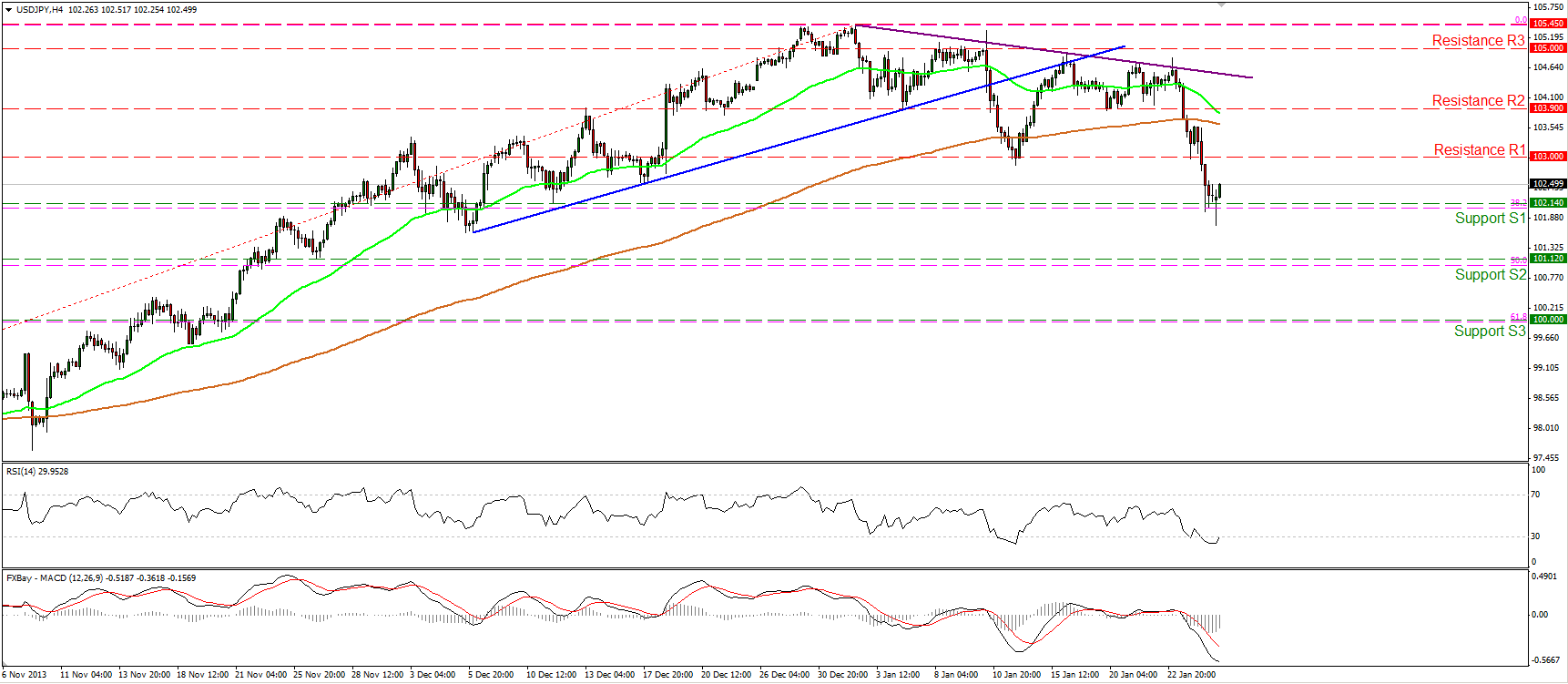

USD/JPY

USD/JPY fell below the 103.00 level and reached the support barrier of 102.14 (S1), near the 38.2% Fibonacci retracement level of the prevailing uptrend. If selling pressure continues pushing the price lower, a downward penetration of the 102.14 (S1) support may extend the move towards 101.12 (S2), near the 50% retracement level of the prior advance. Nonetheless, since the RSI seems ready to exit the oversold zone, we may experience an upward corrective wave, maybe to test once again the 103.00 (R1) level as a resistance this time. The 50-period moving average is getting closer to the 200-period moving average, thus a bearish crossover in the near future may enhance the negative outlook.

Support: 102.14 (S1), 101.12 (S2), 100.00 (S3).

Resistance: 103.00 (R1), 103.90 (R2), 105.00 (R3).

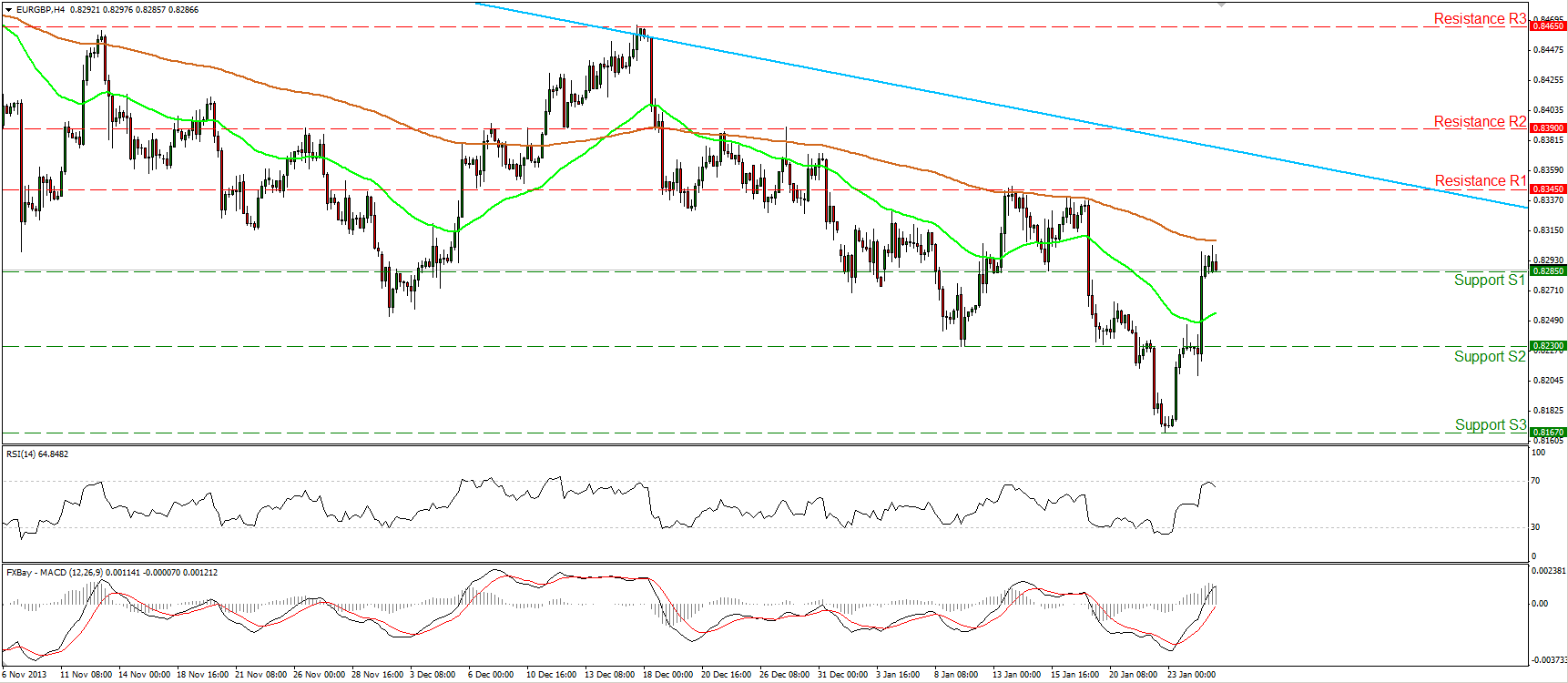

EUR/GBP

EUR/GBP surged on Friday after BoE Governor Carney said that the appreciation of sterling may hamper the exports of UK. The pair violated to the upside the 0.8230 obstacle, driving the action above the next barrier at 0.8285, slightly below the 200-period moving average. A good Ifo release may push the price higher and target the next resistance at 0.8345 (R1). The MACD oscillator lies above both its zero and signal lines, confirming the recent bullish momentum. My only concern is that the RSI found resistance at its 70 level and the price is still trading below the 200-period moving average.

Support: 0.8285 (S1), 0.8230 (S2), 0.8167(S3).

Resistance: 0.8345 (R1), 0.8390 (R2), 0.8465 (R3).

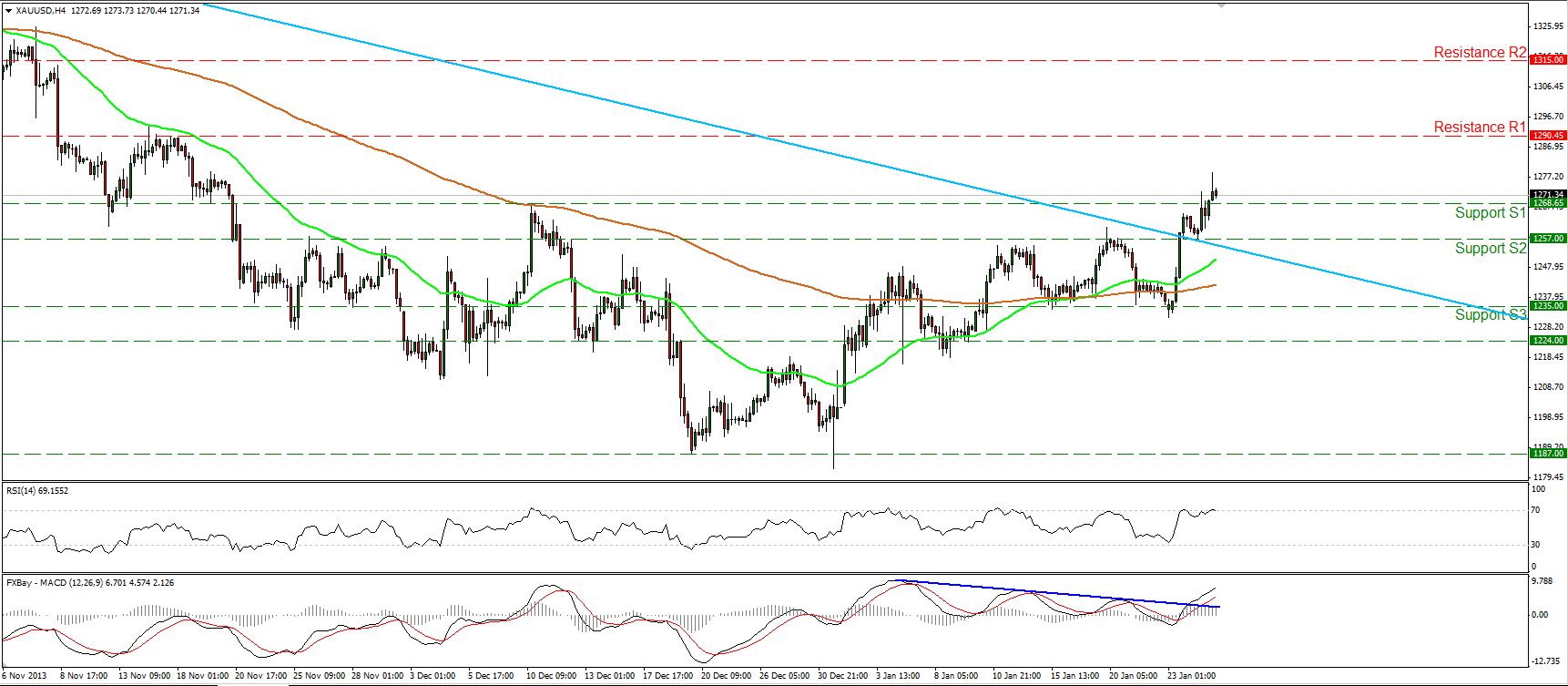

GOLD

Gold tested the longer term downtrend line (light-blue line) as a support and moved higher, breaking above the 1268 hurdle. The picture remains positive and I would expect the metal to challenge the resistance of 1290 (R1). The MACD remains above both its trigger and zero line, indicating that the momentum is to the upside. The RSI is still finding resistance near its 70 level, thus further consolidation or a pullback cannot be ruled out.

Support: 1268 (S1), 1257 (S2), 1235 (S3).

Resistance: 1290 (R1), 1315 (R2), 1340 (R3).

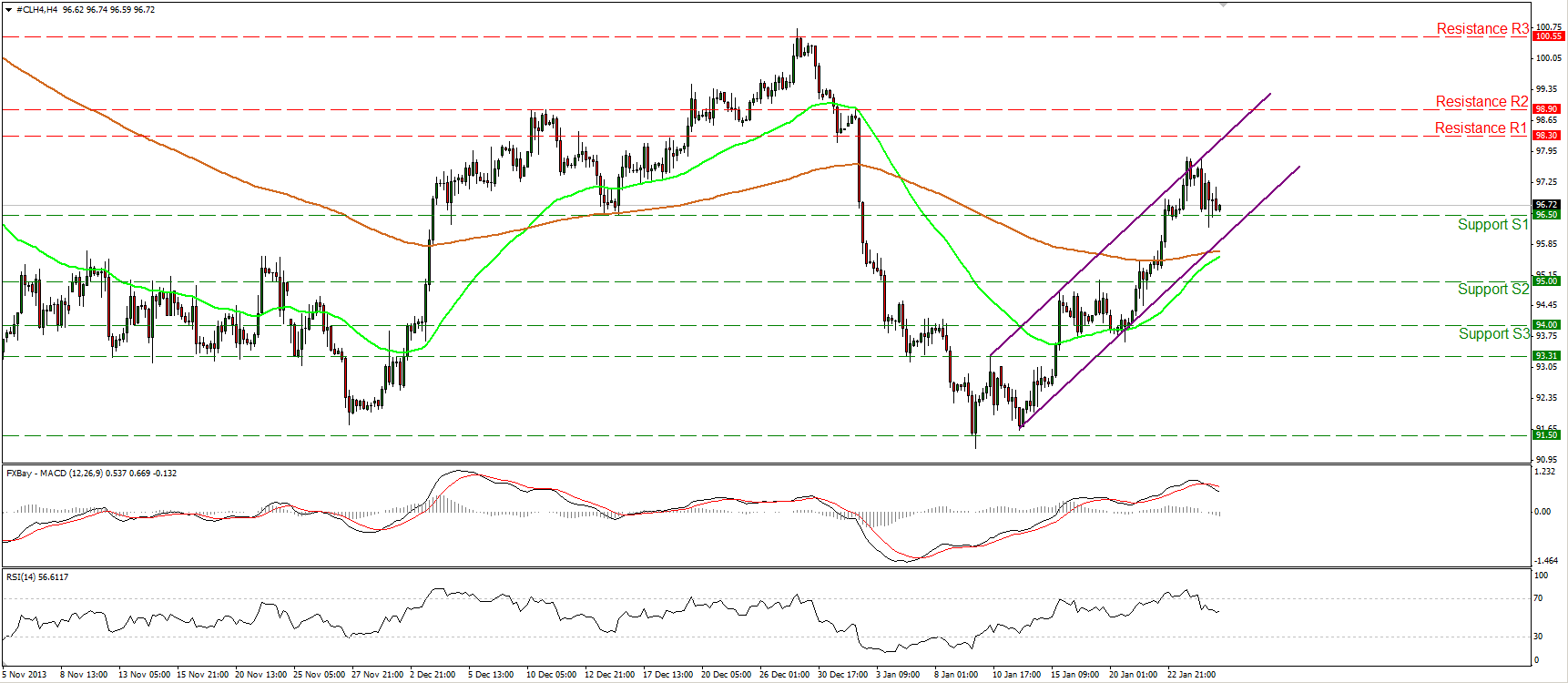

OIL

WTI moved lower after finding resistance near the upper boundary of the purple upward sloping channel and is currently trading slightly above the barrier of 96.50 (S1). I still expect WTI to advance and challenge the resistance barrier of 98.30 (R1). The 50-period moving average is pretty close to the 200-period moving average and a bullish cross may be an additional confirmation of WTI’s positive picture. As long as the price is trading above both the moving averages and since it is printing higher lows and higher highs within the purple upward sloping channel, the near-term outlook remains bullish.

Support: 96.50 (S1), 95.00 (S2), 94.00 (S3).

Resistance: 98.30 (R1), 98.90 (R2), 100.55 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.