Analysis for July 24th, 2014

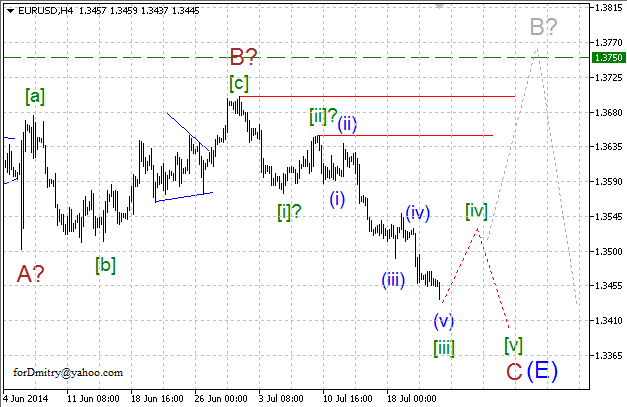

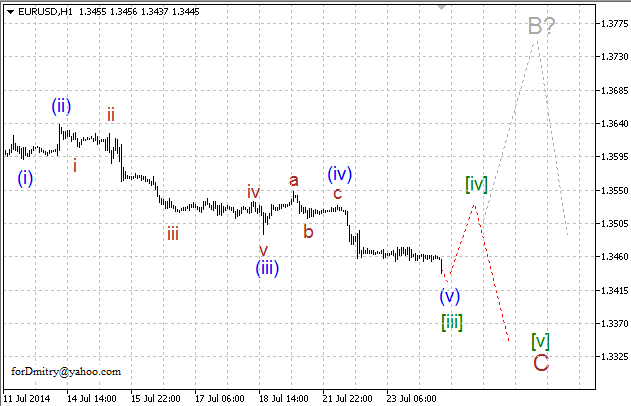

EUR USD, “Euro vs US Dollar”

Probably, Euro finished ascending zigzag (D) of [B]. In this case, price is expected to continue forming final descending zigzag (E) of [B]. However, alternative scenario (colored in grey) may still continue.

Probably, price is forming final descending zigzag (E). It looks like Euro completed ascending correction B of (E) and right now is finishing impulse [iii] of C of final descending wave C of (E), which may be followed by ascending correction [iv] of C.

Possibly, pair is forming descending wave C, which may take the form of impulse. In this case, price is expected to complete impulse [iii] of C and start forming ascending correction [iv] of C. However, one should remember that structure of impulse C might yet be changed.

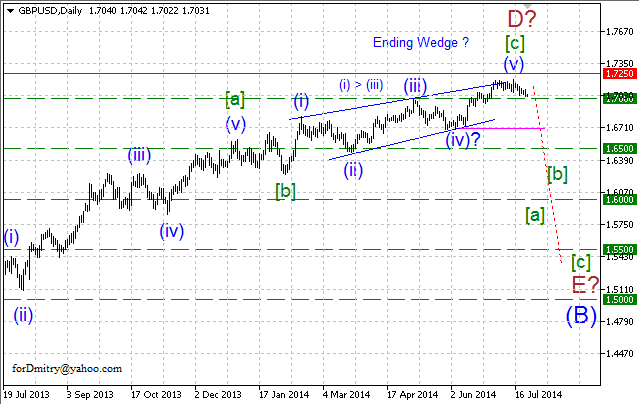

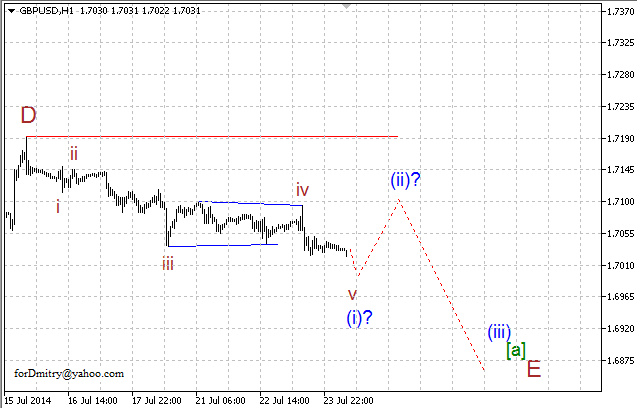

GBP USD, “Great Britain Pound vs US Dollar”

Probably, Pound completed final wedge [c] of D of ascending zigzag D of (B) of large skewed triangle (B), which may be followed by final descending zigzag E of (B).

Possibly, price finished ascending impulse (v) of [c] of D of (B) of large skewed triangle (B), which may be followed by final descending zigzag [a]-[b]-[c] of E of (B).

Probably, price completed ascending wave D. If this assumption is correct, then pair is expected to continue falling down inside descending zigzag E without breaking the closest critical level.

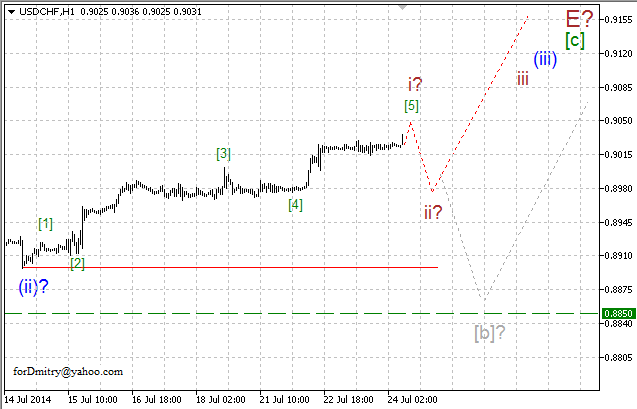

USD CHF, “US Dollar vs Swiss Franc”

Probably, Franc completed descending zigzag D of (4). If this assumption is correct, price is expected to continue forming final ascending zigzag E of (4). However, alternative scenario (colored in grey) may still continue.

Probably, price is forming final ascending zigzag E. Right now, Franc is forming its final ascending wave [c] of E.

Possibly, pair is forming final ascending wave [c] of E, which may take the form of impulse. In this case, price is expected to continue growing up inside impulse (iii) of [c]. However, one should remember that structure of impulse [c] might yet be changed.

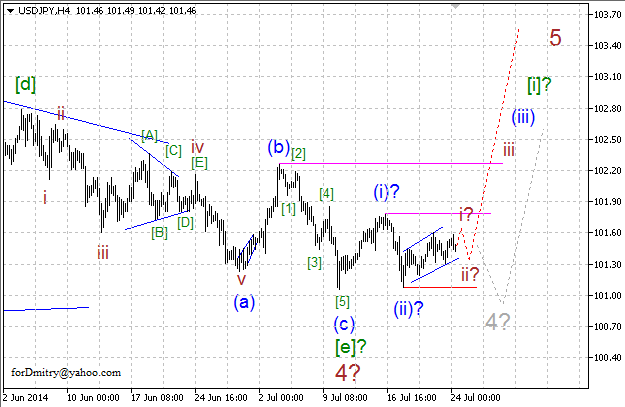

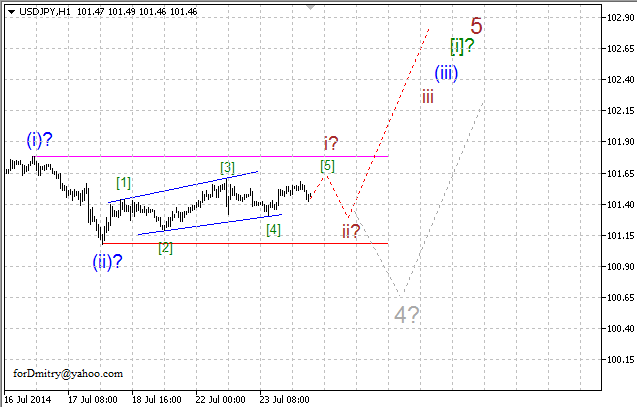

USD JPY, “US Dollar vs Japanese Yen”

Probably, Yen finished long horizontal correction 4 of (A). In this case, later price is expected to start final ascending movement inside wave 5 of (A).

Probably, pair finished descending zigzag [e] of 4 and the whole horizontal triangle 4. In this case, price is expected to start ascending wave 5.

Possibly, price is forming ascending wave 5, which may take the form of impulse. If this assumption is correct, pair is expected to continue growing up inside impulse (iii) of [i] of 5 without breaking the closest critical level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.