Taken positions

AUD/NZD: long at 1.0950, target 1.1300, stop-loss 1.0830, risk factor **

AUD/JPY: long at 88.30, target 91.00, profit locked in at 88.60, risk factor **

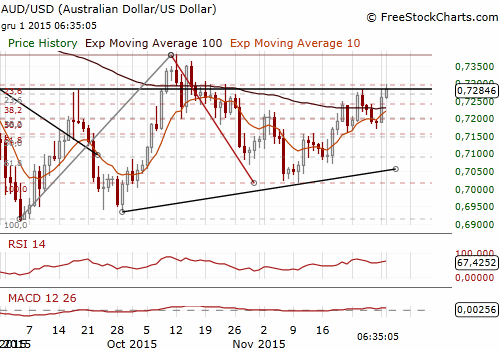

AUD/USD: RBA On Hold, As Expected

(stay sideways)

Australia's central bank kept interest rates steady for a seventh month today, as expected.

RBA Governor Glenn Stevens said: “The Board again judged that the prospects for an improvement in economic conditions had firmed a little over recent months and that leaving the cash rate unchanged was appropriate.” He added that while the local economy is suffering from lower priced commodities, falling terms of trade and low capital investment, the economy is slowly transitioning to non-mining-led growth.

Policymakers have been encouraged by signs of recovery ranging from strong employment to better business sentiment and a big boost to tourism from a low local dollar.

Data due on Wednesday (0:30 GMT) should show the economy regained some momentum in the third quarter after a lacklustre second quarter. Net exports alone likely added an eye-popping 1.5 percentage points to growth - their biggest contribution since early 2009 - as export volumes jumped 5% while imports fell 2%. The contribution from trade helped offset a drag from government investment which dropped over 9% in the third quarter from the previous three months, partly due to a fall in defence spending.

After strong trade data we have raised our third-quarter GDP forecast to 0.8% qoq, above the market consensus of 0.7% qoq.

Supporting activity has been a boom in home building which looks to have some time to run yet. Approvals to build new homes surprised by rising 3.9% October, with approvals for multi-unit blocks were up almost 30% on a year ago.

Interbank futures still imply around a 50-50 chance of an easing next year, with the RBA's next meeting in early February. In our opinion the likelihood of another rate cut is very low. We assume that the next interest rate change in Australia will be a hike.

The RBA decision supported the AUD. We keep our constructive view on the AUD. We have locked in profit on our AUD/JPY long at 88.60. We have used today’s fall in the AUD/USD to open long position at 1.0950. But we stay sideways on the AUD/USD because of broad USD strength.

Significant technical analysis levels:

Resistance: 0.7307 (high Oct 19), 0.7337 (high Oct 16), 0.7363 (high Oct 15)

Support: 0.7223 (low Dec 1), 0.7171 (low Nov 30), 0.7160 (low Nov 23)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns. Gold confirmed a symmetrical triangle breakdown on 4H but defends 50-SMA support.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.