GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: (Full Content - VIP Subscription Only)

GBP/JPY: (Full Content - VIP Subscription Only)

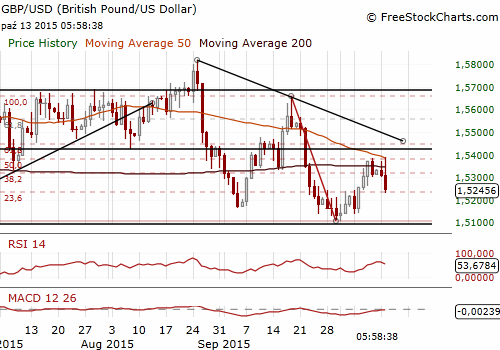

GBP/USD: long at 1.5275, target 1.5440, stop-loss 1.5190, risk factor *

Pending Orders:

USD/JPY: (Full Content - VIP Subscription Only)

USD/CAD: (Full Content - VIP Subscription Only)

AUD/USD: (Full Content - VIP Subscription Only)

NZD/USD: (Full Content - VIP Subscription Only)

EUR/GBP: (Full Content - VIP Subscription Only)

EUR/JPY: (Full Content - VIP Subscription Only)

EUR/CHF: (Full Content - VIP Subscription Only)

AUD/NZD: (Full Content - VIP Subscription Only)

AUD/JPY: (Full Content - VIP Subscription Only)

GBP/USD: Negative British CPI Is An Opportunity To Get Long

(long at 1.5275)

The Office for National Statistics said British consumer price inflation dropped to an annual rate of -0.1%, below market expectations for it to hold unchanged at zero, and along with April the lowest reading since March 1960.

A measure of core consumer price inflation, which strips out changes in the price of energy, food, alcohol and tobacco, held at 1.0% compared with expectations for it to rise slightly to 1.1%.

There was a sharp split between price changes for goods, many of which rely on imports, and services, where costs are more heavily influenced by British rates of pay. Goods prices showed their biggest annual drop on record, falling by 2.4%on the year, while the rate of services inflation picked up to its fastest since October 2014.

Factory gate prices down 1.8% yoy, as forecast and vs. -1.9% yoy in August.

The ONS also released figures for August house price inflation, which showed a 5.2% annual rise across the United Kingdom as a whole unchanged from July.

Unlike policymakers in the Eurozone, the Bank of England is relatively unconcerned about the risk of persistent price falls leading to deflation due to robust consumer demand and rising domestic wages.

Another negative inflation reading in not a big surprise as recent lower oil and commodity prices had risks skewed to the negative. We used a fall in the GBP/USD after the data to get long at 1.5275. We are waiting for tomorrow’s British jobs report. We think British pay growth will likely accelerate faster than expected by consensus. Based on the ongoing tightening in the UK labor market, we expect the BoE to adopt a less dovish stance sooner than the market anticipates. Recent rises in oil prices may also change medium-term inflation outlook soon despite today’s negative reading. The target of our long is 1.5440, just below 61.8% retracement of 1.5659-1.5107 fall.

Significant technical analysis' levels:

Resistance: 1.5388 (session high Oct 14), 1.5400 (psychological level), 1.5448 (61.8% fibo of 1.5659-1.5107)

Support: 1.5223 (low Oct 7), 1.5141 (low Oct 6), 1.5130 (low Oct 5)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.