Taken Positions

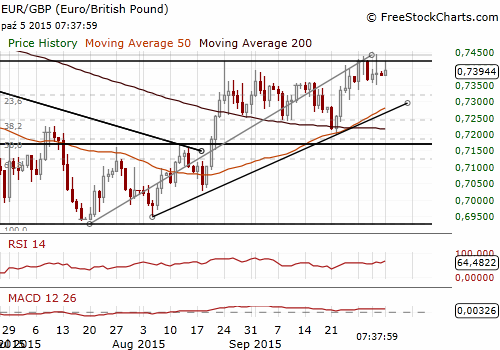

EUR/GBP: short at 0.7435, target 0.7290, profit locked in at 0.7430, risk factor *

More profitable strategies - GrowthAces VIP Subscription Only

EUR/GBP: All Eyes On BoE This Week

(short at 0.7435)

British services PMI fell for the third month in succession to 53.3, from August’s 55.6, indicating the weakest rate of growth since April 2013. PMI showed some firms reported hesitation among clients in placing new contracts, linked to global economic uncertainty. The forward-looking indicator for business expectations fell to a 13-month low in September, but still signaled solid overall growth. What is important, employment at service providers rose at a stronger rate in September.

PMI data indicate that GDP growth slowed to 0.5% in the third quarter, but that the economy is entering the fourth quarter at a pace down to just 0.3%. At the moment, sustained strong hiring in services and construction suggests that companies are generally expecting the slowdown to be short-lived.

The GBP/USD reaction to weaker US non-farm payrolls on Friday was limited, as we expected. Expectations for a Fed hike are strongly correlated to expectations for a BoE hike, so weaker US data mean later monetary tightening in the UK. The EUR/USD reaction was much stronger and as a result the EUR/GBP went up on Friday and we used this jump to go short at 0.7435.

This could be an important week for the GBP traders. On Thursday, October 8, the BoE announces its monetary policy decision and publishes the minutes of its meeting. We expect no change in policy. However, the minutes are likely to be significantly “less dovish” than the market is expecting – see our yesterday’s The Week Ahead for a rationale. Relatively hawkish minutes should support our short EUR/GBP position.

Significant technical analysis' levels:

Resistance: 0.7442 (high Oct 2), 0.7482 (high May 7), 0.7510 (high Feb 5)

Support: 0.7371 (10-dma), 0.7350 (low Oct 2), 0.7348 (38.2% of 0.7197-0.7442)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0600 as focus shifts to Powell speech

EUR/USD fluctuates in a narrow range above 1.0600 on Tuesday as the better-than-expected Economic Sentiment data from Germany helps the Euro hold its ground. Fed Chairman Powell will speak on the policy outlook later in the day.

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

Gold price remains depressed near $2,370 amid bullish USD, lacks follow-through selling

Gold price (XAU/USD) attracts some sellers during the early part of the European session on Tuesday and reverses a major part of the overnight recovery gains from the $2,325-2,324 area, or a multi-day low.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

Canada CPI Preview: Inflation expected to accelerate in March, snapping two-month downtrend

The Canadian Consumer Price Index is seen gathering some upside traction in March. The BoC deems risks to the inflation outlook to be balanced. The Canadian Dollar navigates five-month lows against the US Dollar.