GROWTHACES.COM Forex Trading Strategies

Trading Positions

EUR/USD trading strategy: long at 1.1200, target 1.1450, stop-loss 1.1090

GBP/USD trading strategy: long at 1.5400, target 1.5580, stop-loss 1.5330

AUD/USD trading strategy: long at 0.7805, target 0.8020, stop-loss 0.7710

EUR/CHF trading strategy: long at 1.0690, target 1.0990, stop-loss 1.0590

EUR/JPY trading strategy: long at 133.55, target 136.00, stop-loss 132.30

GBP/JPY trading strategy: long at 183.60, target 186.60, stop-loss 182.20

Pending Orders

USD/CAD trading strategy: sell at 1.2530, if filled - target 1.2320, stop-loss 1.2630, risk factor **

NZD/USD trading strategy: buy at 0.7525, if filled - target 0.7700 stop-loss 0.7425, risk factor **

AUD/JPY trading strategy: buy at 92.55, if filled - target 94.80, stop-loss 91.40, risk factor **

EUR/USD: Get Long, Watch German CPI and U.S. GDP

(long for 1.1450)

Fed policymaker Richard Fisher, who will step down next month and will not take part in the next rate-setting meeting, said: “I would rather tighten sooner and slower than later and sharper.” In his opinion the Fed is not spending much time discussing the strength of the USD at its meetings. The recent rise in the USD has led some in the market to question whether the Fed will push ahead with a hike in interest rates.

Federal Reserve Bank of Cleveland President Loretta Mester (non-voting) repeats June as possible timing for rate-hike liftoff. Mester predicts an increase in inflation in the short term.

St. Louis Fed President James Bullard, a hawkish policymaker who does not have a rotating vote on policy until next year, said: “There is a disconnect between markets and the Fed and that is going to be reconciled at some point. And I am a little bit concerned that one day markets will wake up and reprice everything”.

San Francisco Fed President John Williams said the Federal Reserve would probably start raising interest rates "sometime this summer, or this fall" as inflation bottoms out and begins to recover. He expects the USA to reach full employment by the end of this year and inflation to rise in the latter half of 2015, reaching 2% by the end of next year.

We got a lot of comments from the Fed policymakers yesterday but the most important is the opinion of John Williams, a voting FOMC member. This opinion was, however, the most dovish one and it suggests that we should expect interest rates hikes in the USA rather later than sooner due to dovish FOMC composition this year.

U.S. orders for durable goods increased 2.8% in January after declines of 3.7% in December and 2.2% in November. Excluding transportation, orders showed a more modest gain of 0.3% mom in January. GDP growth for the October-December period will be revised today. The market expects economic growth to be revised down to 2.1% from the initial estimate of 2.6%, but we expect growth to be even lower due to lower contribution from foreign trade.

U.S. CPI fell 0.7% mom and 0.1% yoy in January vs. a rise by 0.8% yoy in December. Core prices, which exclude food and energy, rose 0.2% mom and 1.6% yoy vs. an increase by 1.6% yoy in December. Excessively low inflation is another factor complicating the Fed's decision on when to begin raising interest rates.

The EUR/USD fell surprisingly to 1.1184 yesterday despite strong reasons for such a move. We should watch today’s German preliminary CPI (13:00 GMT) knowing that German state CPIs were higher than expected. Investors will be focused also on a revision in U.S. GDP growth (13:30 GMT).

Our previous EUR/USD long reached the stop-loss level at the entry point (1.1325). We got long again at 1.1200 and set the target at 1.1450.

Significant technical analysis' levels:

Resistance: 1.1335 (10-dma), 1.1350 (21-dma), 1.1380 (high Feb 26)

Support: 1.1184 (low Feb 26), 1.1098 (low Jan 26), 1.1047 (low Sep 8, 2003)

USD/JPY: Japan's Core Inflation Below Forecasts

(we stay sideways)

Japan's core inflation, which includes oil products but excludes fresh food prices, amounted to 2.2% yoy in January. The reading was lower than the median estimate for a 2.3% yoy. The so-called core-core inflation index, which excludes food and energy prices and is similar to the core index used in the USA, rose 2.1% yoy in January.

Japan's industrial output grew a seasonally adjusted 4.0% mom in January vs. the median forecast for a growth by 2.7% mom and a rise by 1.0% mom in December.

Japanese retail sales fell 2.0% yoy in January, more than the median estimate of a 1.3% yoy decline. Japanese household spending fell 5.1% yoy, more than the median forecast for a 4.1% yoy fall.

The unemployment rate rose to 3.6% in January from 3.4% in the previous month. The jobs-to-applicants ratio was 1.14 in January. This was unchanged from December, which was the highest since March 1992.

Japanese Prime Minister Shinzo Abe said the government may further delay another sales tax increase if an unexpected event such as another global financial crisis or a huge earthquake occurs. The government had initially planned a second tax increase for October this year, but recently postponed it to April 2017 due to the weak economy

Bank of Japan Governor Haruhiko Kuroda defended his two-year timeframe for achieving his ambitious inflation target, warning that adopting a relaxed approach to the deadline would undermine efforts to break the country out of the shackles of deflation. Kuroda also pushed back against a proposal, made by members of a key government panel, to set a new fiscal discipline target focusing more on boosting economic growth than on spending cuts. Japan's current target is to return to a primary budget surplus, excluding debt servicing costs and income from bond sales, in fiscal 2020 through tax hikes and spending cuts.

The USD/JPY rose well above 119.00 due to the USD strengthening. Japanese macroeconomic figures had low impact on the JPY. Our trading strategy is to stay sideways, but we maintain our medium-term bullish outlook for the USD/JPY.

Significant technical analysis' levels:

Resistance: 119.51 (high Feb 26), 119.84 (high Feb 24), 120.00 (psychological level)

Support: 119.00 (psychological level), 118.68 (low Feb 26), 118.62 (low Feb 25)

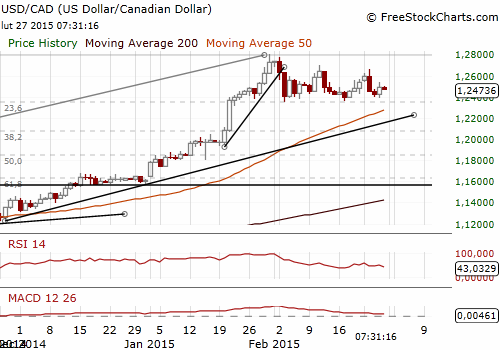

USD/CAD Went Up Despite Lowering Chances For BoC Cut Next Week

(profit taken, get short again at 1.2530)

Canada’s CPI fell to 1% yoy in January from 1.5% yoy in December. The reading was higher than the median of market forecasts of 0.7% yoy. January's rate was the lowest since an annualized 0.9% yoy in November 2013. Core inflation, which strips out volatile items and is closely watched by the Bank of Canada, remained steady at 2.2% yoy. Gasoline prices slumped 26.9% yoy, steeper than December's 16.6% yoy drop.

Investors are pricing in a less than 30% probability that the Bank Of Canada will lower rates again when it meets next week. The market is converging to our forecast that the Bank Of Canada will keep interest rates unchanged.

Despite higher-than-expected CPI and lowering expectations for a rate cut in Canada the CAD depreciated yesterday against the USD and the USD/CAD reached the stop-loss of our short position at 1.2480. However, we took profit on this position taken at 1.2620.

Our trading strategy is to sell the USD/CAD again. We placed the order at 1.2530. If it is filled the target will be 1.2320, just above the strong support of 1.2310 (daily low on January 22). In our opinion the target may be reached next week if the BoC does not change rates.

Significant technical analysis' levels:

Resistance: 1.2535 (high Feb 25), 1.2600 (psychological level), 1.2662 (high Feb 24)

Support: 1.2388 (low Feb 26), 1.2360 (low Feb 17), 1.2353 (low Feb 3)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.