GROWTHACES.COM Pending Orders:

USD/JPY trading strategy: sell at 119.20, if filled target 116.60, stop-loss 120.00

USD/CAD trading strategy: buy at 1.2270, if filled target 1.2720, stop-loss 1.2170

EUR/USD At Its Lowest Since September 2003

(we stay sideways)

The European Central Bank decided to launch a plan to buy investment-grade government bonds. Total asset purchases will amount to EUR 60 bn per month, starting in March 2015 and continuing until at least September 2016.

The EUR 60 bn also includes the purchases of covered bonds and ABS, so the purchases of government bonds, agency and European institutions debt will be probably around EUR 55bn. Purchases of debt of European institutions will amount to 12% of the additional purchases announced yesterday. After considering the above mentioned facts we see that purchases of government bonds will amount to about EUR 50 bn, which is in line with the size that was expected by the market.

The ECB left the programme open-ended and said the purchases would in any case be conducted until the central bank sees a sustained adjustment in the path of inflation towards price stability.

ECB President Mario Draghi said the ECB will be pari passu with other creditors. The purchases of securities issued by euro area governments and agencies will be based on the National Central Banks’ shares in the ECB’s capital key. Mario Draghi said 20% of the asset purchases would be subject to risk-sharing, suggesting the bulk of any potential losses will fall on national central banks.

Although the size of the QE was at the high end of market expectations, the EUR/USD fell significantly and hit its lowest since September 2003. The EUR is set for another trial as global markets await snap Greek elections on Sunday.

The QE programme has been already a history for forex investors and the market will be looking ahead for new events. We are still the opinion that the weak EUR will give a strong boost to the Euro zone economy and better macroeconomic figures will convince investors to buy the EUR again soon. We expect also some corrective moves on profit taking.

Euro zone flash PMI readings were released today. Euro zone PMI composite rose to 52.2 from 51.4 in December, according to the flash estimate. The reading beat expectations for 51.8. Services PMI went up to 52.3 from 51.6, beating forecasts for 52.0, while the factory PMI rose as expected to 51.0 from 50.6. PMIs pointed to first-quarter growth of 0.2%.

The recent slump in oil prices was a major factor behind the first drop in companies’ input costs since May 2013. Firms’ selling prices consequently fell at the fastest rate since February 2010 as lower costs were passed on to customers. The employment index edged up slightly, but it remains consistent with almost no growth in employment.

The strongest upturn was again seen outside of France and Germany. German index rose slightly more than expected, from 52.0 to 52.6, suggesting that the recovery there has resumed. The French index fell from 49.7 to 49.5, implying that the Euro zone’s second largest economy remains at risk of recession.

The first regular FOMC meeting of the year is scheduled for next week. We do not expect any policy action and any major changes in wording. The discussion will most likely focus on the inflation outlook, especially after significant strengthening of the USD and a fall of oil prices. On Friday of next week, the Bureau of Economic Analysis will release its advance estimate for U.S. GDP growth in the fourth quarter. The median forecast is at the level of 3.3% vs. growth by 5.0% in the third quarter.

Due to still strong bearish EUR/USD sentiment we withdrew our EUR/USD buy order from 1.1230 and EUR/CHF buy order from 0.9810 and stay sideways waiting for lower markets volatility.

Significant technical analysis' levels:

Resistance: 1.1247 (hourly high, Jan 23), 1.1291 (hourly high, Jan 23), 1.1356 (hourly high Jan 23)

Support: 1.1115 (session low, Jan 23), 1.1100 (psychological level), 1.1047 (low Sep 8, 2003)

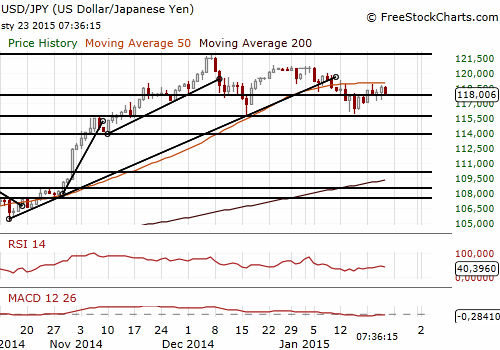

USD/JPY: Looking To Get Short On Upticks

(sell at 119.20)

Japan's government upgraded its view of industrial production and left unchanged its overall economic assessment of moderate recovery as the economy rebounds from a surprise recession last year. The report said industrial production is recovering, reflecting manufacturers' optimistic forecasts for increased production in December and January. The Cabinet Office raised its assessment of the housing market, saying it is stabilising. Housing starts and apartment sales plunged last year after the government raised the nationwide sales tax in April.

PMI index for manufacturing sector was released today. It rose to a seasonally adjusted 52.1 in January from a final 52.0 in December, as domestic and overseas orders picked up. The index remained above the 50 threshold that separates contraction from expansion for the eighth consecutive month.

Japanese Economics Minister Akira Amari said he expects annual wage negotiations between companies and labour unions this spring will lead to a gain in real wages. Amari said in a speech at a seminar that it is important to have a positive economic cycle where rising corporate profits are used to increase salaries and capital expenditure.

Bank of Japan Governor Haruhiko Kuroda said he was not worried that diverging monetary policies in the United States and Europe will complicate his efforts to beat deflation in Japan. In his opinion this action by the European Central Bank will eliminate deflation in the Euro zone and boost growth, which is positive for Japanese economy.

Significant technical analysis' levels:

Resistance: 118.82 (session high, Jan 22), 118.87 (high Jan 20), 119.31 (high Jan 12)

Support: 117.18 (low Jan 21), 116.93 (low Jan 19), 115.85 (low Jan 14)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.