GROWTHACES.COM Forex Trading Strategies:

Taken Positions:

EUR/USD trading strategy: short at 1.1590, target 1.1375, stop-loss 1.1585

USD/CAD trading strategy: long at 1.1880, target 1.2200, stop-loss 1.2010

EUR/GBP trading strategy: short at 0.7640, target 0.7520, stop-loss 0.7670

NZD/USD trading strategy: long at 0.7650, target 0.7950, stop-loss 0.7560

GBP/USD: BOE voted unanimously to keep rates on hold in January

(we stay sideways)

The Bank of England voted unanimously to keep rates on hold in January for the first time since July, after two policymakers Martin Weale and Ian McCafferty, who since August had called for an end to record-low interest rates, said a rate rise now might cause below-target inflation to become entrenched.

British inflation last month unexpectedly tumbled to 0.5% yoy, its lowest level in more than 14 years and far below the BoE's 2% target.

BoE Governor Mark Carney has said inflation could turn negative in the coming months but that the central bank saw no need for more stimulus and still planned to raise rates within the foreseeable future. Carney has said that the fall in oil prices is a net positive for Britain's economy and that the BoE would look through the direct effect on inflation of lower oil prices.

The BoE has focused more on wage growth as it considers when to start raising rates. Average weekly earnings, excluding bonuses rose 1.7% yoy in November. That was slower than growth of 1.9% in October but it was the third month in a row that earnings by that measure rose faster than inflation after lagging for five years.

Britain's unemployment rate fell to 5.8%, its lowest level in more than six years and below the median forecast of 5.9%.

The GBP/USD dropped to 1.5076 on unexpected unanimous MPC vote in January. The rate did not break below yesterday’s low of 1.5058. The GBP/USD recovered and traded above 1.5100 soon. The market is waiting for tomorrow’s ECB’s announcement. We will be looking to close our EUR/GBP short position ahead of the ECB’s decision and will probably go long on the GBP/USD as we expect weaker USD on profit-taking after the ECB’s QE decision.

Significant technical analysis' levels:

Resistance: 1.5200 (high Jan 20), 1.5267 (high Jan 15), 1.5270 (high Jan 14)

Support: 1.5058 (low Jan 20), 1.5034 (low Jan 8), 1.5028 (low Jul 15, 2013)

USD/JPY: No QQE Expansion, As Expected

(we stay sideways)

The BOJ held off on expanding its massive stimulus programme and maintained its pledge to increase base money at an annual pace of JPY 80 trillion through buying government bonds and risk assets.

In a review of its long-term estimates, the BOJ cut its core consumer inflation forecast for the year beginning in April to 1.0% from 1.7% projected three months ago. But it slightly raised its inflation forecast for fiscal 2016 to 2.2% from 2.1%.

BOJ Governor Haruhiko Kuroda said: “Consumer inflation will slow for the time being due to oil price falls. On the assumption that oil prices will flatten out at current levels and rise moderately ahead, the effect of the oil price decline will ease. (…) The effect of crude oil price falls will fade, while the lower fuel cost will benefit the economy. If so, oil price falls will help accelerate inflation in the long run. (…) We haven't said strictly that the target will be achieved in fiscal 2015.”

The BOJ revised up next fiscal year's economic growth forecast to 2.1% from 1.5%, suggesting that a pick-up in growth will boost wages and accelerate inflation.

A drop in oil prices has kept alive expectations the BOJ will expand QQE again soon. The bank is expected to ease again as early as April. BOJ policymakers are increasingly wary of expanding QQE further with the bank's huge purchases already pushing 5-year government bond yields into negative territory.

The BOJ expanded two loan schemes instead of QQE aimed at encouraging banks to lend more, expanding one of them by JPY 3 trillion.

Some investors sold the JPY ahead of Wednesday's meeting in a precautionary move against a surprise action. The USD/JPY had risen as far as 118.87. The rate fall after the BOJ decision, in line with our expectations, and hit a day’s low at 117.30. The market focus will now shift fully to the European Central Bank which is widely expected to unveil a quantitative easing programme tomorrow.

Significant technical analysis' levels:

Resistance: 118.87 (high Jan 20), 118.94 (21-dm), 119.88 (high Jan 9)

Support: 117.30 (session low Jan 21), 116.93 (low Jan 19), 115.85 (low Jan 14)

USD/CAD: Will BOC Return To A Dovish Tone?

(stay long, target 1.2200)

The Bank of Canada’s meeting is scheduled for today. The decision will be announced at 15:00 GMT. The central bank is likely to slash economic outlook. Until now, the Bank of Canada has projected economic growth of 2.4% this year.

The governor of the Bank of Canada Governor Stephen Poloz said last month that the decline in oil could take about a third of a percentage point off of economic growth this year. Deputy Governor Lane said on January 12 that oil prices could fall further which is negative for Canadian economy. In his opinion lower oil prices may delay the economy's return to the production potential.

The International Monetary Fund cut its Canada’s GDP growth forecast to 2.3% in 2015 (from 2.4% previously) and 2.1% in 2016 (from 2.4% previously) yesterday. The market expects that the central bank will not hike rates until 2016.

Tuesday’s data showed Canadian manufacturing sales decreased by 1.4% mom in November, driven by a sharp drop in motor vehicle sales, which dropped 5.9% mom. The decline was greater than the median forecast of 0.7%. In October sales fell by 1.1% mom, revised from a previously reported 0.6% decline.

We keep our USD/CAD long with the target at 1.2200. We expect a retreat of the USD strength soon due to possible delay in Fed’s hikes. However, the USD will stay relatively strong against the CAD – the Bank of Canada is likely to wait with monetary tightening even longer.

Significant technical analysis' levels:

Resistance: 1.2115 (high Jan 20), 1.2200 (psychological level), 1.2202 (76.4% of 1.3066-0.9407)

Support: 1.1985 (high Jan 19), 1.1940 (low Jan 20), 1.1934 (low Jan 19)

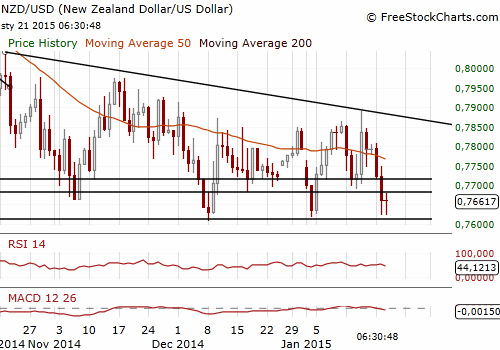

NZD/USD: Use Lower Levels To Get Long

(long at 0.7650, target 0.7950)

- CPI amounted to -0.2% qoq and 0.8% yoy in the fourth quarter of 2014, the lowest since the second quarter of 2013 and below the median forecast of 0.9% yoy. The quarterly fall in the CPI was driven by a 5.7% fall in petrol prices to their lowest level in four years, while costs for fresh vegetables, telecommunications and electronics also fell. Prices of non-tradables such as housing, electricity, and building costs rose 0.3% qoq and 2.4% yoy.

The slowdown in inflation, which took the annual rate below the central bank's 1% to 3% target range, backed the view that the Reserve Bank of New Zealand will stay on the sidelines for an extended period. The central bank is likely to take a wait-and-see approach due to lack of inflation pressures, a strong currency and weakening commodity prices, especially for dairy products, very important for New Zealand’s exports.

The NZD/USD fell after the CPI release hit a day’s low at 0.7625. A dairy auction which saw a 1% rise in prices, offered no relief, as dairy farmers are facing a further cut to this year's expected payout as rising supply, a strong currency and still weak demand will hamper a recovery in the sector.

We got long on the NZD/USD at 0.7650 with the target at 0.7950 and stop-loss at 0.7560. We expect a retreat of the USD strength soon and a gradual rise in the appetite for riskier assets, which would be supportive for the NZD. The NZD traders will be focused on the RBNZ meeting next week (January 29). A threat to our NZD/USD long is a possibility of further verbal intervention of the central bank against the NZD strength.

Significant technical analysis' levels:

Resistance: 0.7782 (high Jan 20), 0.7808 (high Jan 19), 0.7856 (high Jan 16)

Support: 0.7619 (low Jan 5), 0.7609 (low Dec 9), 0.7560 (low Jun 6, 2012)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.