GROWTHACES.COM Forex Trading Strategies:

Trading Positions

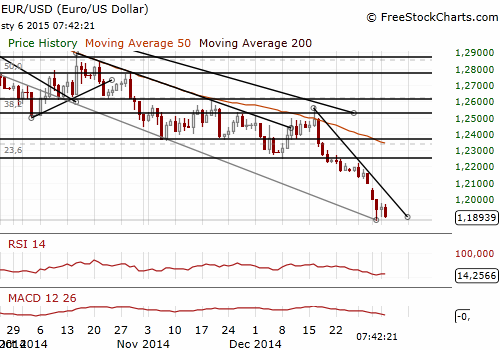

EUR/USD: long at 1.1915, target 1.2060, stop-loss 1.1875

GBP/USD: long at 1.5255, target 1.5480, stop-loss 1.5175

USD/JPY: long at 118.70, target 121.80, stop-loss 117.80

USD/CHF: short at 1.0085, target 0.9960, stop-loss 1.0120

EUR/GBP: short at 0.7850, target 0.7700, stop-loss 0.7880

EUR/CHF: long at 1.2025, target 1.2090, stop-loss 1.1995

AUD/NZD: short at 1.0530, target 1.0320, stop-loss 1.0580

AUD/JPY: long at 96.80, target 99.00, stop-loss 96.10

Pending Orders

USD/CAD: buy at 1.1660, if filled target 1.1990, stop-loss 1.1580

EUR/USD: Stay Long Ahead Of US ISM And FOMC Minutes

(long for 1.2060)

Head of the San Francisco Federal Reserve Bank John Williams, who is a voting member this year on the Fed's policy-setting committee, said yesterday that the pace of interest-rate hikes after an initial liftoff should be gradual to preserve flexibility and to help a U.S. economy that still may need stimulus to have above-trend growth.

Dovish comment from Williams helped the EUR/USD to recover slightly in yesterday’s U.S. session and in today’s Asian session. The EUR/USD reaches a daily’s high of 1.1969 but then fell again below 1.1900 following sharp drops in crude oil, stocks and political uncertainty in Greece ahead of a snap election this month. Moreover, poor Euro zone PMI readings were released today.

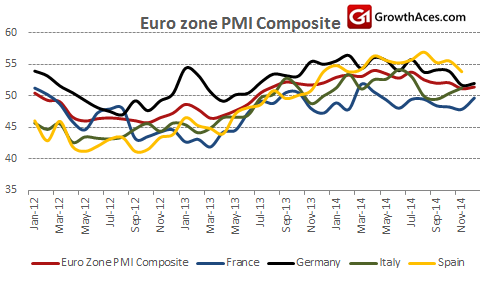

Composite PMI based on surveys of thousands of companies across the region and seen as a good indicator of growth, missed an earlier flash reading of 51.7, coming in at 51.4. The reading beat November’s 16-month low of 51.1. The PMI is consistent with economic growth of just 0.1% qoq in the fourth quarter.

Weakness was again evident in the big three economies of Germany, France and Italy. German economic output posted a mild acceleration at year-end, but the rate of expansion was still lackluster compared with earlier quarters of 2014.

The weakness of the PMI will add to calls for more aggressive central bank steps supporting economic recovery. However, the European Central Bank may say that lower oil prices reduce businesses’ costs and improves consumer spending and give the opportunity for brighter economic activity in the future. The central bank may choose to wait and see if the economic growth strengthens before deciding on full-blown quantitative easing.

We keep our EUR/USD long position in anticipation for some corrective moves. In our opinion the EUR/USD is likely to rise after today’s release of U.S. ISM reading (15:00 GMT) and tomorrow’s FOMC minutes.

Significant technical analysis' levels:

Resistance: 1.1969 (hourly high Jan 6), 1.2006 (high Jan 5), 1.2100 (10-dma)

Support: 1.1860 (low March, 2006), 1.1826 (low February, 2006), 1.1800 (low January, 2006)

GBP/USD: PMI Reading Suggests Weaker Growth In Q4

(long for 1.5480)

Britain’s services PMI suffered its biggest decline in more than three years in December, falling to 55.8 from 58.6 in November to touch its lowest level since May 2013. The index remained comfortably above the 50 mark that signals growth.

PMI signalled Britain's economy grew by 0.5% qoq in the fourth quarter of 2014, slowing from 0.7% in the third quarter.

The composite purchasing managers index combining surveys of the services, manufacturing and construction industries hit its lowest level in 19 months. The GBP/USD fell to its weakest since August 2013 after the data. The GBP is also suffering as investors are pushing back bets on when the Bank of England will start raising interest rates, with many now reckoning that will not happen at all this year.

The Bank of England’s quarterly Credit Conditions Survey showed lenders reported the sharpest fall in household demand for mortgages since the third quarter of 2008. But at the same time, there was the biggest increase in demand for credit card lending since records began in early 2007. Bank lending to businesses continues to remain soft, with lenders forecasting no significant pick-up in credit provision, largely due to fears of a sharply worsening economic outlook.

The GBP/USD almost hit the stop-loss of our long position (today’s low at 1.5177). We stay long and expect weaker U.S. ISM reading today that would be negative for the USD bulls. We expect also more dovish FOMC minutes on Wednesday. That is why in our opinion some corrective moves on the GBP/USD are likely in the days ahead.

We used weaker GBP to get short on the EUR/GBP at 0.7850. The target of our short EUR/GBP position is 0.7700 and the stop-loss is 0.7880.

Significant technical analysis' levels:

Resistance: 1.5319 (hourly high Jan 5), 1.5355 (high Jan 5), 1.5584 (high Jan 2)

Support: 1.5104 (low Aug 2, 2013), 1.5080 (low Jul 17, 2013), 1.5045 (low Jul 16, 2013)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.