GROWTHACES.COM Trading Positions

EUR/USD: short at 1.2450, target 1.2250, stop-loss 1.2530

USD/CHF: long at 0.9650, target 0.9800, stop-loss 0.9590

EUR/GBP: short at 0.7930, target 0.7800, stop-loss 0.7990

EUR/CHF: long at 1.2025, target 1.2040, stop-loss 1.1995

GBP/JPY: long at 186.10, target 190.40, stop-loss 184.70

GROWTHACES.COM Pending Orders

GBP/USD: sell at 1.5730, if filled target 1.5570, stop-loss 1.5790

USD/JPY: buy at 117.30, if filled target 119.80, stop-loss 116.50

USD/CAD: buy at 1.1520, if filled target 1.1640, stop-loss 1.1480

AUD/USD: sell at 0.8330, if filled target 0.8180, stop-loss 0.8400

AUD/NZD: sell at 1.0750, if filled target 1.0550, stop-loss 1.0820

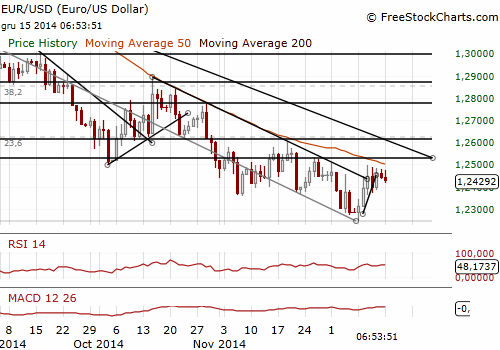

EUR/USD: Stay Short Ahead Of FOMC Meeting

(we stay short)

European Central Bank Governing Council member Ewald Nowotny said the ECB policymakers are not pre-committed to sovereign bond buying to boost euro zone growth and inflation and they would take into account the overall economic situation. He added that TLTRO would not have a big impact on the ECB's balance sheet.

Bundesbank President Jens Weidmann said: “Monetary policy in the euro area, in my point of view, has not reached a situation where the advantages of a quantitative easing program outweigh its costs.” He stressed that the slump in oil prices is largely responsible for the drop in inflation, adding that the current situation is very different from a price reduction coming from a negative spiral in salaries. He also called on France to reduce its tax burden, reinforce competitiveness, cut labor costs and reduce the rigidity of the labor market.

University of Michigan's preliminary reading on the overall index on U.S. consumer sentiment for December came in at 93.8 the highest reading since January 2007 and above the median forecast of 89.5 and November reading of 88.8. Consumer sentiment rose on improved prospects for jobs, wages and on lower gasoline prices.

The EUR/USD fell slightly today on dovish Nowotny’s comments and rising likelihood (after recent very good U.S. macroeconomic data) of more hawkish Fed’s statement on Wednesday. Our trading strategy remains intact. We stay short for 1.2250. The nearest important support level is at 1.2384 (low December 12).

The U.S. Federal Open Market Committee meets on Wednesday. The central bank reaffirmed that it would keep rates around zero for "a considerable time” in its previous statement. On Wednesday investors will be focused on these three words in the statement: “a considerable time”. If they are missing it will be read as a hawkish signal that the long-awaited return to more normal interest rates is coming sooner rather than later and will give the USD a boost.

Significant technical analysis' levels:

Resistance: 1.2524 (high Nov 27), 1.2507 (high Dec 1), 1.2496 (high Dec 11)

Support: 1.2384 (low Dec 13), 1.2382 (10-dma), 1.2362 (low Dec 10)

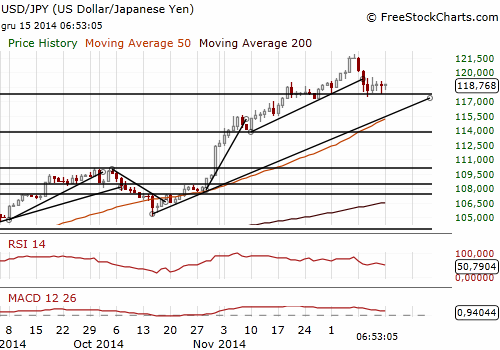

USD/JPY: High Volatility Makes Trading Risky

(outlook is still bullish, buy again at 117.30)

The governing Liberal Democratic Party and its junior partner in government, the Buddhist Komeito, will control two-thirds of the seats in the lower house. A big victory for Japanese Prime Minister Shinzo Abe's coalition in an election on Sunday was a boost for his reflationary economic policies, which are likely to weigh on the JPY in the long term.

The Bank of Japan's quarterly Tankan survey showed that the headline index for big manufacturers' sentiment worsened by 1 point from three months earlier to plus 12 in December. The median market forecast amounted to plus 13. The survey showed also that corporate spending plans were strong. Firms plan to increase capital spending by 8.9% in the current fiscal year ending in March 2015.

The USD/JPY has been very volatile recently. The USD/JPY rose to 119.13 in early Asian session today. Despite a big win of ruling coalition that is negative for the JPY in long term and worse-than-expected Tankan reading, the JPY appreciated soon and the USD/JPY fell as low as 117.78, reaching the stop-loss of our short position at 117.80.

In our opinion the medium-term outlook for the USD/JPY is still bullish, but given the recent volatility, trading USD/JPY is risky now. We have placed our buy order at 117.30.

Significant technical analysis' levels:

Resistance: 119.21 (high Dec 12), 199.43 (10-dma), 119.55 (high Dec 11)

Support: 117.78 (session low Dec 15), 117.56 (30-dma), 117.45 (low Dec 11)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

EUR/USD steadies above 1.0600, awaits German ZEW and Powell speech

EUR/USD is holding above 1.0600 in the European morning on Tuesday, having hit fresh five-month lows. The pair draws support from sluggish US Treasury bond yields but the rebound appears capped amid a stronger US Dollar and risk-aversion. Germany's ZEW survey and Powell awaited.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.